U.S. futures slipped and precious metals tumbled Monday as traders weighed Friday’s strong employment data that fueled expectations the Federal Reserve will move closer to pulling back stimulus. Asian stocks looked set for a mixed start.

Gold slumped to the lowest since March as the prospect of higher rates makes bullion less attractive relative to other assets. Silver dropped to its lowest since November. Crude oil extended last week’s decline -- its worst since October -- on concern the delta virus strain will hamper demand growth. Commodity currencies like the Australian dollar underperformed.

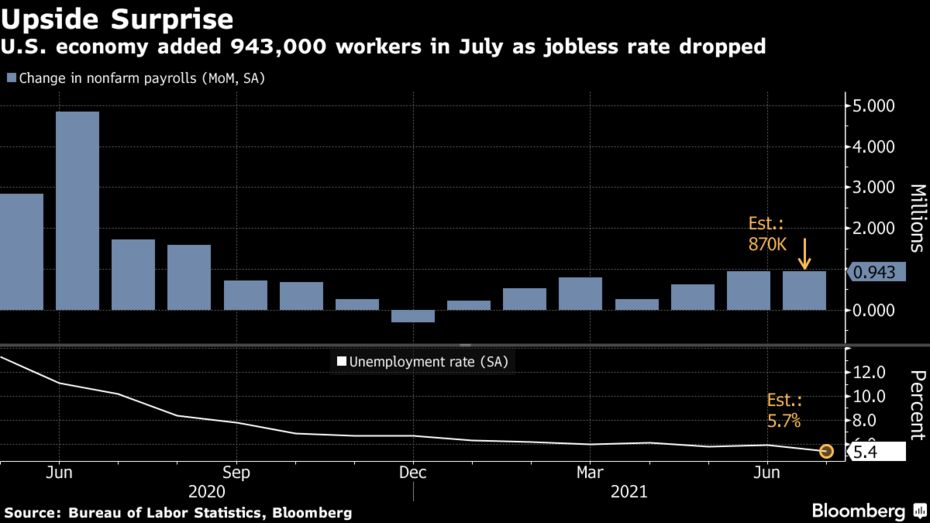

Stock futures pointed higher in Australia, and dipped earlier in Hong Kong. Japanese markets are closed for a holiday. The dollar edged higher. On Friday, data showed U.S. job growth accelerated in July by the most in almost a year and the unemployment rate declined, illustrating momentum in a labor market grappling with hiring challenges.

The U.S. 10-year Treasury yield climbed to about 1.3% Friday. Cash Treasuries won’t trade in Asia because of the holiday in Tokyo.

The jobs report fanned expectations the central bank will start to cut back stimulus as it wrestles with above-target inflation even as delta spreads. Dallas Fed President Robert Kaplan added to the speculation Friday, saying he’d support adjusting purchases soon but in a gradual manner.

U.S. inflation data this week will be a key marker for investors trying to gauge how acute price pressures are, ahead of the Jackson Hole symposium later this month.

“You have these concerns that if the economy is growing very, very strongly then that might bring forward the tightening or the tapering by the Fed,” Shane Oliver, head of investment strategy and chief economist at AMP Capital, said on Bloomberg Television. “There is a good chance they might announce that tapering in September and it would start later this year.”

Chinese assets will be closely watched after export growth slowed in July, adding to concerns the economy’s recovery will face fresh pressure in the second half of the year. China’s inflation data this week could also provide a reason toslowthe bullish momentum in its sovereign bonds’ world-beating rally.

Traders are also keeping an eye on the progress of the vote on the $550 billion U.S. infrastructure package.

On the virus front, Anthony Fauci, the U.S.’s top infectious-disease doctor,said he’s “strongly in favor” of speeding booster shots to people with weakened immune systems, a further sign of how the delta variant continues to shift the strategies for curbing the pandemic.

Elsewhere, Bitcoin traded back above $44,000 after hitting the highest since May over the weekend.

Here are some key events to watch out for this week:

- Atlanta Fed President Raphael Bostic; Richmond Fed President Tom Barkin; Cleveland Fed President Loretta Mester; Kansas City Fed President Esther George among Fed speakers through the week

- China PPI, CPI due Monday

- The U.S. consumer price index on Wednesday is forecast to show prices increased again in July

- OPEC Monthly Oil Market Report due Thursday

These are the main moves in markets:

Stocks

- S&P 500 futures slid 0.3% as of 8:25 a.m. in Tokyo. The S&P 500 rose 0.2%

- Nasdaq 100 futures dropped 0.4%. The Nasdaq 100 fell 0.4%

- Australia’s S&P/ASX 200 Index futures rose 0.4%

- Hang Seng Index futures fell 0.3% earlier

Currencies

- The Japanese yen was little changed at 110.29 per dollar

- The offshore yuan traded at 6.4813 per dollar

- The Bloomberg Dollar Spot Index rose 0.1%

- The euro was at $1.1752

Bonds

- The yield on 10-year Treasuries advanced seven basis points to 1.30% Friday

- Australia’s 10-year bond yield rose about four basis points to 1.23%

Commodities

- West Texas Intermediate crude fell 1.9% to $66.97 a barrel

- Gold retreated 3.8% to $1,699 an ounce

精彩评论