Summary

- CrowdStrike delivered yet another strong quarter, though its stock took a nosedive amidst the tech sector rout.

- The stock still doesn't trade cheaply but it has arguably earned a premium multiple through consistent growth and strong cash flow generation.

- Cybersecurity is like insurance that all firms will need to purchase for cloud security.

- I rate shares a buy as the reduced multiples leave much room to the upside.

CrowdStrike (CRWD) might not come up at the top of the list of cheapest tech stocks to buy, but it has seen its stock get hammered amidst the tech sector correction. The stock has typically traded very richly, making the volatility less surprising, but CRWD remains one of the highest quality stocks in the market today. I view its cybersecurity offerings to be akin to buying insurance for cloud security, making it a critical growth area for the indefinite future. Due to the perceived reliability of future growth, the stock looks ripe for a re-rating. I rate shares a buy.

CRWD Stock Price

CRWD almost perfectly shows what can be expected from a high-growth, high volatility stock, as it appears to move sharply higher during bull runs, and sharply lower during corrections as it has as of late.

CRWD has typically traded at egregious multiples which had kept me from meaningfully investing in the name. Now trading just under $200 per share, one must start wondering if there’s even a value proposition here. While CRWD might not be a household name to the common person, it appears to be a household favorite for Wall Street firms as it is some sort of insurance for anyone operating in the cloud. While the stock far from the cheapest name in the tech sector, this may be the time to pounce.

Is CrowdStrike Overvalued?

Even after the decline, is CRWD still overvalued? At least judging based on the stock price versus consensus price targets, CRWD is trading at its largest difference in many months.

That is no guarantee that CRWD is undervalued, but it gives an indication to the extent that CRWD has fallen amidst the recent market correction.

