We now know there's at least one major asset manager that wants to encourage buying the dip in China. In fact, Blackrock is getting ready to unleash a new exchange traded fund focusing on Chinese technology stocks.

The move comes weeks after a competitor overtook its largest China focused U.S. ETF,Bloomberg reported this week.

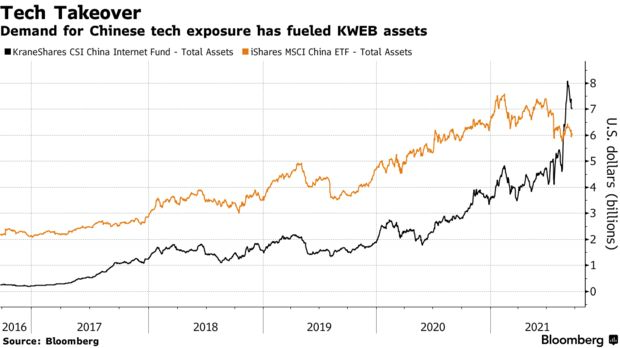

The new ETF is going to be called the iShares MSCI China Multisector Tech ETF and it will passively track an index of tech and tech-related stocks. The new ETF will be similar to the $7 billion KraneShares CSI China Internet Fund, which has seen massive inflows this year amidst the pullback in China-based equities.

The KraneShares CSI China Internet Fund overtook Blackrock's current largest China ETF, the iShares MSCI China ETF, to become the largest of its kind.

Blackrock now has about 400 ETFs that total $6.7 trillion in assets in the U.S. industry. Seven additional ETFs have debuted this year from the asset manager, Bloomberg reported. The pace lags that of 2020, where 30 ETFs launched.

One area Blackrock may be able to out-do its competition is in expense ratio. The KraneShares CSI China Internet Fund carries a steep expense ratio of 0.73%. Blackrock's ETF hasn't disclosed its fee yet.

精彩评论