Summary

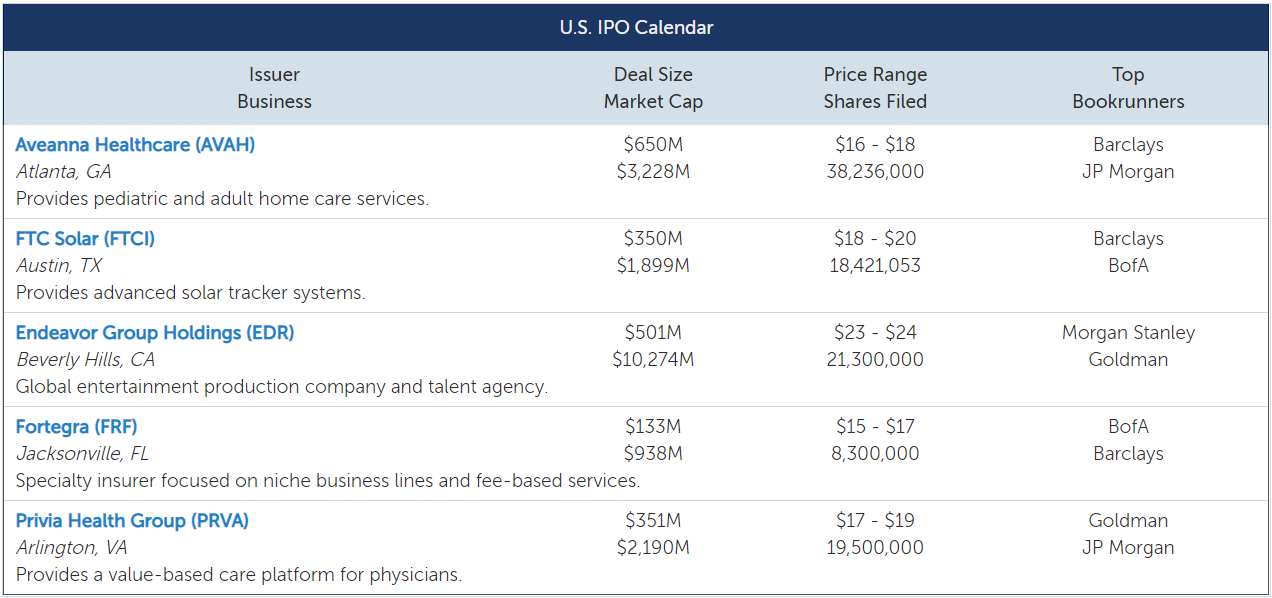

- With the end of April on the horizon, five IPOs are currently slated to raise $2.0 billion in the week ahead. The diverse group features a home care provider, a talent agency, and more.

- Home care provider Aveanna Healthcare Holdings (AVAH) plans to raise $650 million at a $3.2 billion market cap.

- In its second IPO attempt, entertainment and talent agency Endeavor Group Holdings (EDR) plans to raise $501 million at a $10.3 billion market cap.

With the end of April on the horizon, five IPOs are currently slated to raise $2.0 billion in the week ahead. The diverse group features a home care provider, a talent agency, and more.

Home care provider Aveanna Healthcare Holdings (AVAH) plans to raise $650 million at a $3.2 billion market cap. Aveanna's clinical model is led by its caregivers, primarily skilled nurses, who serve the full range of patient populations, from newborns to seniors. Profitable on an EBITDA basis, the company has expanded from 17 states to 30 states over the past five years, and it currently has 245 branch locations.

In its second IPO attempt, entertainment and talent agency Endeavor Group Holdings(NYSE:EDR)plans to raise $501 million at a $10.3 billion market cap. Focused on premium intellectual property, content, events, and experiences, Endeavor's portfolio includes UFC, IMG Media, and WME, among others. The company was significantly impacted by COVID-19, with revenue falling 24% in 2020, though it has since resumed activity in its operating segments.

Healthcare platform Privia Health Group (PRVA) plans to raise $351 million at a $2.2 billion market cap. Privia's platform is powered by its proprietary end-to-end, cloud-based technology solution. Profitable with positive cash flow, the company currently operates in six states and the District of Columbia, covering over 70 target metropolitan statistical areas (including 20 out of the largest 100 MSAs).

Solar tracker system provider FTC Solar (FTCI) plans to raise $350 million at a $1.9 billion market cap. The company's tracker systems are currently marketed under the Voyager brand name, which is a next-generation two-panel in-portrait single-axis tracker. Fast growing and unprofitable, FTC is one of the largest providers of two-panel in-portrait trackers in the US, with an estimated market share of 11%.

Specialty insurer The Fortegra Group (FRF) plans to raise $133 million at a $938 million market cap. Through its US insurance business, Fortegra offers commercial programs with a particular focus on casualty lines, including professional liability, inland marine, and contractor equipment. The company has a financial strength rating of "A-" from A.M. Best and Kroll Bond Rating Agency.

Street research is expected for six companies and lock-up periods will be expiring for up to 11 companies.

IPO Market Snapshot

The Renaissance IPO Indices are market cap weighted baskets of newly public companies. As of 4/22/21, the Renaissance IPO Index was down 2.1% year-to-date, while the S&P 500 was up 10.1%. Renaissance Capital's IPO ETF(NYSEARCA:IPO)tracks the index, and top ETF holdings include Zoom Video(NASDAQ:ZM)and Uber(NYSE:UBER). The Renaissance International IPO Index was down 2.4% year-to-date, while the ACWX was up 6.6%. Renaissance Capital's International IPO ETF(NYSEARCA:IPOS)tracks the index, and top ETF holdings include Nexi(OTCPK:NEXPF)and Kuaishou Technology(OTCPK:KSHTY).

精彩评论