What To Expect After CrowdStrike Earnings

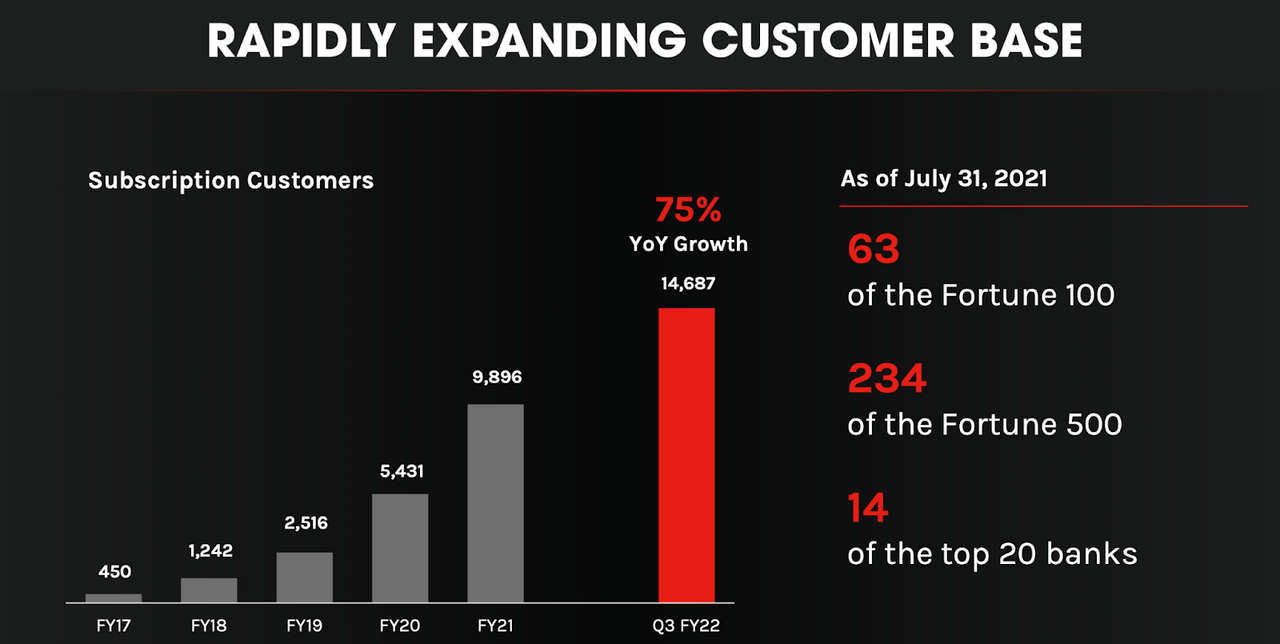

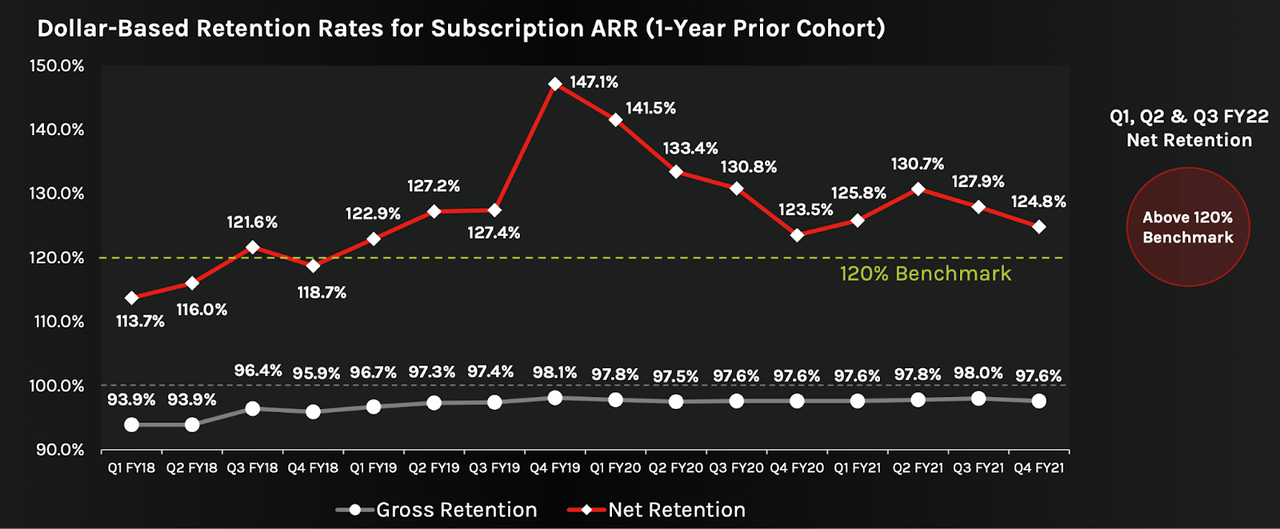

CRWD is a best in class cybersecurity firm which has seen its customer base grow 75% year over year.

That is no guarantee that CRWD is undervalued, but it gives an indication to the extent that CRWD has fallen amidst the recent market correction.

What To Expect After CrowdStrike Earnings

CRWD is a best in class cybersecurity firm which has seen its customer base grow 75% year over year.

Judging based on the metrics above, it appears that CRWD still has more room to grow even among the largest companies. The more that CRWD continues to take market share in the sector, the easier it becomes to attract new clients due to the powerful brand recognition. If the top companies in your sector are using CrowdStrike and you aren’t, then that may put you at greater risk in the event of a cybersecurity event.

