When investing in the stock market, people use different approaches to select which company is worth it. For some investors, the brand is everything – they simply like the product and want to own shares in the company (e.g., Coca-Cola).

For others, picking up a company to invest in comes at the end of a complicated process. Conservative investors will always prefer dividend-paying companies and compound the returns over multiple periods.

As dividends are paid quarterly in the United States, the power of compounding immediately yields results in a few years. Taxes also play an important role in defining a short- or long-term investment. Longer-term capital gains are taxed at a lower rate, the idea behind being to avoid unnecessary speculation.

Most retail investors split the market into two broad categories – growth and value. Growth and valuestocksare two fundamental approaches, two ways of looking at the broad equity market.

Growth investors look for companies that historically delivered strong earnings growth, while value investors look for companies that they believe aretradingat a discount. More precisely, they use various models to find the intrinsic value of a company’s share price (e.g., dividend discount models, capital asset pricing model) and then compare it to the market value. If the intrinsic value exceeds the market price, the company is a buy.

Since the new year started, bond yields are on the rise in the United States. The move higher reflects the ongoing economic recovery from the recession caused by the pandemic and triggered higher yields in other parts of the world. Because higher yields implicitly bring tighter financial conditions, central banks try to intervene so the economic recovery is not hurt and accommodative measures remain.

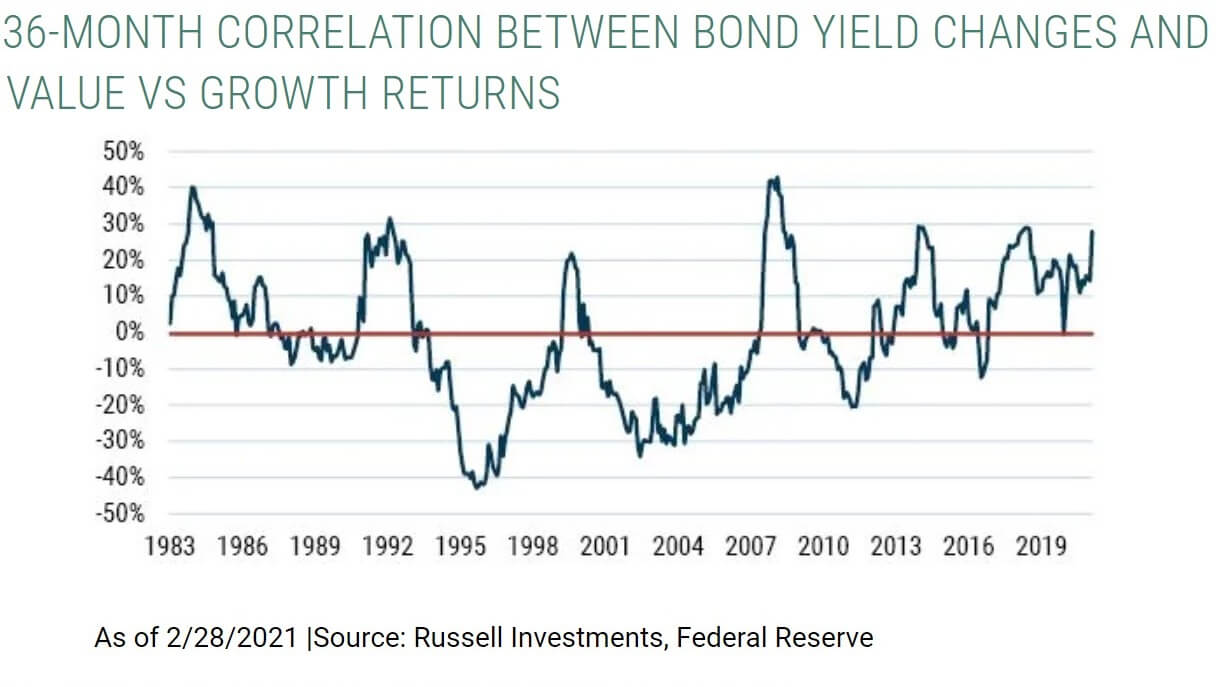

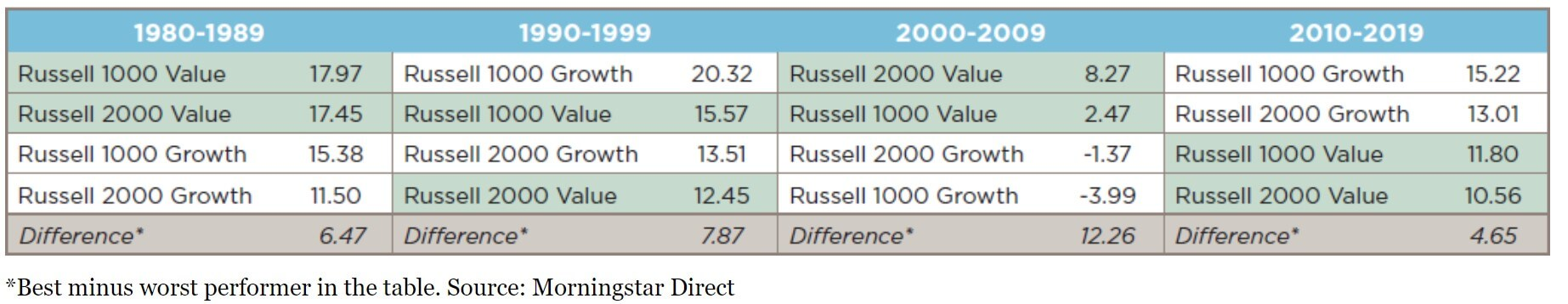

What is interesting is that historically, there is a correlation between rising yields and value stocks. The benchmark widely used is the Russell 1000 Value vs. Growth, and in the last three years that ended last February, the correlation has been +0.28. However, in the long term, the correlation declines, which brings back the question – value or growth for long-term investments?

A close look at the previous four decades shows mixed results. As such, investors would be better off looking to diversify between the two, trying to get a balanced exposure based on where the economy is on the business cycle.

精彩评论