Summary

- Tesla is a Reddit darling, but coverage has peaked, which generally precedes a price fall.

- Elon Musk is famously aware of and actively follows the popular subreddit WallStreetBets and may leverage that following to drive the Tesla share price higher.

- WallStreetBets is made up of 11.2m members and growing, mostly retail traders, who are unpredictable in their mob mentality.

Meme Stock Mentions As An Indicator

I have a theory that the only reason Musk's Tesla (TSLA) has achieved the eye watering market capitalisation of $1.141T, with a P/E ratio of 368, is because Elon Musk himself is a master of PR and marketing.

Core to this theory is that supply and demand is what drives a share's price (whereas fundamental and perceived value is what drives the individual investor to buy or sell), and demand can be manipulated through awareness and PR efforts. I believe prices will revert back to fundamental value in the long run.

I argue that this awareness effect applies more to retail investors than to more sophisticated investors or investment funds, though this would obviously have a flow-on effect on them.

A more traditional example of this theory is how news and announcements affect share prices, albeit they are more closely tied to fundamental value.

Subreddit WallStreetBets As A Catalyst

The Reddit Community WallStreetBets (WSB) is infamous for its role in the January 2021 GameStop saga, which led to a huge price increase in the retail firm's share price after the Reddit community popularised day trading of the firm.

WSB is a community of mostly retail traders, some with no formal investing education or prior experience, and utilising margin loans through trading apps like Robinhood (though more experienced traders are present and active in the subreddit) to invest in the financial markets.

The GameStop saga may be (mostly) over now, but this community is still thriving. At the time of the GameStop saga, the community had less than 3m members, while today it has over 11.2m members.

Given the almost 4X growth in community size thanks to the amount of attention generated in the GameStop saga, it's arguable that the community is more powerful than ever before in the day trading space.

The Elon Musk/WSB Connection

Musk is famously aware of, and following, the WSB subreddit,once tweeting to his 43m followers a link to the subreddit with the caption "Gamestonk."

Musk has also claimed that short sellers have a negative impact on the valuation of TSLA, and it's not hard to imagine how he might see WSB as a tool to affect the share price.

Musk is regarded as a hero by the WSB community, who are very aware that he follows them, and often post memes or comments in a worshipful manner,declaring him a "Meme Lord."

Tracking WSB Community Sentiment

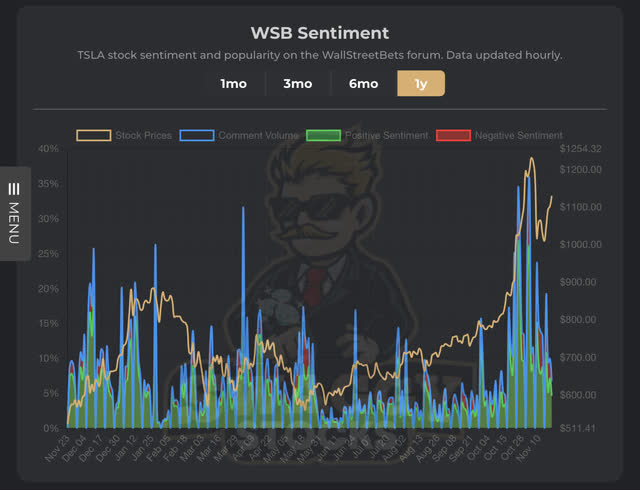

Thanks to a site called Swaggy Stocks, we are able to track WSB sentiment towards TSLA and count TSLA mentions (and various other firms that get attention on the subreddit, such as the infamous GameStop (GME) short squeeze).

If we take a look at a 1-year history of the TSLA share price vs WSB mentions and sentiment, a cursory glance reveals a general correlation between mentions and upward price activity.

Another clear trend is the overwhelming positive sentiment towards TSLA (and almost any other stock mentioned there) from the WSB community. Search many of these comments and posts, and you'll see the phrase "Stonks only go up!" appear across many, many posts.

Do Other Mediums Have The Same Correlation?

