Summary

- We have been in the stock since spring of 2020.

- Record performance in all business lines.

- The valuation is simply ridiculous, even with explosive growth.

- The growth is likely to normalize in late 2022 and that has us concerned, even with the incredible expansion the company has seen into new markets and customers.

- The dividend is a joke, the company should keep that money and reinvest it into growth of the business lines.

Nvidia Corporation (NVDA) is one of several semiconductor stocks we have recommended as having upside with the chip shortage of 2021 to our members. The stock has truly been a winner. However, it is our recommendation that after this most recent earnings report and the huge run in the last month, that you take some off the table. If you have doubled or tripled here, we recommend you take out your initial investment plus 50% profit, and let the rest run with the house's money forever.

This is a winning strategy. You will be entitled to all future dividends, spinoffs, splits, etc. This is how you grow generational wealth and is a key tenet of our teachings. We do believe however that it is prudent to take off exposure after this monster run. While the stock was expensive before, it is dangerously valued right now. Keep your money.

The company is still firing on all cylinders. The stock has garnered a lot of attention from traders, investors, and meme stock chasers alike. Fundamentally, even with Nvidia's chips being used in technologies that are in our everyday lives, and the demand has never been higher, the shortages will eventually balance out. You want to be ahead of that folks. No one ever gets hurt taking a profit. The way we structure our trades and handle our big wins by keeping house money exposed, you can sleep well at night. We have run this play on countless stocks. But make no mistake, at a price well north of $300 per share, even with demand where it is, we have to be calculated. It is ok to lock in profit here. While the company is demonstrating growth, a significant pullback is likely based on the high valuation, moderate growth, and the fact that the supply issues will resolve.

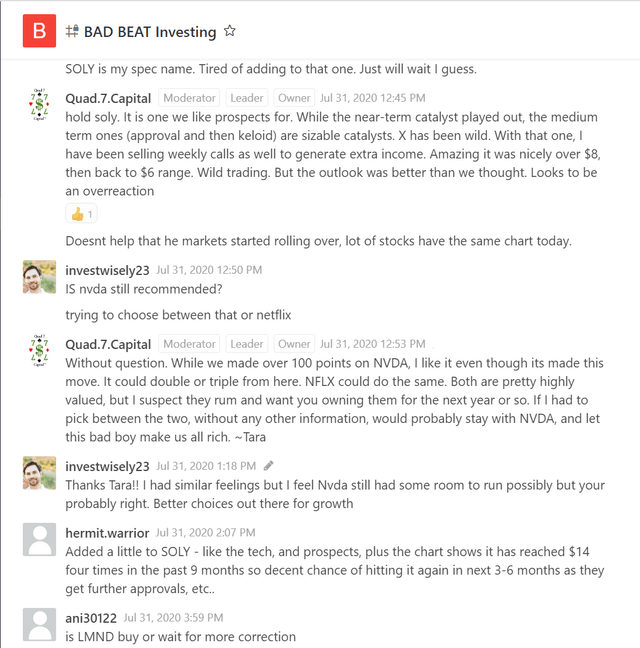

Nvidia has been around a long time. We have been trading this one for a long time. In fact, it was first highlighted by our service as one that was a must own back during the heights of the COVID crisis in 2020:

We feel it is important to bring this to your attention as we have not publicly covered the stock yet, but have been following the company for some time.

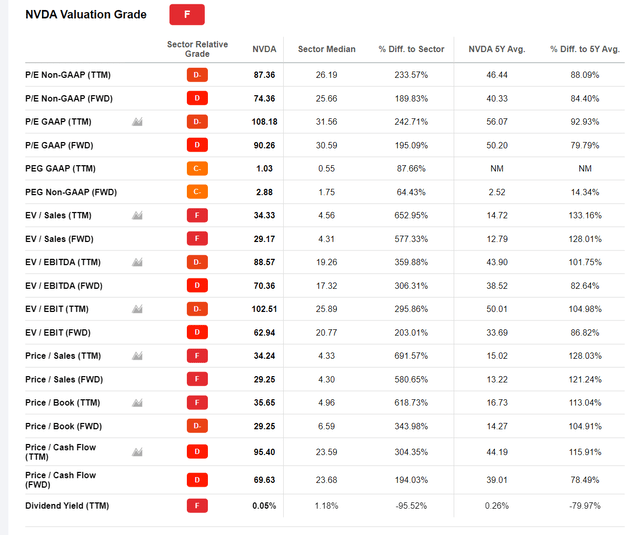

Many of you may (or may not recall) other big run ups like we have seen now. In fact in 2002, 2007-08, and 2018, we saw massive corrections of better than 50% in some cases. Just because the stock is up does not mean it will fall, but we want you to keep your money, and let the house's money go to work for you. Nvidia is the most overvalued it has ever been looking at the metrics of interest for tech and even other chipmakers.

Every valuation metric is stretched. Even with the growth the company is seeing, it does not justify where we are now. We are Nvidia bulls, but we are also prudent traders. While there is growth on display, it is not enough to grow into this valuation. Not by a longshot.

