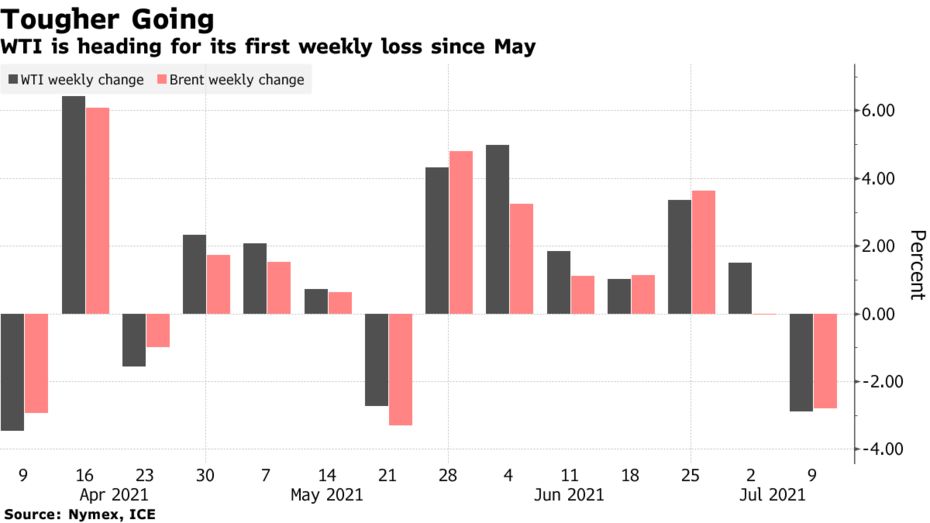

Oil headed for the biggest weekly loss since May as a dispute between Saudi Arabia and the United Arab Emirates clouded the outlook for supply just as the spread of the delta virus variant sapped risk appetite.

West Texas Intermediate, which swung around $73 a barrel, has sunk 2.6% this week, snapping a run of six consecutive weekly gains that had lifted prices to the highest level since 2014. A stronger dollar and investors backtracking onreflation betshave also weighed on the outlook for crude.

The drop for WTI over the week came despite official data on Thursday that showed another fall in U.S. crude stockpiles, as well as record fuel demand. Nationwide oil holdings have shrunk to the lowest since February 2020 as activity picks up with the rollout of vaccines to combat the pandemic.

After an 11% gain last month, July has been more challenging for oil, driven by uncertainties for both supply and demand. While the dispute at the Organization of Petroleum Exporting Countries may prompt the cartel and its allies to leave output steady in August, there’s also scope for members adding barrels unilaterally. At the same time, reopenings in the U.S. and Europe are aiding energy consumption, but rising infections from the delta strain pose a risk.

Sponsored ContentWhy Stakeholder Capitalism Is Becoming More Relevant In JapanYokogawa

“What we are seeing in the oil market is in tandem with the overall softening of global risk sentiment,” said Howie Lee, an economist at Oversea-Chinese Banking Corp., adding that he’s sticking to a bullish view on crude. “OPEC+ may or may not come back to the table but the possibility of a full-out price war, that we saw last year, is low.”

| PRICES: |

|---|

|

OPEC+ members are stalled over the question of how to increase supply in August and subsequent months. So far, the UAE hasblocked the agreementin a bid to raise its own production quota after investing in new capacity.

The market’s pricing patterns still suggest tightness. Brent’s prompt timespread was 84 cents a barrel in backwardation, with near-term prices above those further out. That compares with 47 cents a month earlier. Year-to-date, the global oil benchmark has rallied 43%.

精彩评论