Following September's slide (in both Services and Manufacturing), analysts expected preliminary October data to be more mixed with a slight gain for Services and very slight weakening for Manufacturing (which may be simply mimicking the rebound in ISM's survey in September).

Despite the overall trend lower in US macro data, the PMI prints were indeed very mixed with Services surging from 54.9 to 58.2 (well above the 55.2 expected) while Manufacturing stumbled to 59.2 from 60.7 (worse than the 60.5 expected)...

That is the weakest Manufacturing print since March and strongest Services in 3 months.

Under the hood, thelatest rise in factory production was the softest since July 2020.

October data also highlighted stronger inflationary pressures across the US economy.Average input prices rose at a survey record pace,with firms attributing higher costs to supply issues, material shortages, greater transport fees and increased wage bills. Subsequently, the rate of selling price inflation for goods and services also hit a new series peak.

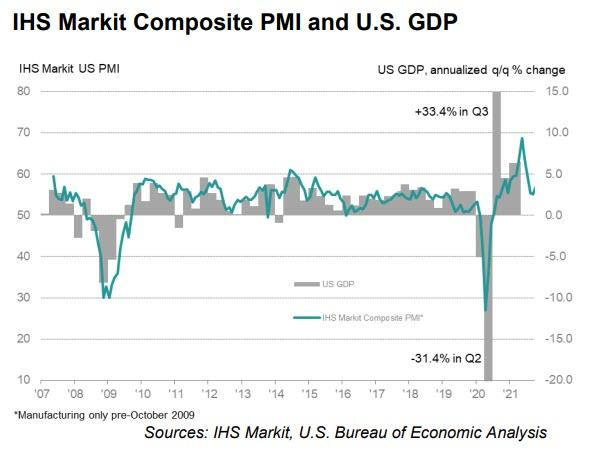

The big gain in Services pushed the US Composite up to 57.3 (from 55.0) and back in the lead on a global basis...

Commenting on the PMI data,Chris Williamson, Chief Business Economist at IHS Markit, said:

“ October saw resurgent service sector activity as COVID-19 case numbers continued to fall, marking a encouragingly strong start to the fourth quarter for the economy.Hiring has likewise picked up as firms have been encouraged to expand capacity to meet rising demand.

“Thus, while the economy looks set for stronger growth in the fourth quarter, the upward rise in inflationary pressures also shows no signs of abating.”

So not transitory then?

精彩评论