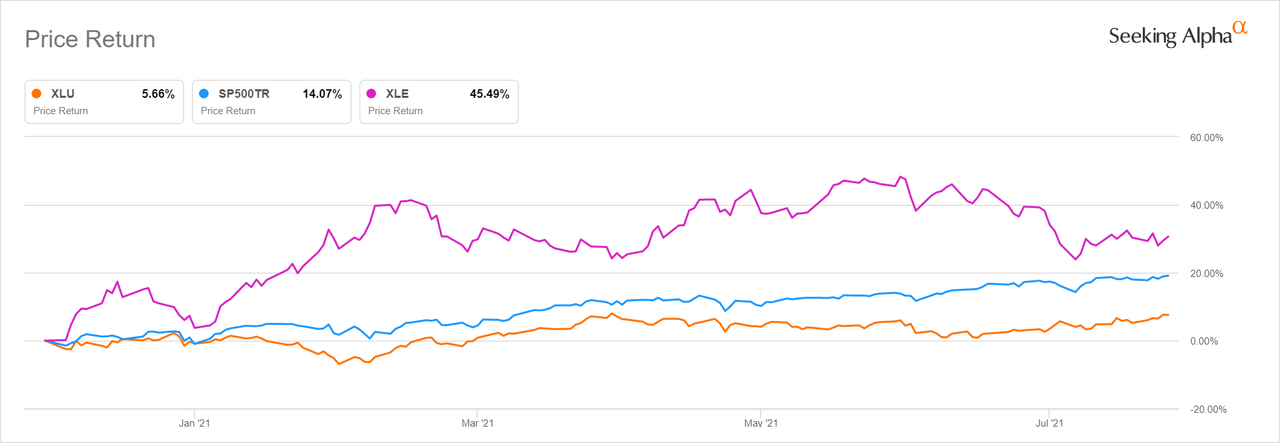

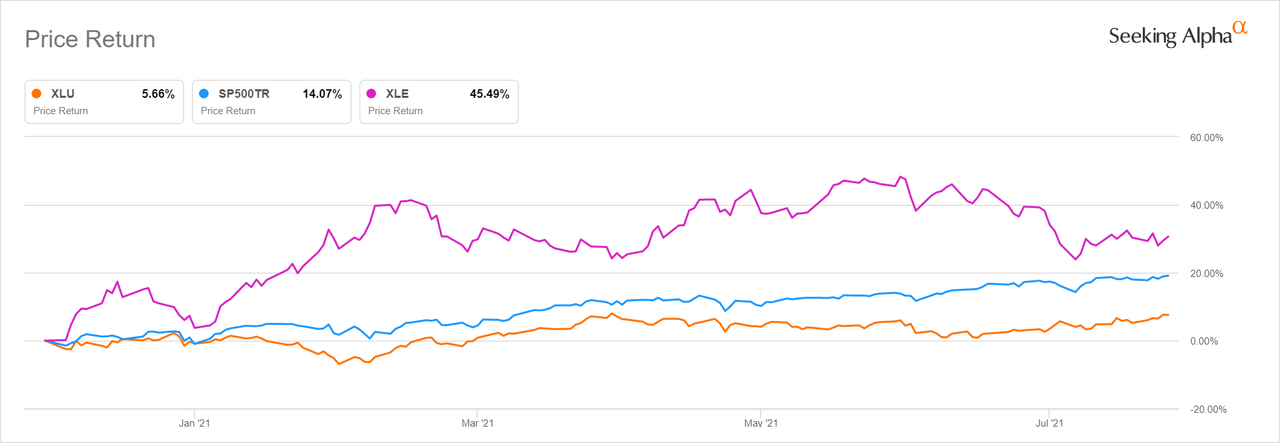

- "With our more defensive tilt and the risk reward skews outlined above, we're changing our order of preference between Utilities and Energy," Morgan Stanley says.

- It's raising Utilities Select Sector SPDR Fund to Equal Weight from Underweight and cutting Energy Select Sector SPDR Fund to Underweight from Equal Weight.

- XLU was one the best-performing sectors last week, rising 4.9%. Energy was lower among the cyclicals, up just 0.2%.

- The S&P500 ETF was up 0.9%.

- Utilities analyst Stephen Byrd notes:

- "Utilities are double beneficiaries if Democrats pass legislation - more support for clean energy growth and an ability to pass alonghigher corporate taxes to customer."

- "Utility stocks are already pricing higher interest rates."

- There "is no spread between BBB bond yields and utility dividend yields which is unusual (bonds typically yield 150-250 bps more)."

- Morgan Stanley Energy analysts "maintain a positive bias given strong free cash flow projections, but given our more cautious view on risk assets, the limited house upside forecast for oil, the importance of rate of change in oil price to sector performance, our revisions breadth analysis above, and a worsening technical picture for Energy equities, our top down preference skews more negative pending a price reset."

- Citigroup recently upgraded XLU to Market Perform, saying the "group as under-owned, yet there are no clear catalysts for appreciation at the moment."

免责声明:本文观点仅代表作者个人观点,不构成本平台的投资建议,本平台不对文章信息准确性、完整性和及时性做出任何保证,亦不对因使用或信赖文章信息引发的任何损失承担责任。

精彩评论