Start saving those pennies now because your grocery bill will likely head higher soon asfood giantspass along inflationary costs in transportation and those related to newCOVID-19 related protocols.

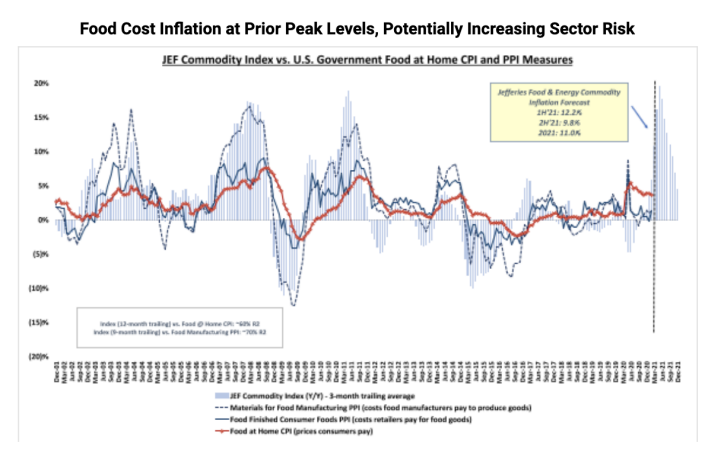

"Our Commodity Index points now to ~11% 2021 agricultural/energy-related cost inflation, essentially in-line with what we saw in 2007/2008/2011, when food sector gross margin contracted," said Jefferies food sector analyst Rob Dickerson in a new research note.

Dickerson points to 17 well-known food companies that have recently warned about rising levels of inflation: B&G Foods; BellRing Brands; Campbell Soup; Conagra Brands; Flowers Foods; General Mills; Hostess Brands; J&J Snack Foods; Kellogg; Kraft Heinz; McCormick; Mondelez; Nomad Foods; Post Holdings; Hain Celestial; Hershey; and TreeHouse Foods.

The analyst thinks the looming inflation could take a bite out of profit margins for Big Food, even as they eye price increases and package size changes to counter the effect.

Explains Dickerson, "Given an average six month lag between spot/future commodity prices and company cost of food sold implications due to hedging, we foresee incremental cost inflation/gross margin risk as we move through the year and into 2022. Most food companies are speaking to incremental pricing, revenue management, productivity, and rolling-off COVID costs as offsets, but elasticity remains the unknown as prices inflate and food-at-home consumption normalizes (at some point)."

Despite the growing margin concerns by the Street,shares of the major food playershave stayed firm lately as investors hold out hope the companies could successfully manage the inflationary pressures. Consumers have also continued to eat a great deal at home in spite of rising numbers of those being vaccinated.

For instance, shares of Campbell Soup are up 7% in the past month, while Conagra has gained 7% and General Mills 6%.

"We are seeing great growth across our North American business in particular, including our pet business. We are seeing rising cost pressures and increased costs to serve [our products], and the inflation is broad-based. We see it in grains and logistics, not only here in the U.S. but also globally," General Mills Chairman and CEO Jeff Harmening said onYahoo Finance Live.

"Fortunately, we have good productivity programs and are looking for some pricing in places," added Harmening. "We have the tools we need in order to battle it, but we are starting to see inflation as are most of our competitors."

精彩评论