- Cyclicals helped S&P 500 to another record high, tech lagged.

- Treasuries steady; jobs data will shape views on Fed policy.

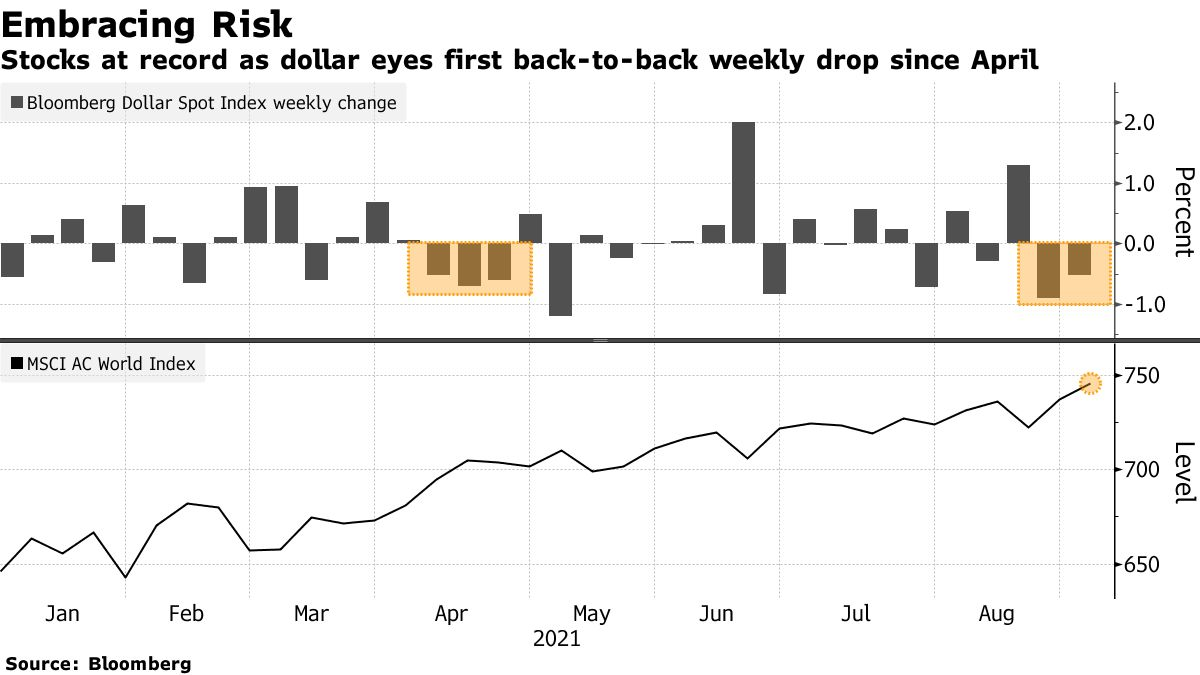

Asian stocks rose Friday and the dollar held a drop after cyclicals led Wall Street to a record high ahead of a U.S. jobs report that will shape views on the outlook for Federal Reserve monetary policy.

MSCI Inc.’s Asia-Pacific gauge climbed for a sixth day, the longest streak since January, as equities advanced in Japan, Australia and South Korea. U.S. futures fluctuated after energy shares helped the S&P 500 to a new peak. The U.S. 10-year Treasury yield edged up.

The payrolls report will color expectations about when the Fed might start tapering pandemic-era stimulus and how long it can wait before hiking interest-rates. The U.S. probably added725,000 jobsin August -- a more moderate pace versus the prior two months, but stronger than early 2021.

Crude oil was near $70 a barrel on bets that the market can absorb additional supply from OPEC+ as the U.S. Gulf grapples with Hurricane Ida’s impact.

There’s going to be a resumption of the growth trade that slowed over the summer, Michael Cuggino, president at the Permanent Portfolio Family of Funds, said on Bloomberg Television. He added that “we’re going to get a few quarters of unusually high growth as we resume to normal; then it gets really interesting -- is that growth sustainable?”

In the latest Fed comments, Atlanta President Raphael Bostic said “we’re going to let theeconomycontinue to run until we see signs of inflation,” before stepping in on interest rates. U.S. data showed initial jobless claims declined to a fresh pandemic low, while factory orders beat expectations.

Traders are continuing to monitor the political debate over planned U.S. fiscal outlays. Senator Joe Manchin is demanding a“strategic pause”in action on President Joe Biden’s economic agenda, potentially imperiling the $3.5 trillion tax and spending package.

Some of the main moves in markets:

Stocks

- S&P 500 futures were steady as of 9:15 a.m. in Tokyo. The S&P 500 rose 0.3%

- Nasdaq 100 futures were little changed. The Nasdaq 100 fell less than 0.1%

- Japan’s Topix index rose 0.6%

- Australia’s S&P/ASX 200 increased 0.3%

- South Korea’s Kospi advanced 0.7%

- Hang Seng futures fell 0.4% earlier

Currencies

- The Bloomberg Dollar Spot Index was steady

- The euro was at $1.1877

- The offshore yuan was at 6.4469 per dollar

- The Japanese yen was at 109.97 per dollar

Bonds

- The yield on 10-year Treasuries rose one basis point to 1.29%

- The yield on Australia’s 10-year bond was steady at 1.20%

Commodities

- West Texas Intermediate crude was at $69.74 a barrel, down 0.4%

- Gold was at $1,809.18 an ounce

精彩评论