Summary

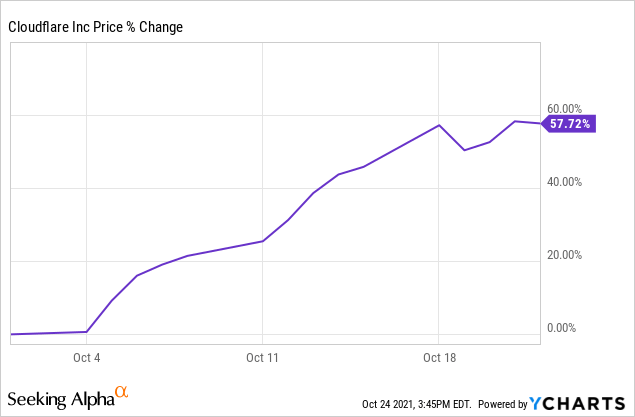

- Cloudflare has once again experienced huge gains in a very short period of time.

- The reasons for this are multiple, however they seem to return to the company's necessary nature and leadership from Matthew Prince.

- Earnings are around the corner and investors are likely bracing for impact due to the high valuation of this stock.

Investment Thesis For NET Stock:

Cloudflare, Inc.(NYSE:NET)(also "the Company" hereafter) is an innovative company in the evolution into the cloud, edge computing and the internet of things (IoT). 25 million internet properties count on Cloudflare to provide security and performance. The Company has a vast and growing total addressable market (TAM) expected to reach over $100B in a few short years and has experienced massive growth. The stock has again reached all-time highs and is up over 60% since my previous article in only three weeks, as shown below. The big question is: is there any upside left?

The Pandemic Revealed Cloudflare's Indispensability

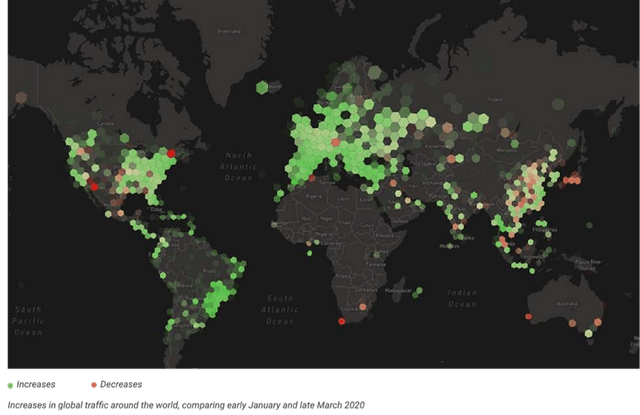

At the onset of the pandemic, almost everything moved online. Schools were being taught virtually. Restaurants who would normally have a majority of in-person patrons were taking orders mostly online. Grocery delivery skyrocketed. And perhaps the most drastic change, employees were working from home (WFH) in record numbers.

The results are clear to see in this graphic. Internet traffic exploded around the globe.

“We sit in front of more than 10 percent of all websites, so we have a pretty representative sample of how traffic patterns change in response to events globally,”- Matthew Prince.

During this time, attacks also increased exponentially. This included attacks on critical infrastructure like hospitals.According to Cloudflare, attack traffic was up significantly from January 2020 to March through May 2020 on healthcare centers.

The increase in traffic, however, was no great sweat to Cloudflare's systems which handle DDoS attacks which are exponentially more traffic than even the height of the pandemic's increased traffic. In fact, in summer of 2021 Cloudflare deflected such an attack that was 3x larger than any other noted on record. The single attack produced nearly 70% of the total of all legitimate traffic. The attacks were deflected successfully and automatically.

We also had a fairly important election season in 2020 which you may remember. In 2017 the Department of Homeland Security reported that 21 states had voter registration files and websites targeted. Cloudflare developed Athenian Project to provide protection to state and local governments' voter related sites - for free. There are several case studies from local and state government internet security personnel and technology executives. Cloudflare states that there are over 120,000 threats per day to election sites nationwide. Yet, there were no major stories of local or state level hacks during the previous cycle. To this end, Cloudflare also mitigated over 77M threats to campaign websites over a six month period with Cloudflare for Campaigns.

In September 2021 Cloudflare announced an initiative into email security. Phishing is the most common type of attack on enterprises according to the FBI. Cloudflare will be providing its Advanced Email Security Suite to customers as a fully integrated solution.

The bottom line is that Cloudflare has become a necessity to keeping the world moving that many people may not even be aware of.