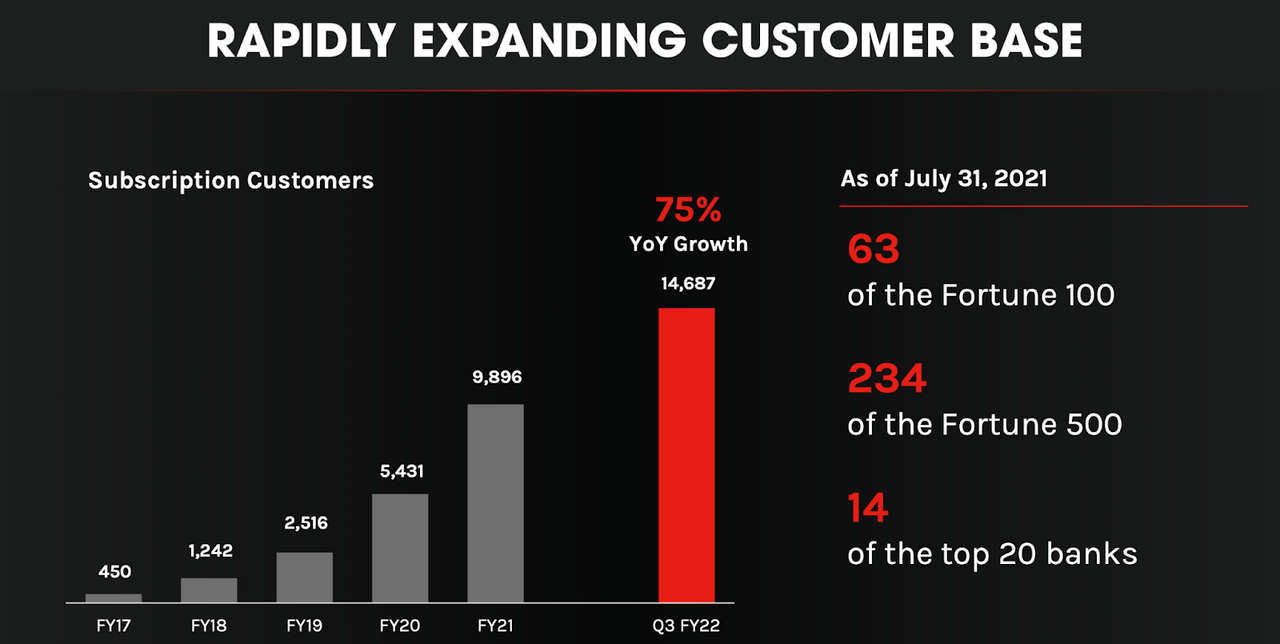

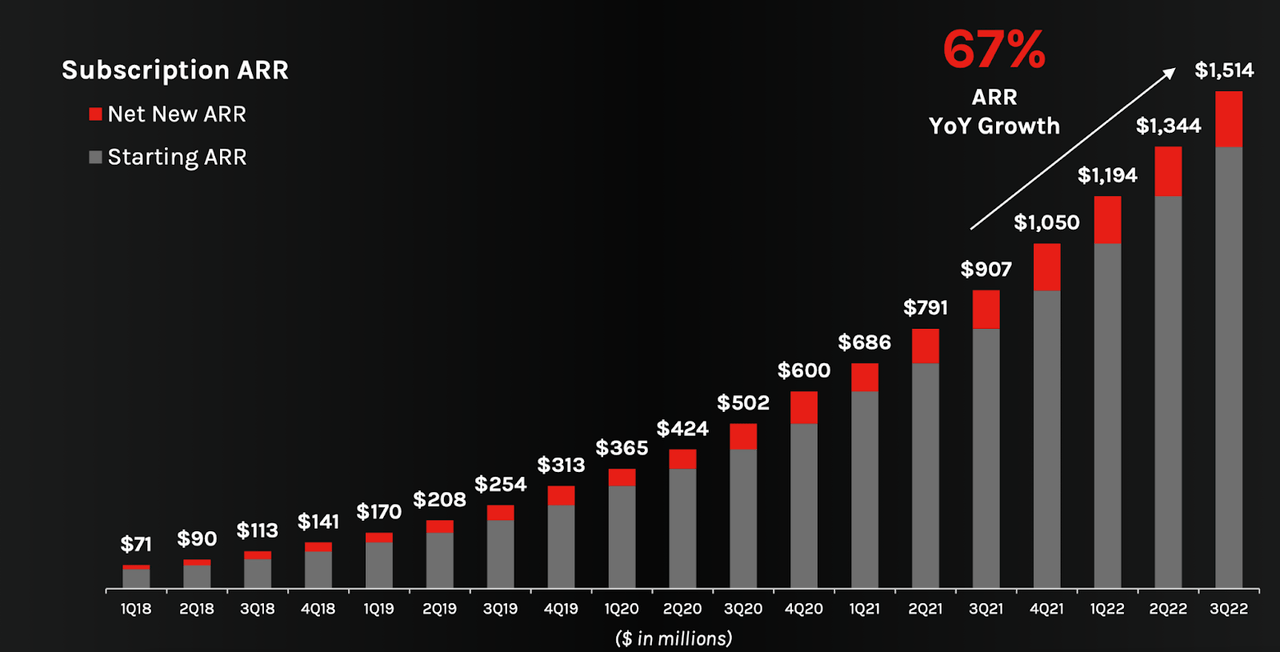

CRWD has generated strong dollar-based retention rates in excess of its 120% benchmark.

