- Fed rate path, inflation, valuations may all be playing a role

- Stock declines are much broader than from delta pullback

Investors are worrying about a lot more than just the omicron variant, if recent market moves are anything to go by.

While the newly discovered virus strain has been one of the main catalysts for the recent slump in U.S. stocks, action under the surface points to concerns about the Federal Reserve, inflation, valuations, year-end volatility and perhaps even some some profit-taking after a solid year of gains.

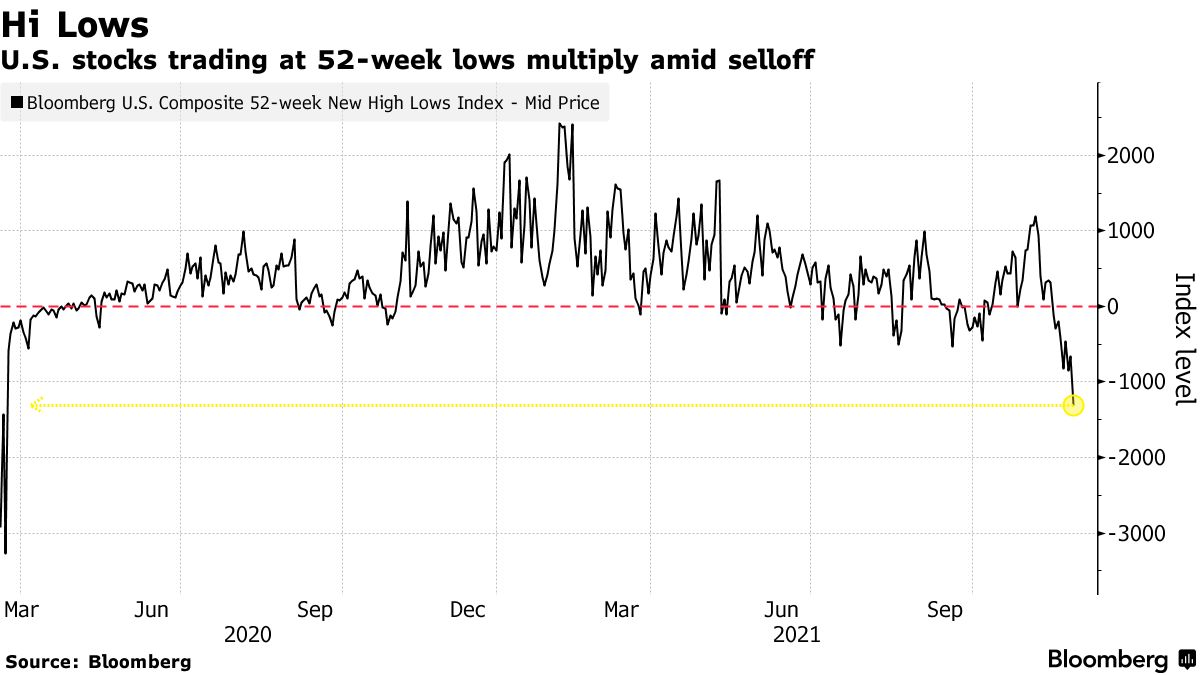

The selloff is the broadest since the worst pandemic fears last year, at least according to a gauget racking shares hitting 52-week lows relative to those at highs.

“Both Covid headlines and the perception that the Fed will tighten in the face of a negative shock to the economy are weighing on equities,” said Peter Berezin of BCA Research.

