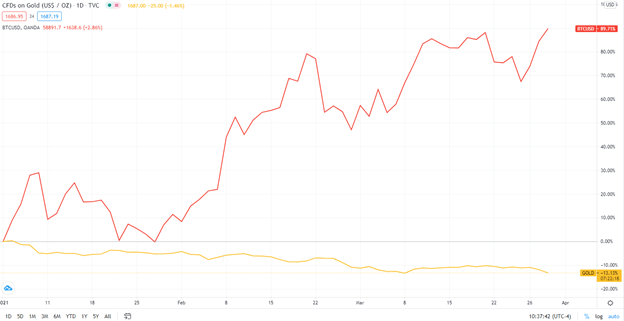

Gold continues to drop in Tuesday's trading, falling below the $1,700 watermark -1.53%. Gold is down -11.72% YTD and -18.51% since early August of 2020.

Interestingly enough, bitcoin (BTC-USD), on the other hand, is +1.50% on the day and is +102.88% YTD. Some investors see the digital currency stealing market share from gold as investors have chosen the cryptocurrency over gold of late.

This inverse relationship between gold and bitcoin is not a first-time offense. Dating back to the fourth quarter of 2017, bitcoin ran up over 300.00% to its then all-time high of $19,458 back on December 18th. During that time, investors saw gold slide over -7.00% to the downside.

While it's possible that bitcoin may be stealing a portion of gold's market share, there are still other significant factors at play. The fact that the vaccine rollout continues to strengthen and virus impacts subside doesn't play well for the haven asset.

Below is a YTD chart of the performance on gold and bitcoin.

精彩评论