Fed minutes due Wednesday could clarify when the central bank will begin to tighten policy.

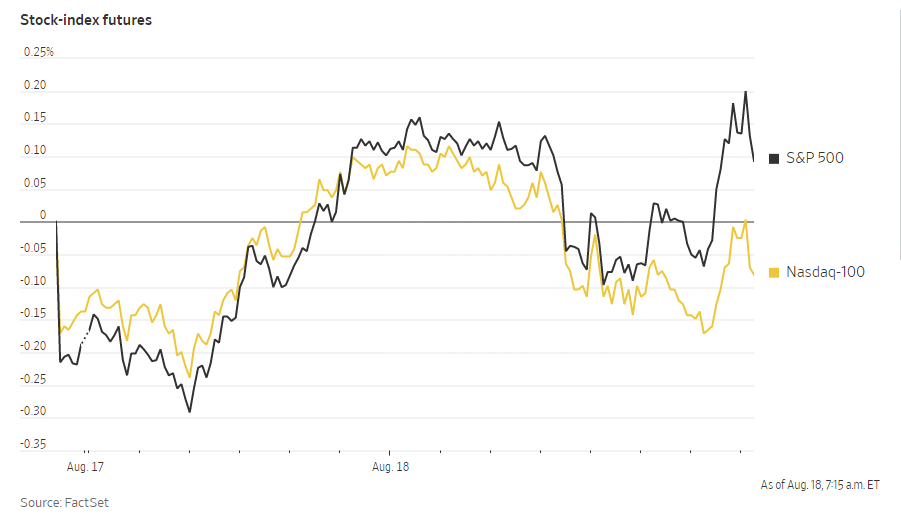

Futuresare waveringahead of the release of minutes from the Federal Reserve’s July policy meeting. Here’s what we’re watching before Wednesday’s opening bell.

- U.S.-traded shares ofAlibabaclawed back 1% premarket after Tuesday’s 4.9% drop, which put the tech giant’s stockdown more than 25%this year. New draft guidelines released Tuesday by China’s top market regulator aim to prevent internet companies from adopting forced exclusivity and blocking competitors’ links and apps.

- Targetwas among the first of the big retailers reporting earnings on Wednesday. Its shares slipped 3.7% premarket immediately after the release, though the earnings topped estimates, and the board approved a new $15 billion share repurchase program.

- Home-improvement retailerLowe’sgained 2.8% premarket after it said it now expects 2021 revenue of about $92 billion. In May, the company said only that it was tracking above a previous forecast for sales of $86 billion.

- Vaccine makers were charting divergent courses ahead of the bell. The Biden administrationis expectedto call for a third Covid-19 shot for Americans who were fully vaccinated with thePfizerorModernashot. But while Moderna gained 1.8%, Pfizer edged down 0.2%.

- Two U.S. senators are urging the Federal Trade Commission to open a probe into whetherTeslaused deceptive marketing practices involving driver-assistance features that the electric-vehicle maker calls Autopilot and Full Self-Driving. Investors don’t seem worried. Tesla shares gained 1.1% premarket.

- La-Z-Boyslipped 0.8% premarket after the furniture company’s sales in its first quarter rose over 80% from a year earlier and earnings jumped.

- CDK Globaldropped nearly 10% off hours after the digital-services firm focused on the car industry reported earnings following Tuesday’s close.

- TJX Cos.,Bath & Body WorksandCisco Systemsare among the companies reporting earnings Wednesday.

- Refiners such asMarathon Petroleumare benefiting from a surge in U.S. gasoline demand, but investors remain wary because of rising costs for meeting environmental rules.

精彩评论