Summary

- Apple's business is healthy and should continue to perform well, but the current valuation is inflated. This is likely to cap your long-term upside.

- Mega-cap tech continues to rally as money flows in, leading to easy profits for momentum traders.

- I've made more money on Apple than any other stock over the years, but the current rise in the stock is being mostly driven by speculation and not business fundamentals.

Apple has been good to me over the years. I made the biggest trade of my life as a freshman at the University of Miami, making a large bet on Apple (AAPL) call options before quarterly earnings in January 2015. Everyone-and I mean everyone-was buying the new iPhone 6 at the time, but Wall Street wasn't as positive on Apple. Some guys writing onSeeking Alphawere big on the Apple trade as well-in contrast to sell-side analysts who got it wrong focusing on meaningless metrics like iPad sales. This was before Robinhood and the rise of WallStreetBets, so trading options wasn't nearly as mainstream as it is now, although wanting to impress a cute girl from New York was a factor in the aggressive sizing of the trade.

AAPL ended up beating earnings estimates by one of the largest margins in its history If you buy cheap stocks that are going up and sell expensive stocks that are going down then you'll find that you'll get "lucky" more often than not. To this day, Apple stock and options remain the biggest contributor to my lifetime trading profits, and I love the company for its growth and cash flow. However, as time has passed over the last 6 years, AAPL stock went from dirt cheap to extremely expensive. If you buy Apple today, you still get the same great business, but the valuation is severely capping your upside as the stock has outrun the business fundamentals. I'd like to do some of the same analysis I did in making that trade to show why today's Apple is not the same stock as the one I bet on 6 years ago. To paraphrase Kenny Rogers, you've got to know when to hold and when to fold.

Is Apple a Good Long-Term Stock?

Apple has historically been a great long-term stock due to being a great business and the behavioral bias of disposition effect selling. Back when I made my Apple trade, I sketched out the thesis for Apple on the back of a napkin. Apple was selling tons of iPhones, the stock traded for like 13x earnings, and the company had a ton of offshore cash that they could borrow against to endlessly buy back the stock (they successfully have bought back nearly 40 percent of the company since Tim Cook started). Apple additionally had an arbitrage play with the offshore cash as the investment income they got off it was the same or higher than the interest on their own debt. EPS had nowhere to go but up.

Today it's not so clear. Apple trades for 27x 2021 earnings while analysts only expect EPS growth in the 5 percent range going forward. The Trump Administration freed Big Tech's offshore cash hoard, and Apple's secret weapon of buybacks isn't as effective with the stock at nearly 30x earnings. Apple additionally got a one-time boost in net income from the corporate tax cut, which is now fully priced into the stock. If you owned Apple before you get the same great business, but the stock is completely different. I noted in my original trade that the sell-side analysts were wrong. They're likely to be wrong again on the low side because of Apple's mastery of sandbagging, but the market set the bar so high for Apple that the error traders may now be making is expecting too much future growth.

Apple has always been a product-cycle-driven company. One reason that Apple today trades for a higher multiple is that they have figured out how to generate recurring revenue from services. For example, it's estimated that Google (GOOG) pays Apple over $1 billion per month for the right to be the default search engine on iPhones. Apple also takes a cut of App Stores purchases, charges for data storage, music streaming, and other services. Service revenue has a 70 percent gross margin, compared with ~35-37 percent on Apple's other products.