CRWD charges on a per-endpoint model, which should help sustain the high dollar-based retention rates as the world continues moving toward a digital world. Combining high dollar-based retention rates with customer growth has helped CRWD grow its annual recurring revenues by 67% in the latest quarter.

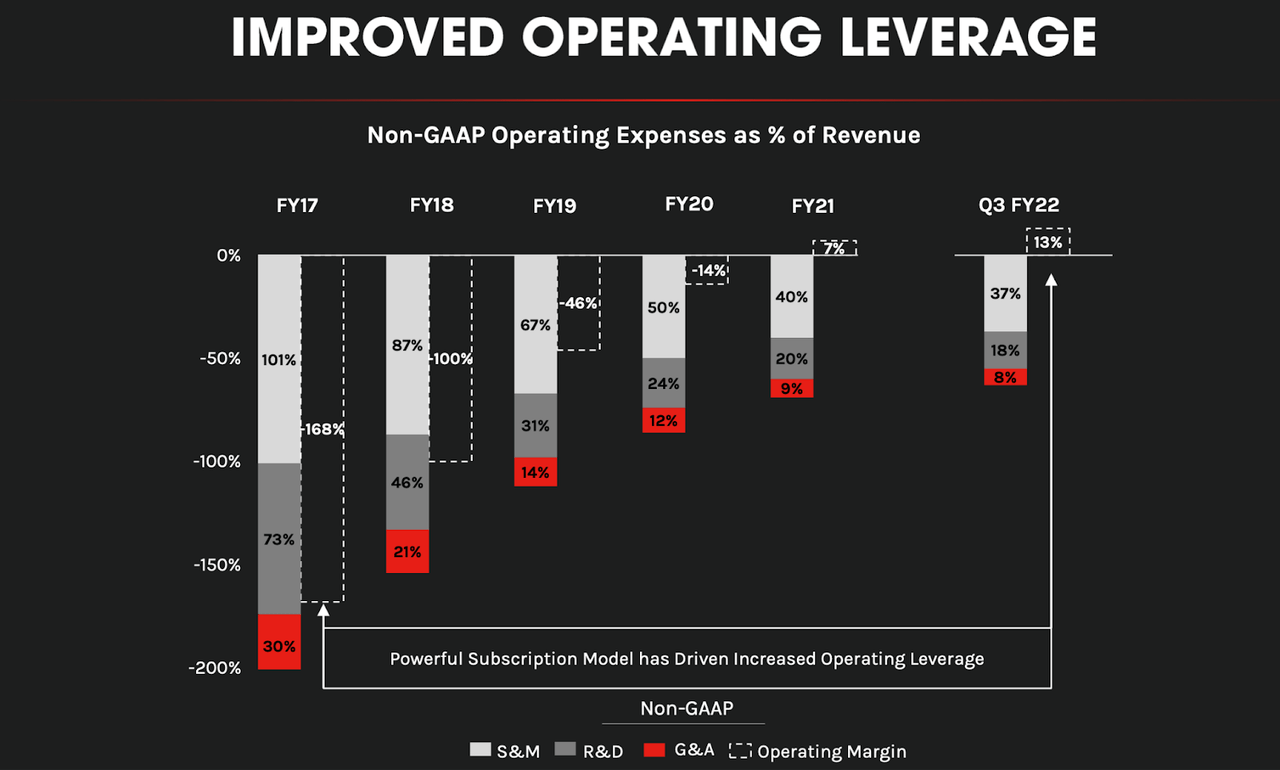

While CRWD is not yet GAAP profitable, it has been consistently achieving operating leverage and is solidly profitable on a non-GAAP basis (the main difference is stock based compensation)

