Summary

- Attendance of 2 million is terrible for AMC.

- The company needs to more than double attendance to return to 2019 - when it still lost money.

- Someday shares will fall 90% from this point.

I'm pretty bad at predicting what makes AMC Entertainment(NYSE:AMC)go up or down in the short term. After all, I said to short it at $26/share (Short Squeeze Presents Many Ways to Make Money) and then explained why there was no fundamental news behind the run up at $58/share (Recent Events are Just Re-Runs). But I'm pretty good at reading press releases, news articles and financial statements, and it's clear from recent news just how big a hole AMC has to climb out of on an operating basis.

Attendance at theaters is terrible and AMC will continue to lose money

On Monday, AMC put out a press release touting its "post-reopening record" of 2 million attendees and highlighting the biggest box office draw "Fast and the Furious 9" which grossed $70 million:

For reasons that should be clear to all,these numbers are terrible. As you can see from the company's earnings release showing results for 2018 and 2019:

The pace for attendance in 2019 was 250 million in the US, or 4.8 million customers per week and in 2018 it was 4.9 million customers. So it's very nice to learn that 2 million customers is the largest number of people to see a movie at AMC since COVID-19 led to lockdowns, but the real numbers mean show attendance is down almost 60% from 2018 and 2019.

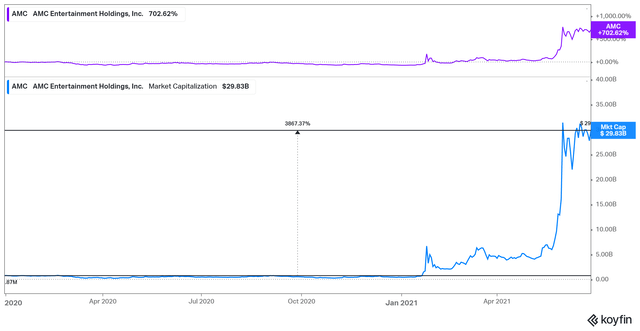

As you can see above, 2018 and 2019 were not great years for the company, either. AMC lost $149 million in the second of two years and made $110 million in the first one. At the end of 2019, the stock price of a money-losing AMC was just over $7/share. Bullish shareholders ("Apes" as they style themselves) are excited about the move of more than 700% to this week's price of over $55/share:

But what many of them don't seem to be paying attention to is the market capitalization. As you can see in the chart above, increasing the share count from 100 million to almost 480 million shares outstanding in the last year has pushed the market cap far higher leading to an increase of almost 3,900%.

This kind of securities analysis is not "optional" and shareholders are now paying almost 40 times as much to own this company as they did at the end of the last full year before COVID-19.

Not all MemeStocks are created Equal

The first "memestock" to capture everyone's attention this year was GameStop (GME). After a number of years of declining sales, a new class of investors such as Chewy founder Ryan took interest in the company and eventually took over the board of directors. At the same time this change in leadership was underway, a number of hedge funds who had been short the stock began losing money at an alarming clip.

In the popular imagination, the rise in GameStop shares was a win for retail investors sharing information on Reddit such as the now-famous "Roaring Kitty," but the evidence is the biggest winners were in fact other hedge funds (see "This Hedge Fund Made $700 million on GameStop"). Since Cohen took over the company, he is shifting its business model to online sales and hiring executives from leading companies such as Amazon(NASDAQ:AMZN).

None of the kinds of positive things that are happening at GameStop are even close to being talked about at AMC. AMC has had thesame CEO since 2015. There is no change in business model, and now that he has cash from equity sales, thebest ideahe's come up with is just buying more movie theaters! Meanwhile, many of the most successful companies on the planet such as Disney(NYSE:DIS), Netflix(NASDAQ:NFLX)and Amazon are all developing streaming services to entertain customers at home - which keeps them from going to the movies.

Likewise, the entire growth of the online gaming industry with services such as Twitch from Amazon and Microsoft(NASDAQ:MSFT)with Xbox is another substantial competitor getting in the way of customers going to the movies. All this is to say that the future is not getting brighter for AMC.

Conclusion

Maybe AMC's share price will double next week. Maybe it will get cut in half. I don't know and neither does anyone else. But one month, one quarter or one year from now, shareholders will own a money-losing company in a fading industry at an extremely high valuation.

I'm short shares in this stock because one day in the not-too-distant future, those shareholders will start selling, and then once the stock goes down regularly I expect them to start selling shares rapidly. Ultimately, I expect the shares to go back to the level they were at the end of 2019 - only when that happens, they won't be $7/share anymore. They'll be closer to $2.00.

Good luck to all!

精彩评论