September was a turbulent month in the stock market, but things have been normalizing lately. Here is why the recent decline in volatility is good news for Amazon stock.

After a turbulent end to the third quarter, the stock market now shows signs of relative calmness once again. The same has been true of Amazon stock. As shares seem ready to make another run towards early July peaks, volatility has declined to pre-pandemic levels.

The Amazon Maven explains why low volatility is good news for long-term investors looking for capital appreciation without the uncomfortable market “jitters”.

A look at volatility patterns

I have recently written about the idea that investing is a two-sided coin. While most investors think almost exclusively about return opportunity, not as many realize that upside potential is usually highest when risk is also elevated. So, to hopefully win big, one must usually “risk big” as well.

I, on the other hand, prefer the idea of the slow climb: decent returns driven by business fundamentals without all the gut-wrenching ups and downs.

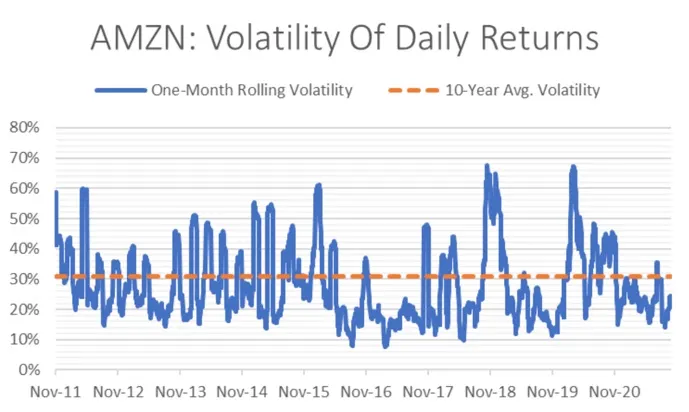

The graph below shows that, on average over the past decade (see dotted orange line), the volatility in Amazon’s daily returns has been about 31% annualized. As a reminder, volatility is a traditional measure of risk that informs how much a stock tends to “bounce around” from period to period (day to day, in this case, but in annualized terms).

The one-month rolling volatility in AMZN stock is currently only 22% – well below historical levels. See solid blue line below.

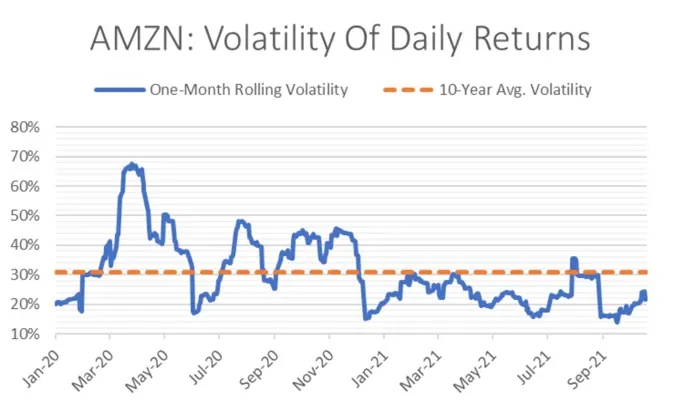

The following graph is simply a zoom into the rolling one-month volatility pattern since the start of 2020. Notice that today’s 22% is nearly as low as the metric has been since the start of the COVID-19 crisis. In fact, volatility was a comparable 20% on the first day of January of last year, when the term “COVID-19” was still unknown to the world.

What does this mean?

The recent drop in volatility, a.k.a. risk in Amazon stock can be attributed to a general sense of comfort that investors seem to have about the health of the global economies and the markets. Sure, inflation is still a concern, and so is the global supply chain crisis. But keep in mind that worries will always exist – they are just less prevalent now than they were during the thick of the pandemic, or even in the early days of the “return to normal” transition.

To be fair, there might still be some skepticism about Amazon stock, since the company proved in Q2 that the end of the stay-at-home tailwinds will weigh on its ability to perform as well in e-commerce. But still, the seas have been looking a bit less choppy in the past few weeks.

What to expect

It is well known that volatility is “sticky”. That is, moments of high volatility tend to follow periods of high volatility, and vice versa. Therefore, looking at the next couple at weeks at least, I expect AMZN to behave in somewhat “civilized” fashion, not rising or dropping too much in any given trading session – except for earnings day on October 28, possibly.

It is also well understood that low volatility tends to be associated with a slow climb in asset prices. Think about 2017, for example, when AMZN’s volatility dropped to a timid 21% and gains for the year reached 56%, suggesting impressive risk-adjusted performance.

Therefore, I believe that now is a good time to hold Amazon stock. Shares remain around 7% away from the peak, and I (hopefully not too optimistically) expect this gap to slowly narrow as Q4 progresses.

精彩评论