Apple shares remain stuck in the mud following strong fiscal Q3 results. One analyst believes that things will get even worse for the stock before they get better.

Applereported very solid fiscal Q3 numberson July 27, zipping past Wall Street’s most optimistic estimates once again. But as Apple stock failed to get traction after earnings season, not all analysts seem convinced that robust past performance will translate into higher share price.

Take Bernstein Toni Sacconaghi, for instance. The Apple skeptic, who has a hold rating on the stock and price target of $132 apiece,believes that AAPL has 10% downside from current levels. The Apple Maven explores the reasons why shares might dip this much.

The case for a 10% loss

Toni begins his argument by recognizing that the bar had been set too high ahead of earnings season. This is reasonable, as Apple appreciated about 20% in the two months leading to its earnings day. Other Big Tech companies experienced similar “sell the news” pressure after reporting robust financial results –think of Microsoft(MSFT), for example.

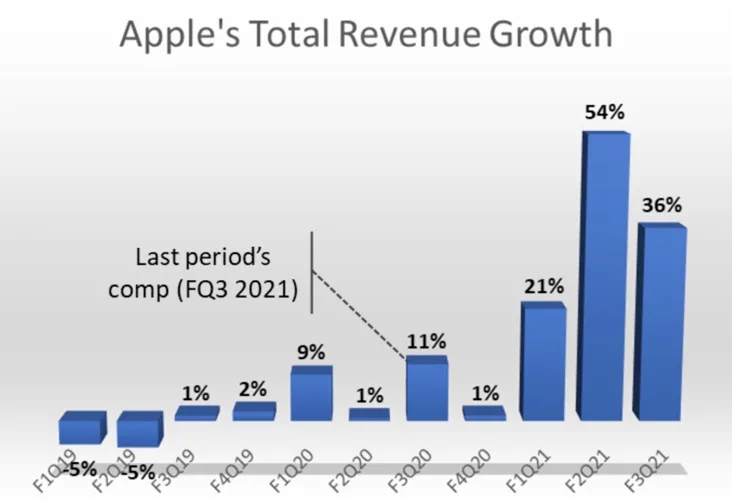

But the analyst’s concerns do not end here. According to him, there is a belief on the Street that things cannot get much better for the Cupertino company. Apple will start facing very tough comps starting now (see chart below) while dealing with supply chain challenges, and growth deceleration is all but a certainty at this point.

The analyst thinks that revenue should be lighter than expected going forward and the iPhone, weaker through the next year. Apple is certainly more about services today than it used to be, but the iPhone remains a crucial component of the ecosystem.

Mr. Sacconaghi also thinks that valuations have stretched too thin. Historically, AAPL has been valued at a discount to the market. Today, the stock trades eight turns higher on a trailing twelve-month P/E basis, at 29 times earnings.

To be clear, Bernstein’s analyst believes that Apple deserves to be valued higher than the S&P 500 now, given the growth in the higher-margin and recurring revenue service businesses. But he questions how much is too much. The analyst thinks that a fair earnings multiple would be around 25 times.

The Apple Maven’s take

In my view, Bernstein’s analyst raises a few important points. Apple stock rallied ahead of earnings, which may explain a period of share price consolidation, even after strong earnings. It is also undeniable that comps will be very hard to beat immediately before, during and just after the 2021 holiday season.

But I am not too concerned about the other points that Toni has raised. On valuation,I side with Wedbush’s Dan Ives in thinking that relying on P/E alone can be tricky. Apple stock has probably been re-rated for higher growth (5G cycle, wearables, mixed reality, Apple Car) and heavier service mix leading to stickier revenues and better margins.

As AAPL hovers within two percentage points of its all-time high, I understand that investors should not expect outsized returns in the next 12 to 18 months. But I continue to find the stock a good buy-and-hold investment for the long term.

精彩评论