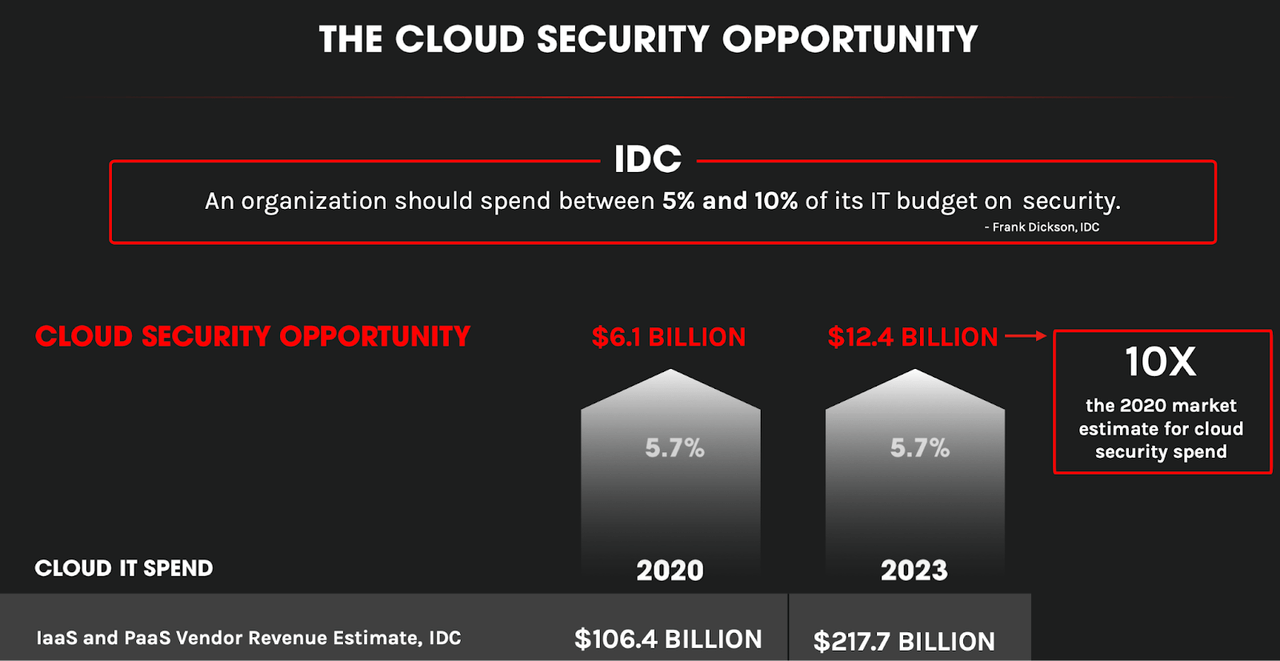

In fact, I suspect that CRWD’s 32% free cash flow margin to be a huge drawing point for investors, as it may be predictive of future operating margins. CRWD’s cash flow generation has helped it amass over $1 billion in net cash. Looking forward, CRWD expects the strong growth to continue, as it expects organizations to steadily increase their spend on cloud security to as much as 10% of its IT budget.

This kind of thinking makes CRWD appear like some sort of insurance for anyone in the cloud, which is arguably a phenomenal place to be in the expense structure. Further, there is the clear implication that CRWD will grow in-line with the growth of data, which is one of the stronger secular growth stories in the market today.

Is CRWD Stock A Buy, Sell, or Hold?

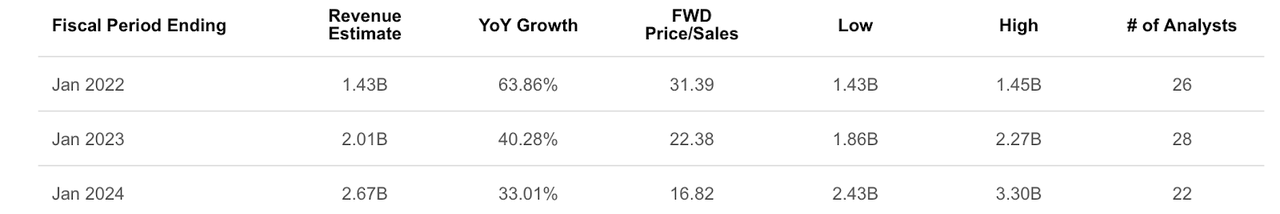

The strong growth, solid cash flow generation, and insurance-like niche all make CRWD look like a safe stock. That safety characteristic has helped it trade at healthy multiples. Even after the recent stock declines, CRWD still trades above 30x sales.