Delta Blues

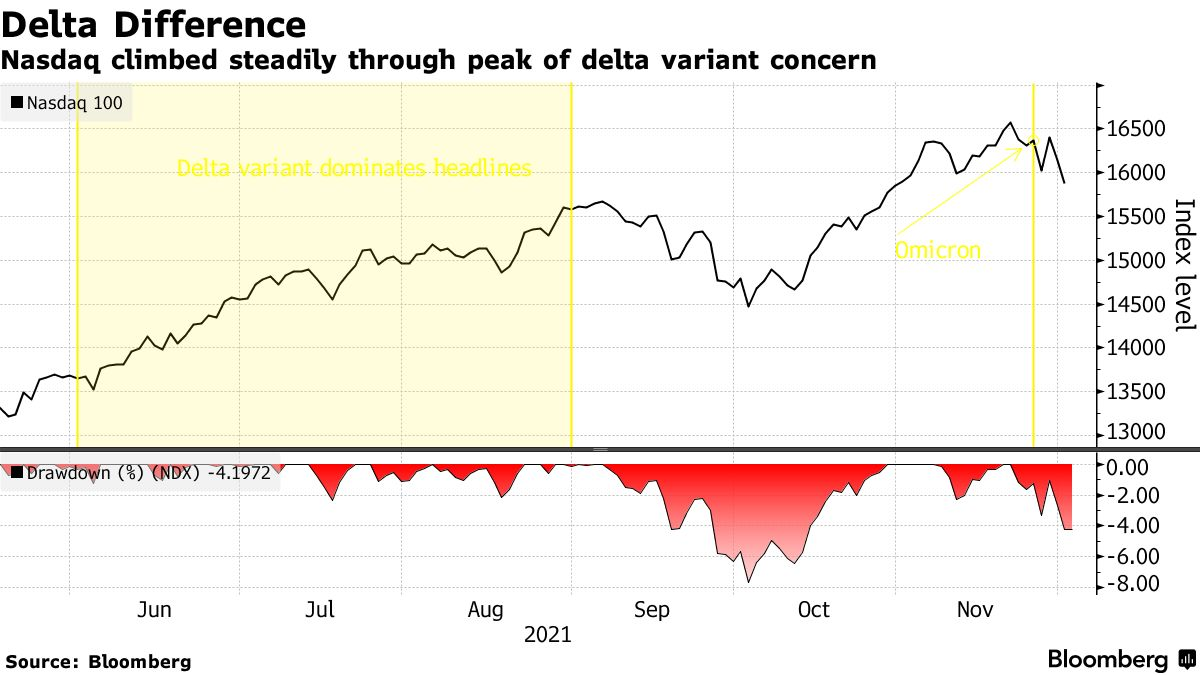

When the delta variant was emerging as a concern, investors rotated to stay-at-home and defensive growth stocks, and away from reopening shares.

This time around, a wider swath of the market has suffered -- including technology names that should benefit from further restrictions such as Zoom Video Communications Inc. and Netflix Inc.

The Nasdaq 100 Index -- which rose 14% during the ‘peak’ delta months of June, July and August -- has fallen 3% since Thanksgiving, when omicron first hit the attention of traders.

The weakness is especially noticeable as bond yields are falling, a move which usually helps investors justify high-priced valuations for growth stocks though also a signal of concern over the outlook for the economy.

“The problem is U.S. equity valuations, which have been priced for perfection and now confront a noticeably less-perfect world,” said Nicholas Colas, co-founder of DataTrek Research. “We won’t know much about the latest pandemic variant for a few weeks, and 10-year Treasuries are flashing yellow about future economic growth.”

Investor concern over inflation is still prevalent, especially the worry it will force the Fed to jack up rates sooner-than-expected, putting the pandemic recovery under threat.

Jerome Powell told Congress this week the Fed will consider ending its asset purchases earlier than planned, tapering the stimulus that has helped fuel this year’s record stock rally.

“The real issue is the fear of liquidity coming out of the system, not so much the variant,” Alicia Levine, head of equities and capital markets advisory at BNY Mellon Wealth Management, said on Bloomberg Television. Liquidity “has really driven markets for the last 20 months and has made everybody a genius and everybody a winner. Now it’s going to get a little bit more complicated.”

Seasonal Swings

The sharp selloff has blindsided investors contemplating the chances of a year-end rally to cap a stellar 2021 for stocks. The S&P 500 closed at an all-time high on Nov. 18, up almost 27% for the year. It has fallen about 4% since.

The last month of the year traditionally sees investors dialing back risk and an increase in price swings as trading volumes dry up. Over the last decade, the Cboe Volatility Index has jumped by 12% on average in December.

“Stock investors’ knee-jerk reaction may continue to be to take profits before the end of the year,” said Ed Yardeni, president of Yardeni Research. “The Santa Claus rally started early this year. The question is whether it is over already.”

精彩评论