Do you own shares of Perennial Energy Holdings Ltd.?

You might be surprised. Thanks to the machinations of MSCI’s benchmark indices there’s a good chance that you do, so long as you own broad exposure to China or emerging markets in general (where the Middle Kingdomnow accounts for 35% of total exposure) through passive vehicles.

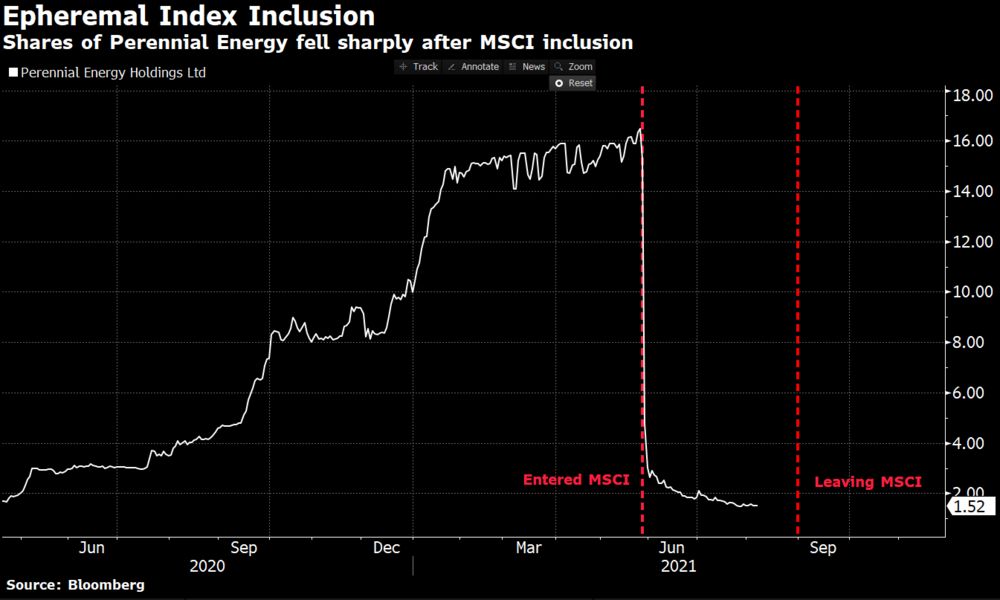

The Hong Kong-listed coal miner was included in MSCI’s China Index back in May as part of the benchmark index provider’s quarterly review. Shares of the company, based in China’s southern Guizhou province, had surged almost 450% in the year before the index inclusion took effect, boosting its market value to a high of almost $3.4 billion -- sizable enough for it to be included in the China Index.

But shares of Perennial dropped a stunning 69% on thefirst day of tradingfollowing its inclusion in the benchmark index. Since then, shares of the company have dwindled to a fraction of what they once were, taking its market cap down to around $420 million.

And so, the inevitable has happened. Overnight, MSCIannounced that it was removing the company from the index.

The exclusion means passive investors effectively bought at the top and are exiting very near to the bottom.

Perennial’s brief adventure in the benchmark big leagues therefore serves as a neat reminder of the influence of index providers and who’s left holding the bag as more active investors try to take advantage of passive flows.

精彩评论