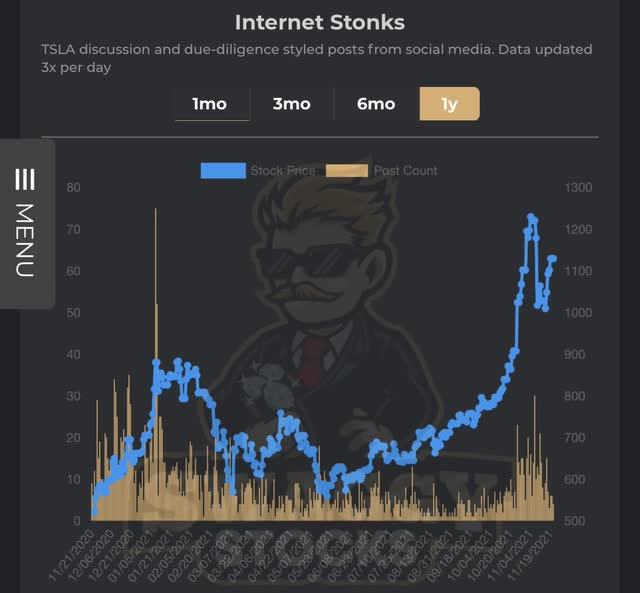

Swaggy Stocks also tracks TSLA mentions across more traditional news sources and other social media sites.

Searching social media for discussion and due-diligence style posts, Swaggy Stocks is able to show the total number of mentions TSLA generates, to compare with WSB.

There appears to be a very similar correlation between broader social media mentions of TSLA and stock price activity, but it appears that this attention is reactionary rather than a lead indicator. It is, however, a confirmation of awareness of the stock following along with major price movements, up or down.

What Trends Can We See?

Looking at the two graphs of mentions vs stock price, the most prominent trend is how TSLA mentions, and discussion peaks mostly as major price spikes occur. It does not appear that mentions are a leading indicator, but perhaps a slow-down in mentions might indicate that any further major price movements are not to be expected.

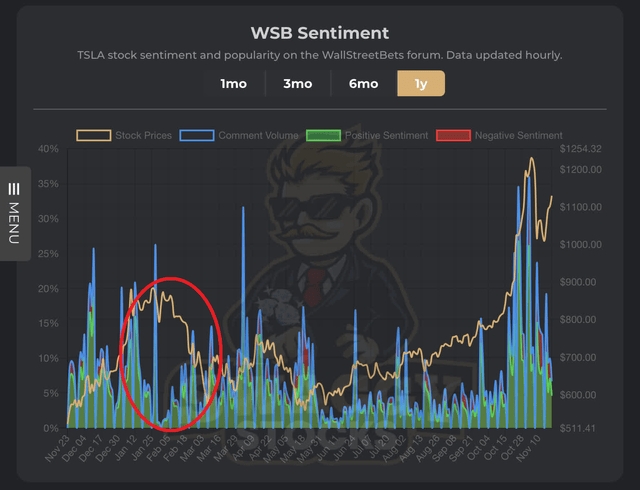

In my eyes, the more interesting time period (circled in red below) is where mentions of TSLA slowed considerably, and the stock price dwindled following the peak in mentions.

I argue that in this instance, when the stock fell from $900 to $600, WSB retail investors attention was diverted from the firm and this halted the upward price movement, sending the stock backward towards it's true long-run fundamental value.

Does This Awareness Effect Apply To Other Stocks?

