Amazon’s Q3 was challenging, and the holiday quarter will likely see the impact of higher costs and supply disruptions. As worries remain, should investors buy the dip in November?

Since the company’s second quarter earnings report, Amazon stock has been struggling to find traction. And while some hoped that third quarter results could suggest a post-pandemic recovery in e-commerce, Amazon’s online store sales climbed a mere 12% – low compared to nearly 40% last year.

Now, AMZN is 12% off its all-time high. Given the current setup, could November be a good month to buy Amazon stock? The Amazon Maven discusses the opportunity below.

Fundamentals still solid

Few will disagree that Amazon is still the king of e-commerce. The company has been using the “flywheel approach” to its advantage, pulling together demand for its products and services and creating customer loyalty. With the number of Prime members expected to reach nearly 7 out of 10 American households by 2025, we believe that the Seattle-based company is the obvious candidate to capture the most growth opportunities.

On the cloud side, Amazon seems to have nothing but blue skies ahead (pun intended). AWS (i.e. Amazon Web Services) was instrumental in keeping total company op profits afloat in the third quarter – a combination of top-line momentum and a low marginal cost model. With the cloud space projected to grow at a CAGR of nearly 20% through 2028 at least, market leader Amazon stands to benefit.

Buying the dip

While it is hard to make short-term predictions on price movement, the recent pullback in AMZN could be an opportunity for long-term shareholders.As the Amazon Maven has discussed before, “buying the fear and selling the greed” has worked well for Amazon stock.

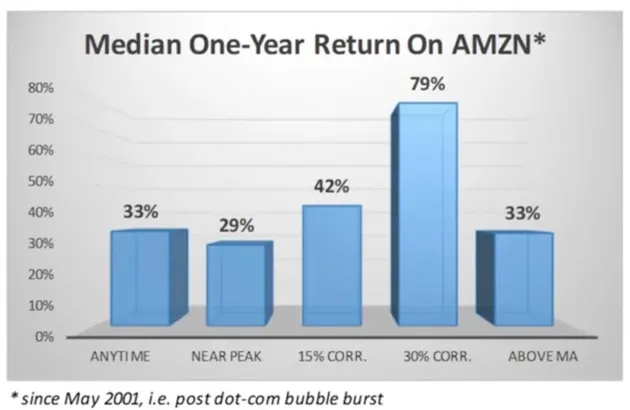

The chart below shows that buying AMZN and holding it for a year has produced an average of 33% in gains over the past two decades. Doing so after a 15% correction or more has led to even better returns of 42%. Therefore, with the stock officially in correction mode (i.e. 10% or more below peak levels), November could prove to be a good time to buy.

Wall Street says buy

The pandemic has led analysts to think that shopping habits would be disrupted for good. However, Amazon’s two most recent earnings reports have proven that e-commerce benefited from a temporary spike in buy-from-home activity in 2020 – and that enough demand has been shifting back to the brick-and-mortar channel this year.

Expectations seem to have been reset. Still, Wall Street consensus remains highly bullish. Analysts believe that Amazon stock should be worth over $4,000 in the foreseeable future, according to TipRanks. If so, this would represent upside of 22%, even if such gains may take months to materialize.

精彩评论