Matthew Prince's Leadership

Matthew Prince has a very public role in the company. However, he is not a promotional mouthpiece. When he speaks, he does so on the needs of their customers, the needs of enterprises and individuals, and what Cloudflare seeks to provide. Prince is a regular on major financial networks and several videos and fireside chats can be found on YouTube.

Matthew Prince is also no stranger to emergency situations at Cloudflare. Serious outages have affected the company. He has been lauded for his leadership and communication during these incidents, even when the outages may only last for minutes.

"We built Cloudflare with a mission of helping build a better Internet and, this morning, we didn't live up to that,"Cloudflare CEO Matthew Prince told DCD. "I take personal responsibility for that. And so I think that that it's disappointing, and it's painful."

I believe customers value this level of openness, quickness to communicate, and personal responsibility.

He has an excellent grasp on the various issues facing the internet, including the differing regulations and upcoming changes to laws in many countries throughout the world. One example is the Digital Services Act in the European Union. And why not? He has an MBA from Harvard, a Law Degree from the University of Chicago, and a computer science degree, among other qualifications. Co-founder, COO, and Director Michelle Zatlyn also has a strong pedigree with a Harvard MBA and having served as Head of User Experience for several years prior to this role.

Hitting On The Numbers

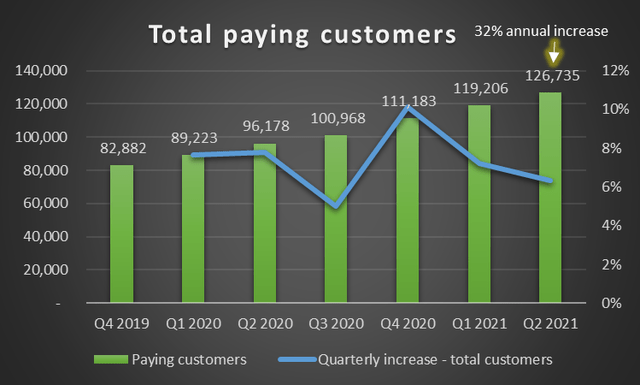

I have previously delved deeper into the quantitative aspects of the company. Cloudflare will report on November 4th and estimates for revenue average $165M for the quarter. This would be an 8% increase over Q2 2021. Year over year, Q2 2021 revenues were over 52% above Q2 2020. Estimates for forward growth are over 33% for fiscal 2022.

Cloudflare has some excellent metrics that will assist in achieving profits once the company has scaled. First, the gross margin has reached 77% over the prior three quarters. This is higher than most companies in this industry. Another metric to watch will be the increase in paying customers and paying customers providing over $100k in annual recurring revenue (ARR). The Q2 figures were very impressive and represented a 32% gain over the prior year for total paying customers, as shown below.

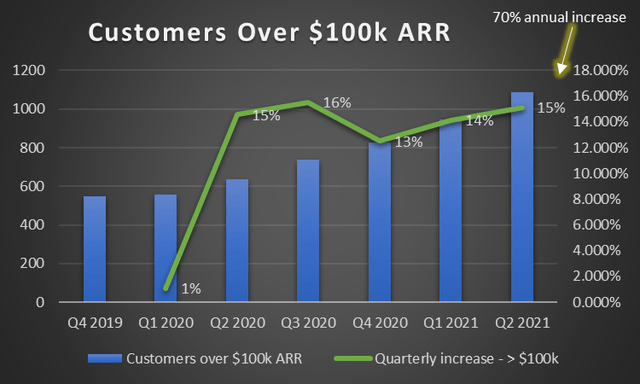

The data is even more impressive with the increase in large customers or those who provide over $100,000 in ARR. The chart below depicts these gains.

Cloudflare's valuation has once again appeared to outrun the short-term fundamentals, however there is still a long-term opportunity with this indispensable company. A short-term pullback would not surprise me after the earnings call. The fact is that even a blowout quarter will make the valuation tough to justifyat this point. I believe the company will continue to grow and become quite profitable as it scales in the coming years.

Conclusion

In my previous article on Cloudflare I noted that pullbacks in this stock signal opportunities.

"The 17% pullback on no company-specific negative news is the essence of this approach. Stocks like NET are prone to taking the escalator up and then quick elevator pullbacks."

Since this pullback the stock has gained well over 50%.

I consider this to signal a recognition from investors and institutions that Cloudflare has an immensely bright future. Earnings will be a test of investor confidence on this stock and I would not be surprised to see a significant pullback, although likely still substantially above the prior pullback level. It is also entirely possible that management hits a home run and the stock runs higher. As always it is best to accumulate shares over time to manage short-term risks. The thesis remains the same: I consider any short-term pullback an accumulation opportunity in NET stock.

精彩评论