While traders are making bank chasing Apple to a $3 trillion market cap, many in the market are adding cash to their accounts amid heightened concerns around the Omicron variant and a more hawkish Federal Reserve.

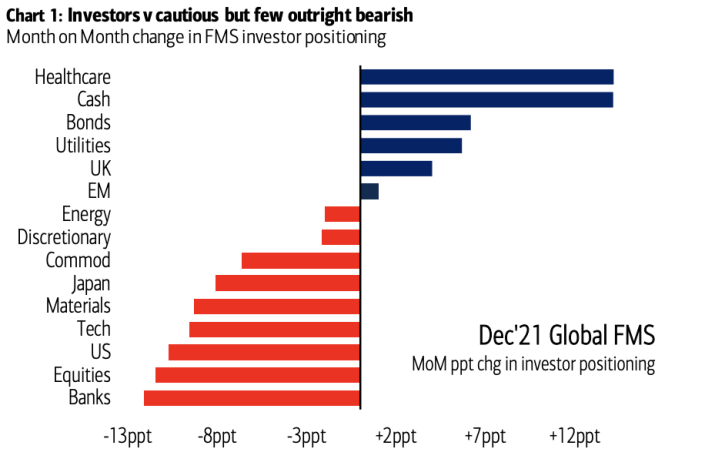

Bank of America's monthly fund manager survey out Tuesday found cash allocation among investors surged 14 percentage points in December from November. Fund managers were net 36% overweight cash, the highest allocation to the asset class since May 2020.

Besides cash, investors also rotated into defensive sectors of the market such as health care and REITs.

"Hawkish central banks spark a surge in cash and more defensive asset allocation," explains BofA strategist Michael Hartnett.

"If December FOMC [meeting] is dovish, crypto, unprofitable tech, banks, EM would rally… if hawkish, cash stays cash," Hartnett adds.

Decreased investor appetite for risk-taking right now — and more appetite to raise cash — could be seen in the yawning bearishness in meme stocks.

Shares of GameStop and AMC dropped 4% and 6%, respectively, in pre-market trading Tuesday. On Monday,AMC's stock crashed 15% while GameStop tanked 13%.

Both popular meme stocks are down more than 60% from their highs achieved earlier in the year, when owning cash wasn't exactly in favor.

精彩评论