Adventure. Excitement. The stock market doesn’t seem to crave these things lately. Investors should hope it stays that way.

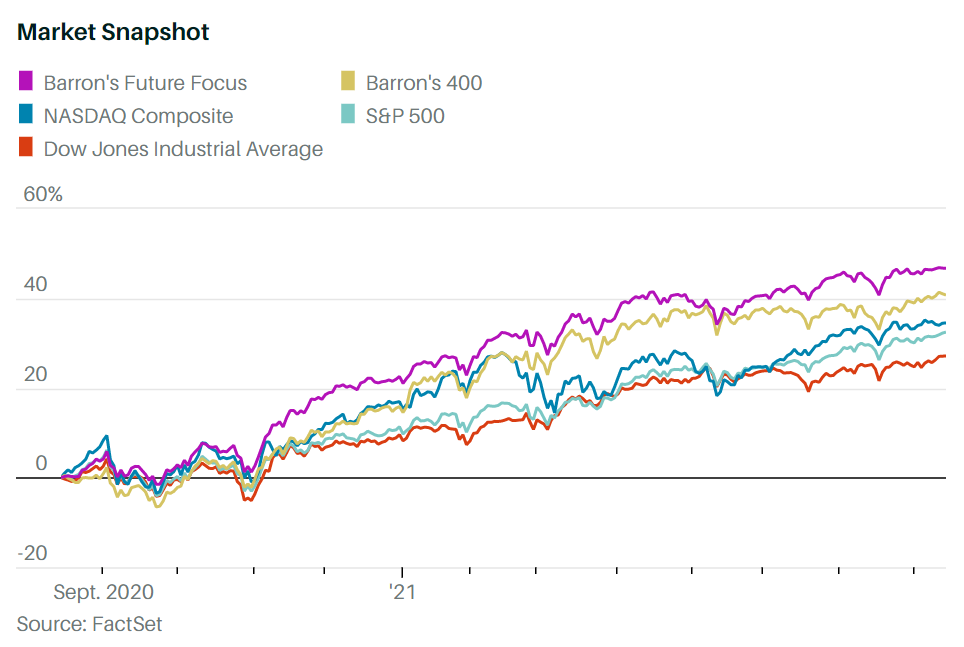

It wasn’t quite like watching paint dry this past week, but it wasn’t that far off, either. Earnings reports were few and far between, the most prominent coming from Walt Disney (ticker: DIS) and eBay (EBAY). The economic news, including July’s consumer-price data, didn’t contain any shockers. And while the S&P 500 closed the week on a streak of four new highs, one of them was by less than a quarter of a point. The index rose 0.7%, to 4468.00, while the Dow Jones Industrial Average gained 306.87 points, or 0.9%, to 35,515.38. The Nasdaq Composite dipped 0.1%. to 14,822.90.

Exuberance this ain’t.

Why Stock Prices Are Poised to Keep Rising

Still, there was some action underneath the surface. Tech,particularly chip stockslikeMicron Technology(MU),Lam Research(LRCX), andApplied Materials(AMAT), took it on the chin, while banks, includingGoldman Sachs Group(GS), and industrials such asCaterpillar(CAT), soared. And theInvesco S&P 500 Equal Weightexchange-traded fund (RSP) gained 0.8% on the week, outpacing the market-cap-weighted version.

That suggests that the stock market is rotating once again, out of tech and other growth stocks, which had been outperforming since May, and back into stocks that benefit from the strength of the U.S. economy, says Katie Stockton, founder of Fairlead Strategies. “A lot of rotation in constituents can fuel a bull market,” she says, noting that if more stocks start winning, it’s only a matter of time before the small-cap Russell 2000 index does, too.

That cyclicals have started breaking out again is impressive, particularly given the nonstop focus on the Covid-19 Delta variant. Whether it’s about states like Mississippi and Florida, or the Food and Drug Administration’s approval of a vaccine booster shot for people with compromised immune systems, renewed pandemic fears should have hit those stocks hard. That they didn’t says a lot about what investors are thinking.

“If you just look at the market action this week, it’s saying the Delta variant is a public-health crisis, but not an economic crisis,” says Dave Donabedian, chief investment officer at CIBC Private Wealth US.

At some point, the boredom will end, and the market will get more volatile. And the biggest risk might be that investors use the volatility to push the entire stock market higher, notes BTIG’s Julian Emanuel, treating it like one big meme stock.

“[The] dramatic price action in ‘meme stocks’ both old and new raises the probability that higher volatility could result in an ‘altered reality’ exception,” he writes. “And there is only one previous exception where volatility went up and stocks continued to go up, and up, and up. At least for a while.”

That, of course, was in 1999. Let’s hope we avoid the kind of excitement that followed.

精彩评论