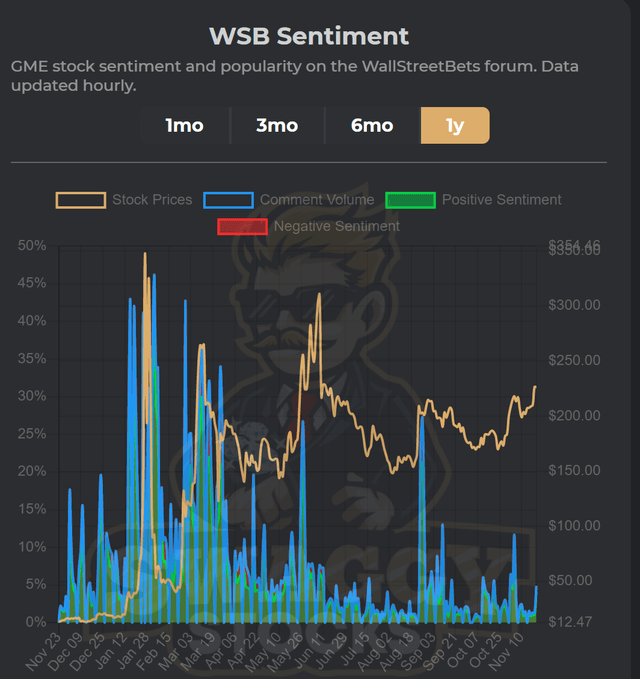

Given GME was the beginning of notoriety for WSB, it's worth comparing the GME ticker to WSB sentiment to search for similar trends.

Again, large price movements occur around the same time as WSB commentary spikes, and prices tend to drift lower as attention drifts away.

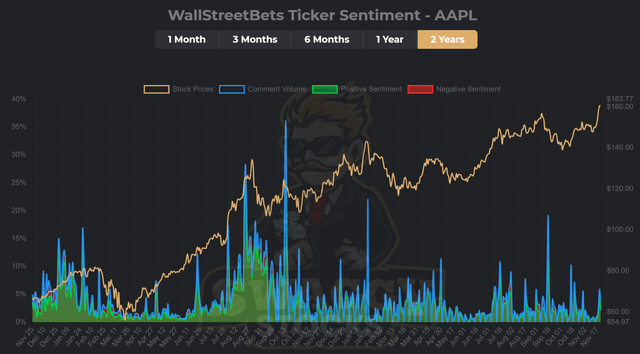

Looking at a third firm, Apple (AAPL), to compare WSB activity with the largest market cap firm in the US, the correlation between mentions and price activity is much weaker, suggesting that there may be a limit to the WSB community's influence. While activity still follows price movements, there is also the possibility WSB is just simply not as interested in AAPL as it is in TSLA or GME.

The Investment View: Results May Vary

I would argue that WSB is not perhaps a leading indicator, but it does play a part in stock awareness and encourages new investors to enter the market.

I would also argue that 11.2m retail investors is certainly a force to be reckoned with and worth paying attention to - perhaps not a guidance of which stock will boom next but rather which ones are overpriced or have peaked.

Overall, there's a strong sense that stocks that receive attention from WSB undergo price volatility, and do drift back to their long-run fundamental value given enough time.

Perhaps it's a case of, if WSB is promoting the stock, you're already too late.

So What Does This Mean For TSLA?

Coming full circle back to TSLA, and reviewing their WSB sentiment chart, I feel there is strong argument to be made that the stock is over-priced due to the presence of retail traders.

However, monitoring WSB activity may give investors a helpful indicator of when TSLA may be about to experience a price correction as retail investor's attention is drawn away from the firm.

With that said, Elon Musk remains a variable worth watching given his awareness of the subreddit and its effect on the market, and he has the platform to drive attention back onto TSLA as he sees fit.

The Value Of A Mention

It's hard to place a quantifiable value on what a mention on WSB is worth to a firm, as individually they are probably worth close to $0. But more significant interest could have a life changing short term impact on current shareholders as the value of their portfolio balloons thanks to retail traders taking an interest in one of their holdings.

On the other hand, short sellers (such as those shorting GME earlier this year) could feel substantial pain, as their positions require covering at ever increasing prices.

If I was to place a value on it, I would suggest adjusting price targets by as much as 2X current price if a firm were to see significant interest through WSB - but this is tempered by the expectation that long term, the stock would return to its fundamental value.

If you're holding TSLA shares, it appears the music has stopped over at WSB, and prices may fall back to around $700 in the coming weeks.

In short, if your holding becomes a 'meme stock', take 2X your money and run - things are about to get volatile.

精彩评论