Critical information for the U.S. trading day.

The summer lull is real for investors right now, as stock catalysts seem few and far between. Thursday’s update on consumer prices could bring the next one, after May dataspooked markets last month.

With equitiesSPX,-0.08%hovering at record highs amid a mind-blowing recovery from the COVID-19 pandemic slump, investors want to know when and how central banks will start responding to signs of surging global inflation. And as not all stocks are built alike for different stages of a recovery, many rightly want to know if they are betting on the right ones.

They should start by keeping an eye on what has been the most reliable indicator for stock direction since 2008 — the 10-year bond yieldTMUBMUSD10Y,1.541%,according to The Leuthold Group’s chief investment strategist, Jim Paulsen, who provides ourcall of the day.

Since the 2008-09 financial crisis, “the bond market has been determining, or at least coincidentally signaling” which groups of stocks will be the winners and losers, he told clients in a note. That has been particularly true for several popular themes including cyclicals, growth investing, small-caps, etc.

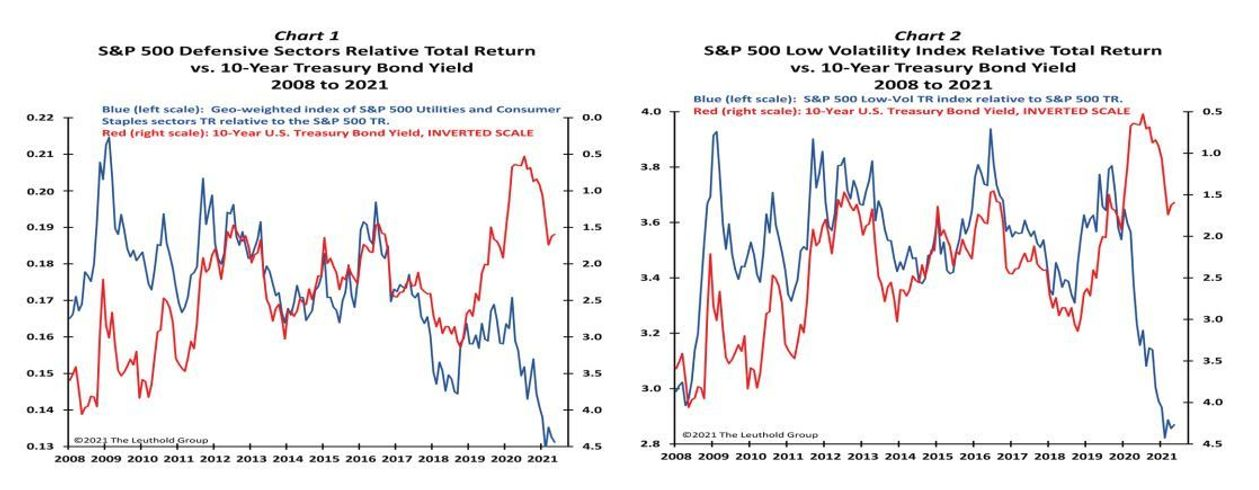

For example, via the below charts he showed how defensive sectors, such as utilities and staples or low-volatility investments, only do well when bond yields are headed lower:

So should the yield on the 10-year, currently hovering at 1.561%, make another run at 2%, that group is likely to underperform, he said. But if the economy is headed for overheat pressures and yields are set to rise, history has shown the most volatile stocks are often winner, he added.

