Despite constant contact over the last year and a half, Zoom and its investors are on the outs.

Full-time remote work won’t stick just because some of us want it to.

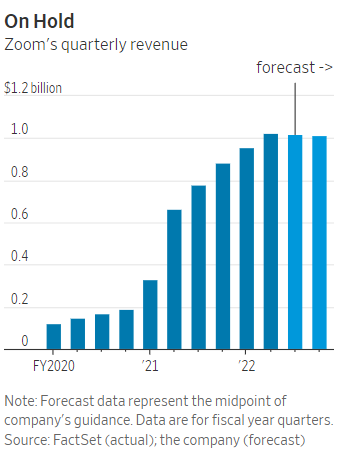

Zoom Video CommunicationsZM1.96%’latest financial resultsare a case in point. While revenue for the videoconferencing company’s quarter ended July 31 came in just above Wall Street’s estimate, Zoom is no longer selling itself. Research and development costs nearly doubled in the quarter from the same period last year, while sales and marketing as a percentage of revenue also increased. Despite the added investments, the company’s guidance implied revenue growth will significantly decelerate throughout the year. Shares of Zoom fell 11% in after-hours trading immediately following its earnings report.

Assuming a given 52-week year offers 260 total weekdays, that works out to a roughly 300% increase in work days done at home—a figure that matters as investors try to value Zoom’s shares as it aims to go from a pandemic workaround to a workweek staple. Heading into Monday’s report, Zoom’s shares were up just 3% this year, which may appear modest given the hybrid work models many companies are pursuing.

Because business from small companies has been volatile as economies reopen, investors have turned their focus toward the longer-term opportunity ofin-office tools. With these newer products likeZoom Phone, meant to replace traditional office phones, and Zoom Rooms for enhanced conference rooms, Zoom is trying to sell consistency to companies in what is currently a highly inconsistent world.

It is a value proposition that has been resonating lately—at least among its existing customers. Back in June, Zoom said it took seven quarters to sell its first million Phone seats. It now says it will have reached two million Phone seats in August, adding roughly half a million seats in just four months.

The purchase of Zoom’s in-office tools are corporate-level decisions, the likes of which are being made in size right now as companies roll out their post-Covid work plans. The question is where that growth will shake out longer-term, especially relative to competitors like Google and Microsoft. Zoom continues to show strong increases in user adoption and in purchases of additional products among its existing customers. But the company added less than 8,000 customers with over 10 employees in the quarter ended July 31—down from about 30,000 customers of that size in the previous period.

Zoom is a company that ended the last quarter of its last fiscal year growing revenue more than 360%. The midpoint of its new forecast implies it will end the same period of this fiscal year growing revenue under 20%.

At the end of the day, those are numbers that even the best video technology can’t amplify.

精彩评论