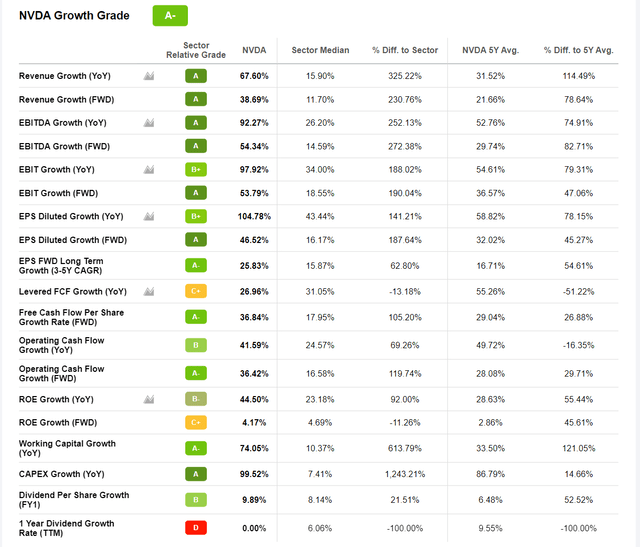

The growth is impressive, but catching up to that valuation even with 50% EPS growth and 40% sales growth is out of reach. And, like every chip cycle, eventually, supply will normalize, pricing will stabilize, and the stock will retrace. It is all but guaranteed, and that comes even with Nvidia's tech being used in many facets of our technological lives.

Make no mistake, this is NOT a bubble. We are not saying this is a bubble. It is just super expensive and upside now is limited. New money will get a chance to buy much lower. For now, we celebrate the gains. The company brought in revenue of $7.10 billion, up 50% from a year earlier and up 9% from the sequential quarter.

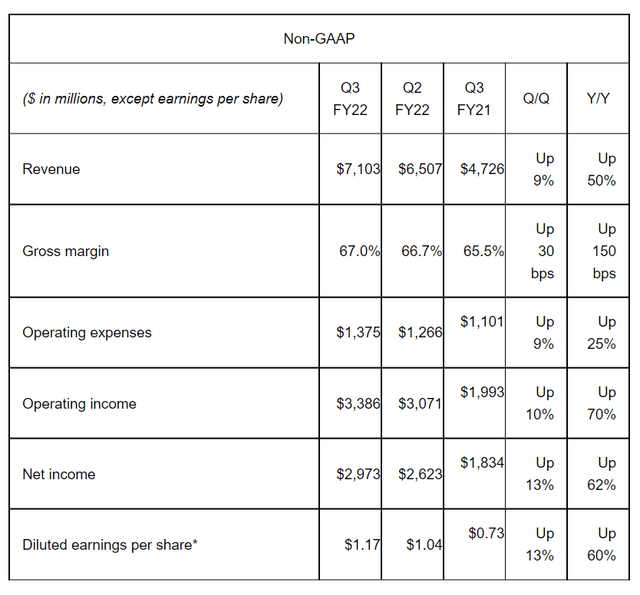

Folks, they set again new record revenue in Gaming, Data Center and Professional Visualization market platforms. That is some winning! One of the biggest drivers of the stock and the company's growth has been the AI tech. Demand for Nvidia AI is surging each month and it is driven by being scaled to the cloud as well as much more mainstream adoption with over 25,000 companies on board. The results are impressive:

The best part of all of this expansion and record setting sales is that gross margin is expanding. Gross margin came in at 67.0%, and was up 30 basis points from the sequential quarter and up 150 basis points from a year ago. The company is doing a solid job with controlling the growth of operating expenses relative to revenue growth. You see a 50% revenue growth coupled with an increase in gross margin and a 25% growth in operating expenses was a recipe for operating income and net income expansion. Net income was up 13% from Q2 and up 62% from a year ago, with EPS rising to $1.17.

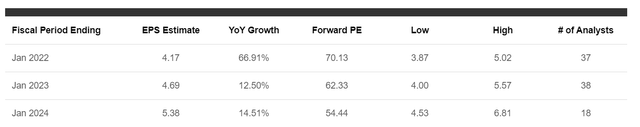

While the growth is significant, and traditional valuation metrics cannot capture the possible expansion in AI software, networking, omniverse, or in robotics, cars, or healthcare, we are looking at a stock that is around 70X FWD EPS. Still, the growth is expected to stall, and that has to be a concern of all investors and traders who want to protect their money.

The forward look for Q4 and early 2022 is strong, but we suspect we see normalization to a degree in the overall sector and space as we move through 2022. Let us not forget the tons of competition in this space. There are lots of chipmakers, and while they all have unique approaches and specialties, this is a real concern.

Speaking of keeping your money, we think Nvidia should keep its paltry dividend to itself. The whopping $0.04 quarterly dividend really does not do much for investors (ok it is not zero) but no one is "looking forward" to that sizable payout. We believe the company should keep that money and reinvest it in its business lines to help fuel company growth and help it catch up with the valuation.

As we move forward, there will be sizable growth for the next couple of quarters but we do expect a slowdown. The acquisition of ARM Holdings if approved will be transformational, but this is a $40 billion dollar shot. The company is committed to the transaction. We don't know if it can get through U.S., U.K, and Chinese regulators however. It remains unknown at this point. For more on this, please see one of the several dozen prior articleson this topic.

Make no mistake, those who bought this stock have done very well. Many have locked in profit, but for those who have not, we think that you sell your original investment plus 50% profit and let the rest run. By doing this, you are locking in with shares near highs, while having exposure to any and all future gains, dividends, spinoffs, etc. That said, new money should definitely not be buying here. Let it pull back.

精彩评论