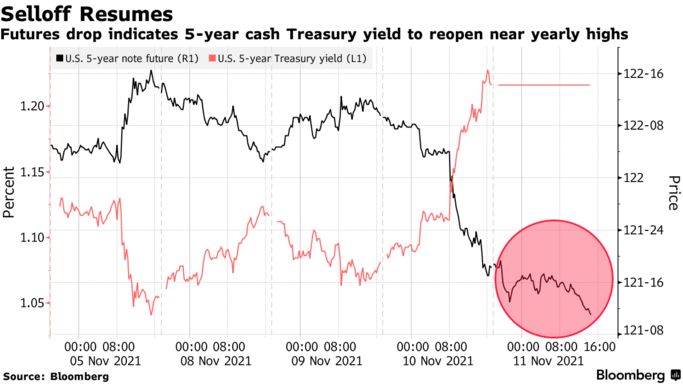

- With bond market closed for Veterans Day, derivatives slump

- Five-year note contract suggests new 2021 yield high ahead

Another dark day awaits the U.S. Treasury market when trading resumes on Friday, based on Thursday’s price action in futures.

With the bond market closed in observance of Veterans Day, a U.S. bank holiday, Treasury futures trading continued, and it wasn’t pretty. Futures prices fell across the maturity spectrum, with the five-year note contract falling as much as 10.25 ticks to a record low 121-09+, and settling at 121-10¼.

Five-year yields soared 13.5 basis points on Wednesday, the market’s worst day since February measured by the performance of the Bloomberg Treasury Index, reaching 1.23%. It peaked this year at 1.25% on Oct. 22, after Federal Reserve Chair Jerome Powell said rising inflation rates would draw a response from the central bank.

Wednesday’s yield surge was unleashed by bigger-than-expected increases in consumer price gauges for October.

Eurodollar futuresalso fell sharplyThursday, with the December 2022 contract reaching its lowest level since March 2020, implying the Fed will raise rates at least twice next year. Volumes in both futures markets were no more than half their 20-day average levels for most contracts.

精彩评论