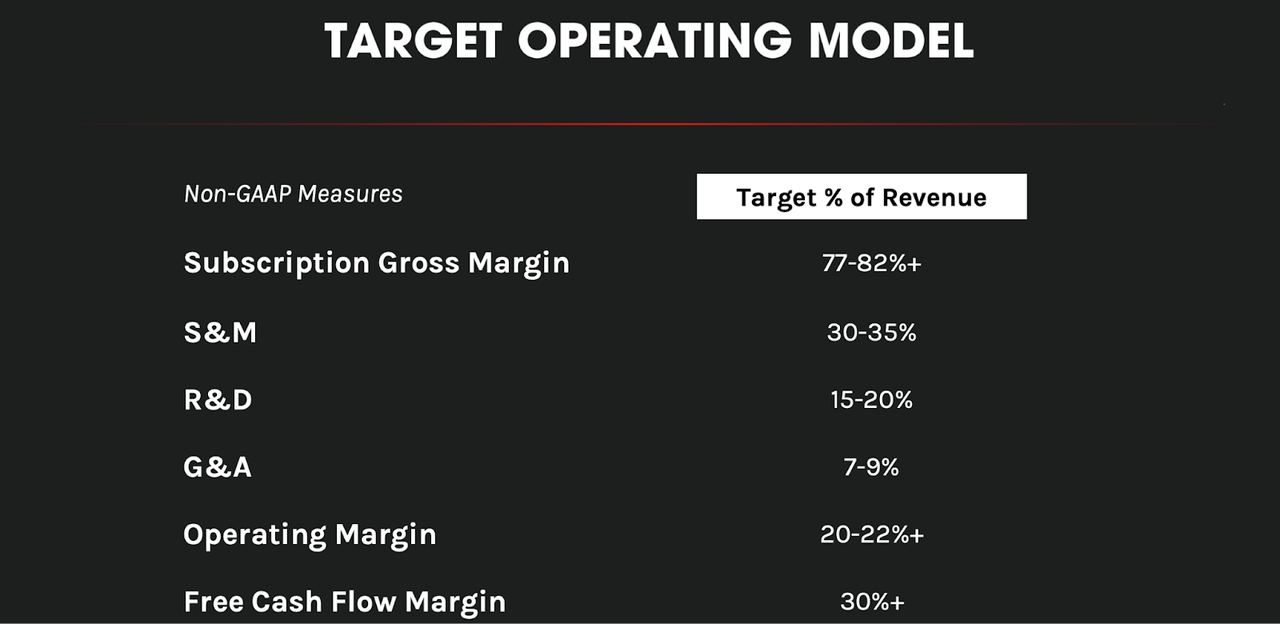

What is a fair value for the stock? CRWD has guided for long term 20% operating margins.

At the risk of coming off optimistic, I view these targets as being highly sandbagged especially considering that the company is already generating 40% cash flow margins. Nonetheless, I assume 30% long term operating margins (50% seems more reasonable). At recent prices, CRWD is trading at an effective 1.4x price to earnings growth ratio (‘PEG’) based on 2022e sales, and 1.3x PEG based on 2023e sales. Yet those projections for 2022 and 2023 growth seem understated, as CRWD should be able to get to around 20% growth just from dollar-based net retention alone. I expect CRWD to be able to sustain 30+% growth over the next five years at least. With that kind of reliable growth profile, I would expect CRWD to trade closer to a 2x PEG, implying around 40% potential returns over the next 12 months. CRWD isn’t cheap, but the stock looks very buyable on the thesis that its high quality is deserving of higher multiples. I note that such a thesis leaves plenty of room to the downside, as the stock will likely be punished severely in the event that growth estimates fall short or if the company loses its quality luster. That said, the recent broad declines in the tech sector have brought CRWD down to highly reasonable multiples which appear to leave much room to the upside. I rate shares a buy.

精彩评论