Fintech company SoFi, which recently went public via SPAC, has become the new target of meme mania. But in this case, there may be better fundamentals behind the frenzy.

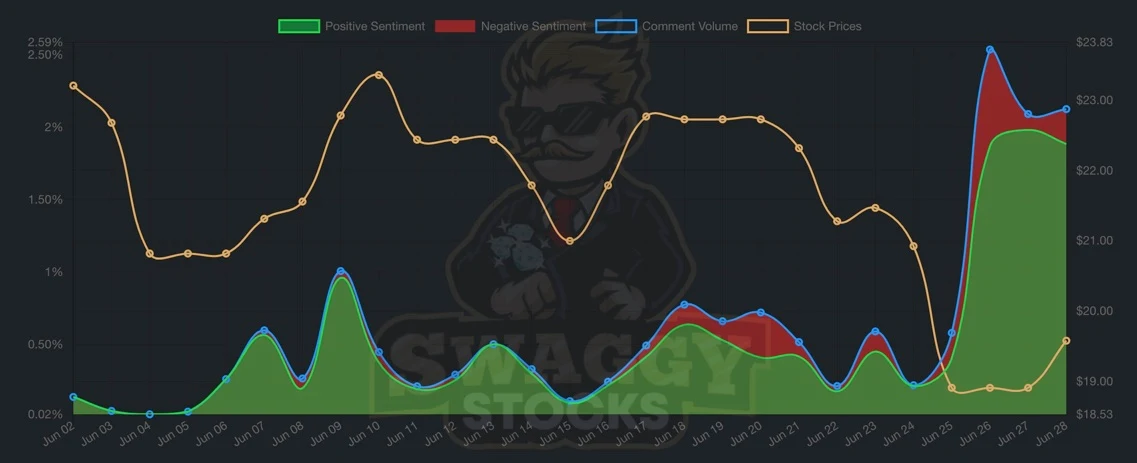

The most discussed stock on Reddit this Monday, June 28, was that of Social Finance Technology, known as SoFi. Traded volume soared to an average of 50 million shares per day since Friday, from a previous daily average of only 7 million since the IPO.

Since January 2021, the financial company has been listed on the US stock exchange via SPAC, supported by well-known billionaire Chamath Palihapitiya. The mogul has also supported Clover Health and Virgin Galactic, both also popular on Reddit forums lately.

Today, Wall Street Memes talks about this company whose stock could benefit from short-term momentum driven by online forums – but that also has long-term potential from robust business fundamentals.

About SoFi

The San Francisco-based company, founded in 2011, is a fintech created by four students with the initial goal of providing more affordable options for student lenders. Later, services expanded to personal loans, home loans and financial services in general. SoFi operates the B2B Galileo platform in addition to Apex, an investment platform without brokerage fees.

The company currently has about 1,400 employees and its equity is valued at $15 billion. It has over 700,000 members and over 7 million registered users. At the end of the first quarter of 2021, the company went public via SPAC and debuted on the stock exchange in early June.

Fintech matures

An alternative to large banks and traditional investment companies, fintech offers practical services with little bureaucracy and low fees. As the industry matures, it forces large financial institutions to rethink their business models. Third-party surveys show that the sector is expected to grow 25% by 2022.

The big challenge for fintech today is to reach profitability. Providing excellent user experience, low fees and transparent products has resulted in large numbers of active users, but low margins. Companies that figure out how to balance the growth plus margin formula will likely reap the benefits.

SoFi shines

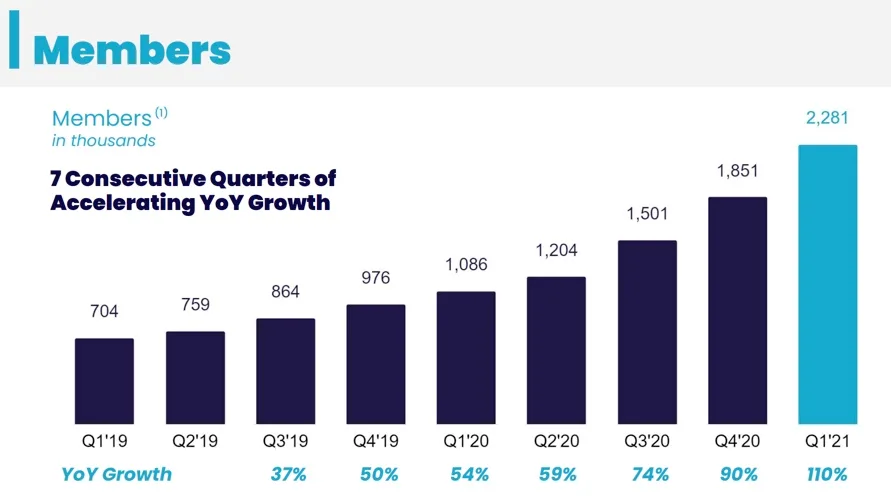

SoFi appears to be well run. The company has delivered encouraging growth in members, up 110% YoY in the last quarter. Also, total financial service products increased 121% YoY. In B2B, Galileo is on the right track, posting more than 100% YoY growth in accounts in the last three quarters.

In the aggregate, revenues reflect the great operating metrics, at over $750 million for the past 12 months and 151% YoY growth recorded in the last quarter.

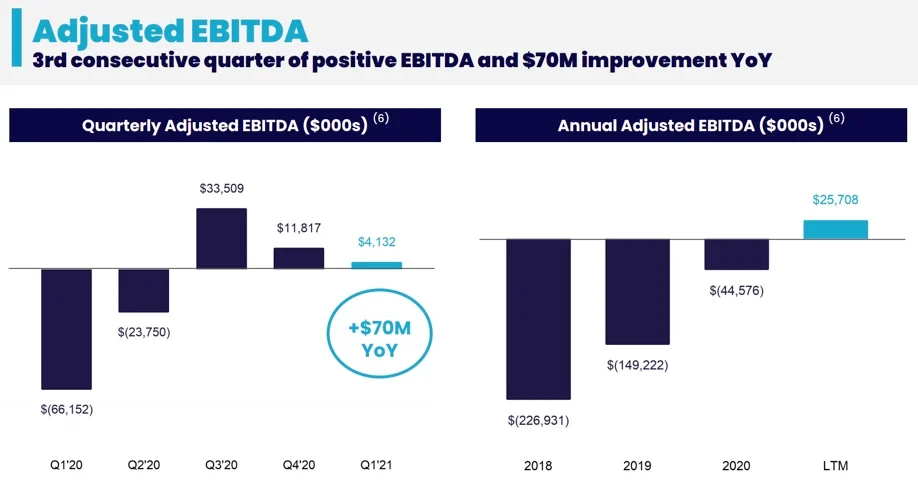

The icing on the cake for SoFi are the profits. The company has posted positive EBITDA for three consecutive quarters, with the last period showing $70 million YoY growth –see chart below. The results came through a combination of cost savings in the Lending segment and increased revenue.

Wall Street Meme's Take

Apparently, SoFi has what it takes to continue showing good results, while it has already found the path to profitability. The company has delivered strong results, expanded its services, and still has plenty of opportunity to grow.

As a potential target of meme mania, the stock could see shareholder value creation in the short term from momentum alone. But better yet, the company has been presenting decent fundamentals that can lead to stock price appreciation also in the medium and long terms.

精彩评论