- Morgan Stanley is going against consensus on earnings again, predicting a bigger earnings growth slowdown than Wall Street is pricing in.

- "We can’t help but recall our position over a year ago, when we argued for much faster earnings growth than the consensus," equity strategist Mike Wilson writes. "We argued then that the record fiscal stimulus would effectively serve as a government subsidy for corporations to over-earn."

- "Today, we find ourselves on the direct opposite side of consensus again, but for the same reasons," Wilson says. "Since we believe consensus failed to see that logic last year, it seems plausible it could now be missing the corollary. "

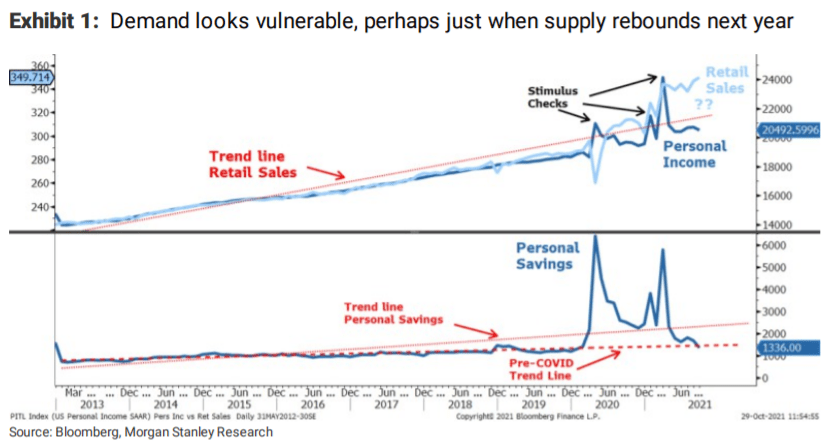

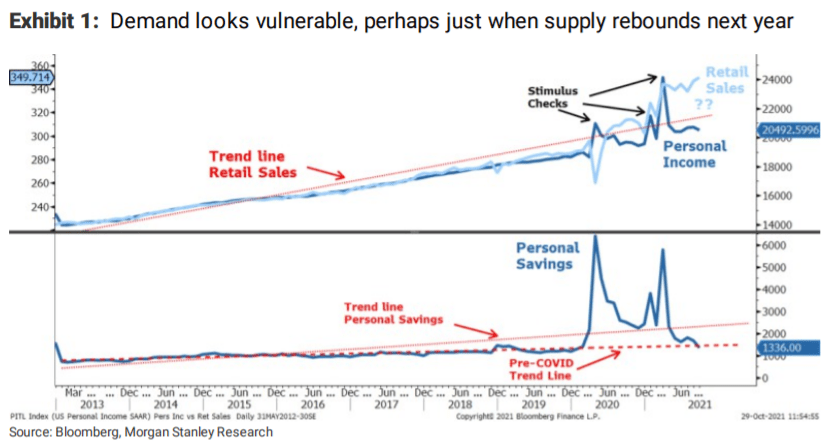

- "In short, we think the earnings growth slowdown will be worse and last longer than expected as the payback in demand arrives early next year with a sharp year-over-year decline in personal disposable income."

- Consumer sentiment is dropping at the lower end of the income spectrum and personal savings have already been depleted to pre-COVID levels, he adds. (See Morgan Stanley chart at bottom.)

- The earnings slowdown, combined with Fed tightening and inflation worries, will eventually arrest the market's rise, Wilson says.

- Stocks are looking to kick November off on the front foot, though, with S&P futures(SPX) (NYSEARCA:SPY)and Nasdaq 100 futures(NDX:IND)(NASDAQ:QQQ) rising through the morning.

- "Bottom line, the fundamental picture for stocks is deteriorating as the Fed starts to tighten monetary policy and earnings growth slows further into next year, turning outright negative for some companies," Wilson says. "However, asset prices are continuing to rise as retail investors keep plowing excess cash into these same investments."

- "Meanwhile, with strong seasonal trends and pressure to perform high at this time of year, many institutional investors we speak with are staying fully invested for these technical reasons. If our analysis is correct, we think that this bullish trend can continue into Thanksgiving, but not much longer."

免责声明:本文观点仅代表作者个人观点,不构成本平台的投资建议,本平台不对文章信息准确性、完整性和及时性做出任何保证,亦不对因使用或信赖文章信息引发的任何损失承担责任。

精彩评论