Summary

- An investment in DoorDash brings up many questions, such as, what's DoorDash's stable revenue growth rate once the economy reopens.

- Investors are being asked to pay up 44x forward contribution profits - a rich price tag.

- In the best case, this investment is already fairly priced. Worst case, the stock is very expensive for what it is.

Investment Thesis

DoorDash(NYSE:DASH)is a fast-growing food delivery platform. Yet, it's very difficult to find its sustainable revenue growth rate for the coming twelve months.

What's more, given that the stock is already valued at close to 44x forward contribution profits, I don't see this investment as particularly compelling.

Moreover, even if DoorDash's growth rates start to stabilize, I am unsure of whether this business has enough pricing power to be rewarded with such a premium valuation.

Revenue Growth Rates Aren't the Full Story

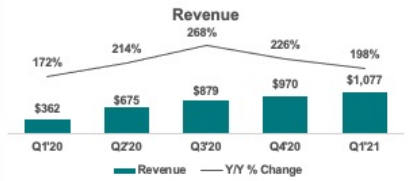

On the one hand, the graph above describes one story. The story that bulls are holding on to. Specifically, bulls make the case that DoorDash is evidently growing at such a fast clip with Q1 2021 reporting 198% y/y revenue growth that investors should be willing to pay up for these sort of revenue growth rates.

On the other hand, bears contend that if we consider DoorDash's guidance for the quarter ahead it's pointing towards Marketplace GOV of $9.9 billion at the high end, which equates to roughly 61% y/y growth for Marketplace GOV.

Digging Into the Positive and Negatives of DoorDash

Presently we are faced with a slight problem.

For the bullish thesis to work out positively, investors need to be confident as to what DoorDash's sustainable revenue growth rates are going to be as we move over the next twelve months.

Because for a high growth stock to guide towards decelerating revenue growth rates, that's always going to cause investor anxiety.

Although, it's inevitable that at some point DoorDash's revenue growth rates are bound tostart to decelerate. In fact, it's fairly obvious that DoorDash wasn't going to continue growing its revenues at north of 170% y/y for a prolonged period of time.

Nonetheless, the issue gets further complicated because thepaceat which DoorDash is slowing growth is causing some questions to surface, such as, at what revenue growth rate will DoorDash stabilize?

If, for instance, DoorDash was able to somehow report more than 80% y/y revenue growth rates for its quarter ending June 2021, this would largely put to the rest of the overarching concern investors have that as the economy reopens, that the demand for its platform is slowing demand.

Furthermore, if DoorDash could indeed grow its revenues at 80% y/y, this would demonstrate to investors that DoorDash's business is not maturing and that it has a leading position in a rapidly growing market and that investors are justified in paying a very large multiple for this high growth stock.

Having said all this, even if DoorDash were to somehow indeed report 80% y/y revenue growth for its upcoming Q2 2021 period, bears would be right to at leasttentativelymake the argument that, during Q1 2021, DoorDash's revenue growth rates were close to 200%, whereas 90 days later its growth rates have slowed down by more than 100% from one quarter to the next.

Please note, I'm not comparing sequential growth rates between Q1 and Q2 2021, but y/y growth rates. Consequently, I'm declaring that DoorDash's growth rates are unpredictable.

Nevertheless, the case remains, that as DoorDash comes up against those particularly challenging comps, the most pressing of which being Q3 2021. Investors are going to be tested on their ultimate conviction as to whether DoorDash has enough of a moat around its operation, or not. And, if DoorDash can deliver more value to Dashers than other food delivery companies to their own merchants, or not.

Valuation -- Difficult to Find Upside Potential

I know that DoorDash is not a ''bottom-line stock''. It's a story stock where the narrative is squared on it being a high-growth stock. However, our discussion allows us to momentarily focus on its EBITDA trend.

For Q2 2021, DoorDash is guiding for $100 million of EBITDA. This is a 27% y/y increase with the same period a year ago. But when a company is largely expected to grow its top-line by somewhere around 60% and perhaps as much as 80% y/y in the quarter ahead, while its EBITDA is only being guided to grow for sub 30% y/y growth, this forces the question as to whether DoorDash has positive operating leverage or not?

Consider that DoorDash's guided $38 billion Marketplace GOV and let us further make the bullish argument that DoorDash's contribution margin reaches a high of 3% for 2021. This would imply that DoorDash's contribution profit for the year reaches $1.1 billion. In that case, DoorDash is valued at approximately 44x forward contribution profits.

For a company without tangible pricing power around its operations, and a rapidly decelerating top-line growth, I am struggling to find its upside potential here.

The Bottom Line

I have attempted to lay out a balanced argument of the puts and takes that investors should consider when it comes to DoorDash.

Bulls would be correct to argue that DoorDash is not looking to maximize its profits at this stage in the game. For now, DoorDash will do whatever it can to reinvest its bottom line, in order to sustainably grow its top line and carve out market share.

However, given that its revenue growth rates are rapidly decelerating, we are only right to question whether DoorDash's reinvestment of its profit carries compelling ROI?

I declare that these questions are very difficult to correctly answer so I will be looking elsewhere to deploy my own capital. Happy investing!

精彩评论