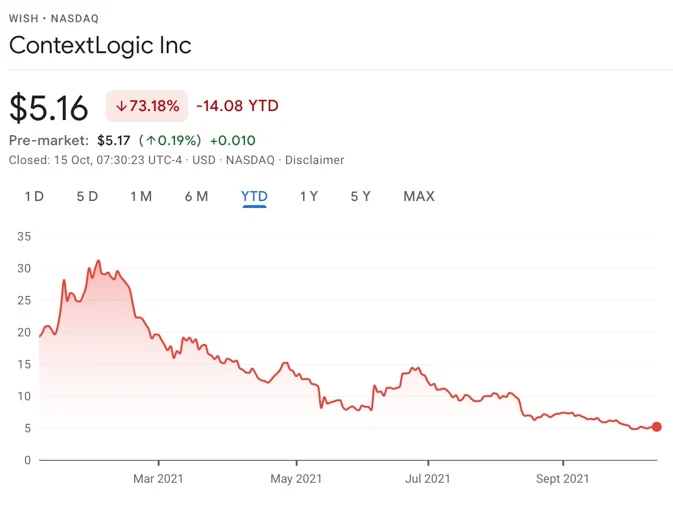

ContextLogic shares have been struggling since the February peak and are down 80%. Wall Street Memes discusses whether WISH may be a good buy-the-dip opportunity.

Shares of e-commerce company ContextLogic, also known as Wish, recently reached all-time lows of less than $5 per share. The stock, which is quite popular among Reddit users, has already accumulated losses of over 80% since the peak, in February of this year.

Despite Wall Street's skepticism and the sharp rise in short interest, experts still believe that the stock could have considerable upside ahead. Wall Street Memes discusses whether investors should take advantage of ContextLogic stock’s lows to buy the dip.

Skepticism, but with upside ahead

On average, Wall Street has a neutral rating on WISH. But based on the ten most recently published reports, WISH shares are expected to reach $9.17 over the next 12 months, representing very enticing 76% upside potential.

A perfect storm of challenges heading into Q4 is the main reason for bearishness, according to Oppenheimer’s analyst Jason Helfstein. He downgraded WISH stock to a sell rating and has a $4 price target, backed up by the research company’s report on supply chain issues coming out of Asia, particularly Vietnam and Indonesia. He also warned that online retailers in general stand to lose from the bottlenecks – although not all digital channel operators would be impacted equally.

On the bullish side, despite a barrage of price target reductions, analysts still see the stock as undervalued. Loop Capital’s analyst Laura Champine, for example, reduced her price projection from $20 to $15, saying that the company’s outlook for declining sales over the next three quarters disappointed. But the analyst believes that shares are cheap based on 1.3 times expected 2022 total revenue.

The most bullish expert, Credit Suisse’s Stephen Ju,reducedhis price target from $24 to $19. The drop happened after ContextLogic missed Q2 revenue and adjusted EBITDA estimates due to lower customer retention and declining usage rates. At the same time, the analyst still sees massive upside potential of nearly 200% from current levels.

Q3 earnings: could it be better?

During the last earnings call, ContextLogic said that the company has already begun to significantly cut back on digital advertising spend, and that it would focus on retention of the existing user base in the near term.

Last quarter’s revenue reached $656 million, a $66 million miss from consensus estimates. Q3 estimates now sit at $361 million, almost half of Q2 levels. To be clear, revenues will probably be lower now than in Q2 due to a pullback in e-commerce activity and supply chain issues. But with paid advertising costs being reduced recently, the company could surprise on margins and earnings, possibly delivering a beat this time.

Short interest and popularity

The latest data from MarketBeat shows that WISH’s short interest has doubled to nearly 14% of the float since mid-September (see below). However, according to Yahoo Finance, this number could be even higher: 25%. The sudden increase in short interest ratio is probably due to bearishness driven by recent financial performance and the company’s challenges ahead.

Elevated short interest may suggest negative sentiment towards the stock and the company’s business fundamentals, which is certainly a red flag. However, it can also serve to “upgrade” the stock to a meme target on the verge of a short squeeze.

WISH ticker has been trending within the most popular discussion boards online, Perhaps retail investors with an appetite for risk might want to take advantage of this moment of weakness and place a long-shot bet on WISH stock at a historical bottom.

精彩评论