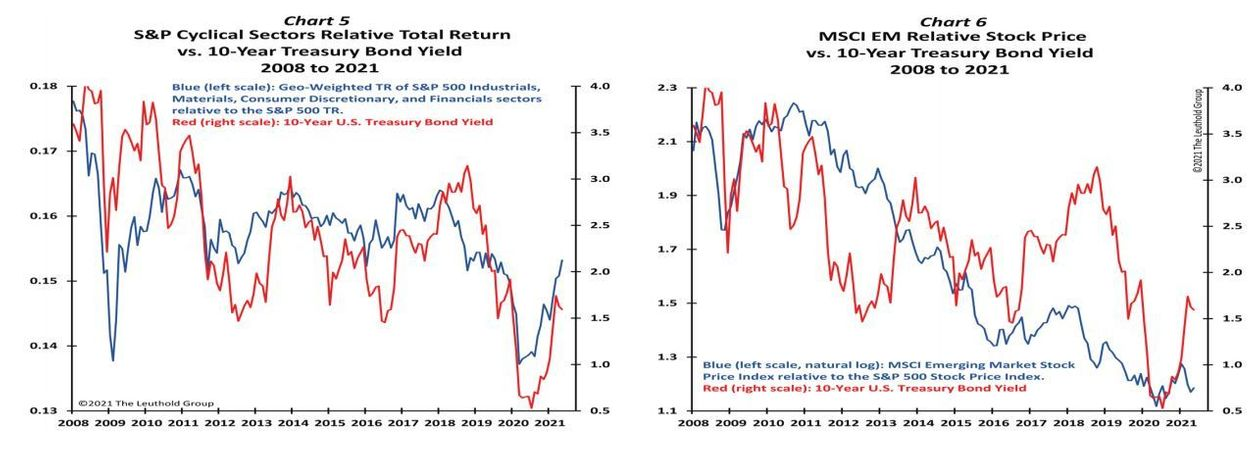

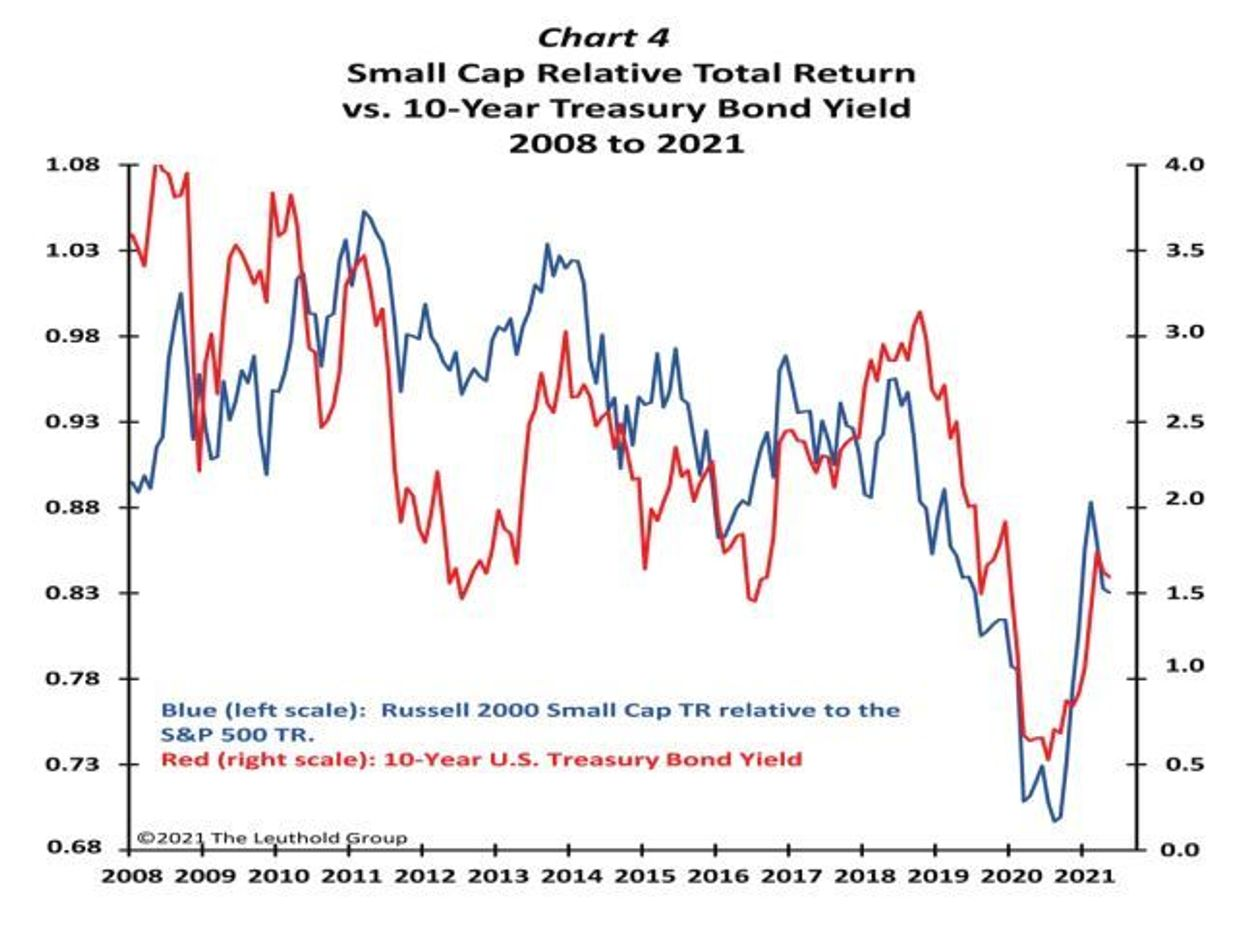

Paulsen pointed to the below charts of small-cap stocks, cyclical sectors and emerging markets that are “often the winners during periods in which rising yields cause stock market mayhem.”

And the strategist is among those who do indeed see yields rising.

“The recent pause in the 10-year yield despite escalating inflation expectations has been puzzling. Moreover, if yields continue to trend sideways or retrace part of their recent advance, defensive investments, including growth stocks, will likely be stock market leaders,” wrote Paulsen.

He expects another leg higher for that yield, pushing it above 2%, likely by the end of 2021. And that means “stock investors should heed the bond market’s message and drive a few of those fast ‘cyclical’ stock cars!”

Bitcoin blues and billionaires and taxes

U.S. stock futuresES00,0.14%NQ00,0.49%YM00,-0.06%are trading mixed, with European stocksSXXP,0.35%flat, while Asian marketspulled back. OilCL.1,-0.92%is slipping, the dollarDXY,0.14%is up and bitcoinBTCUSD,-3.83%and other cryptocurrencies continue to fall. Some note digital assets sagging since the news that U.S. authoritiesmanaged to recover most of the bitcoin usedto pay a ransomware attack on a key energy pipeline.

Major global websites including Amazon.com, CNN and Bloomberghave been hit by outageson Tuesday. Shares of FastlyFSLY,+7.17%fell briefly after the cloud platform said it hasidentified a problemand was working on a fix.

Billionaires including AmazonAMZN,-0.26%Chief Executive Jeff Bezos and Tesla Chief Executive Elon Musk at times have sidestepped federal income taxes,a new report says.

Jerome Guillen, longtime president of TeslaTSLA,+1.01%Heavy Trucking, apparentlyleft the electric-car makerlast week.

Back in May 2020, a U.S. government report on COVID-19 origins wasurging an investigation into the theorythat it leaked from a Wuhan laboratory.

精彩评论