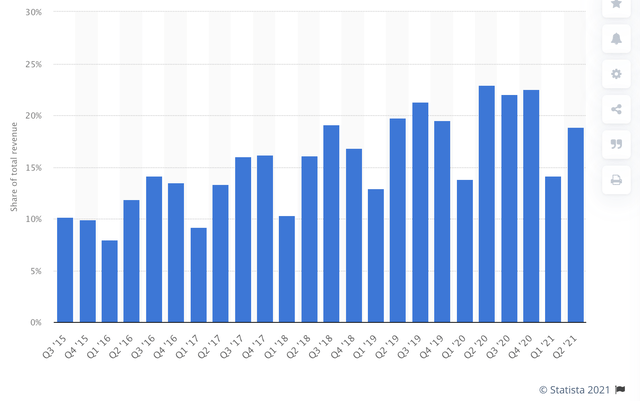

Here you can see that services are making up an increasing amount of Apple's revenue. Note that services will make up a lower percentage of revenue in holiday quarters when retail sales are higher. For FY '21, services are expected to make up around 19 percent of Apple's revenue.

Apple's service revenue is likely to drive nearly all of the growth in Apple earnings. Thankfully for bulls, services revenue could plausibly double in the next 5 years. The growth isn't a given, especially if regulators push back against Apple's somewhat monopolistic position with its App Store and against the escalating payments they demand from other tech companies for access to Apple's closed ecosystem. Consensus analyst earnings estimates only go out to 2023 for Apple, so we have to make some educated guesses about earnings. I believe the analyst earnings estimates are again too low for Apple. Service revenue should double in 5 years and take up a greater and greater share of earnings, while iPhone revenue has not shown a track record of consistently growing over the past few years.

Where Will Apple Stock Be in 5 Years?

The quickest way for me to value Apple is to adjust analyst earnings estimates for sandbagging and then make some quick growth assumptions to get 2026 earnings. Apple beats analyst earnings estimates somewhere around 90 percent of the time historically, so we have to adjust for analysts being lazy. I'm going to assume that analysts are 10 percent low for FY 2022 (analysts expect $5.30 in earnings) and then a little low on forward growth assumptions due to services growth (analysts expect around 5 percent EPS growth from Apple going forward, I'll go with 7 percent). This gets me an earnings estimate of $7.60 for 2026. Putting a 25x multiple on Apple gets a price target of $190 for AAPL in 2026. At today's price of over $143 as of writing this, this is roughly a 6.5 percent annual return for Apple shareholders, plus the 0.6 percent dividend for a total return of 7.1 percent. This is after adjusting analyst numbers to the upside and assuming the P/E multiple stays historically high but contracts slightly. Any corporate income tax hikes would lower this price target slightly. Should Apple trade more in line with historical valuations, the result would almost certainly be painful for shareholders.

If you're a big Apple bull and you're reading this, you shouldn't be surprised. Apple stock has nearly doubled since the start of the coronavirus pandemic, and while the underlying business has done well, it isn't anywhere near twice as good. This naturally caps the upside for Apple shareholders. The last time I ran my S&P 500 model, I modeled S&P 500 (SPY) returns of between 8.2 percent annually and 8.7 percent annually. With the market up even more since I ran my last numbers, I believe that the expected return to index fund holders is now likely on the low end of my previous range. It's completely natural for the largest components in the index to be slightly overvalued compared to the rest of the market due to their popularity, and my intuition seems to be confirmed here with Apple and most other large-cap tech stocks I've analyzed.

Is AAPL a Good Buy Now?

Apple would need a substantial pullback before I would consider the stock a good buy. The last time I covered Apple, I suggested buying Apple on any pullback to 20x earnings, which would now imply buying a dip to the $110 to $115 range-possibly closer to $100 in a broader market downturn. The history of Apple stock is full of booms and busts- your patience is likely to be eventually rewarded. If you own highly appreciated Apple stock I would consider taking advantage of current prices to take some profits. While you can always make money trading NASDAQ stocks on momentum, I just don't see business fundamentals justifying paying up for Apple here. Either the business will need to catch up while the stock stays flat, or the stock will need to fall for Apple to converge with fair value here.

Anything is possible, but I find that AAPL is a little overvalued compared with the market as a whole, and as such, shareholders should lower their expectations going forward. Today's Apple is not the same stock as yesterday's Apple, and the current fundamentals warrant waiting for a dip.

精彩评论