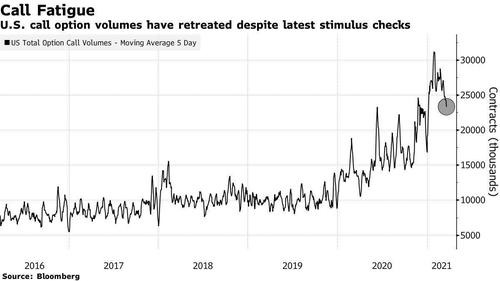

It was less than thanthree weeks agowhen we first noted that retail participation in stock trading had seemingly collapsed after a wild start to the year, with JPMorgan reporting that US retail investors share in equity trading declined sharply in March after a strong January and February, and a record high share of 28% in December.

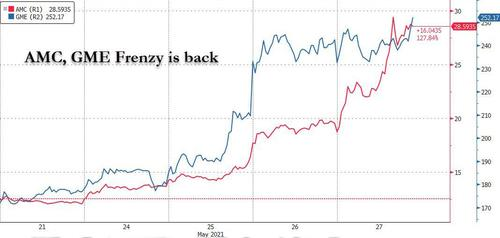

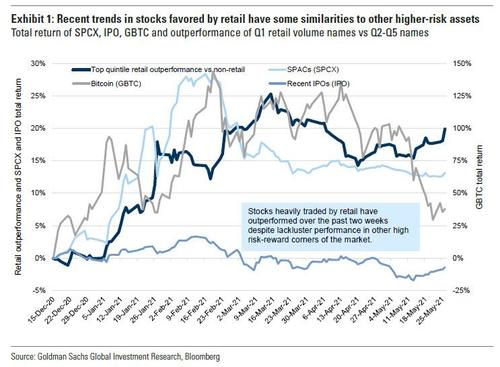

Echoing JPMorgan's observations, Goldman then notes that while declines in daily trades at retail brokers showed significant declines last week (DARTs), leading to fresh concerns that retail trading activity was on the decline - with many going so far as to conclude that retail investors were no longer investing their stimmies - this too appears to have been the wrong conclusion, as the rise in retail stocks yesterday and especially today, when both GME and AMC have soared...

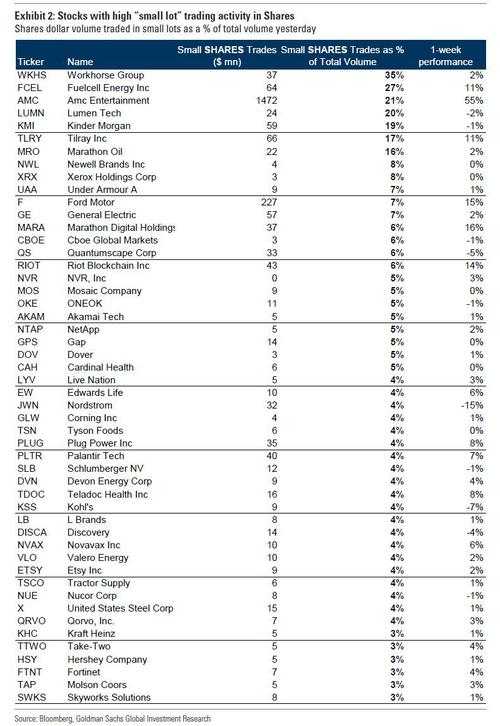

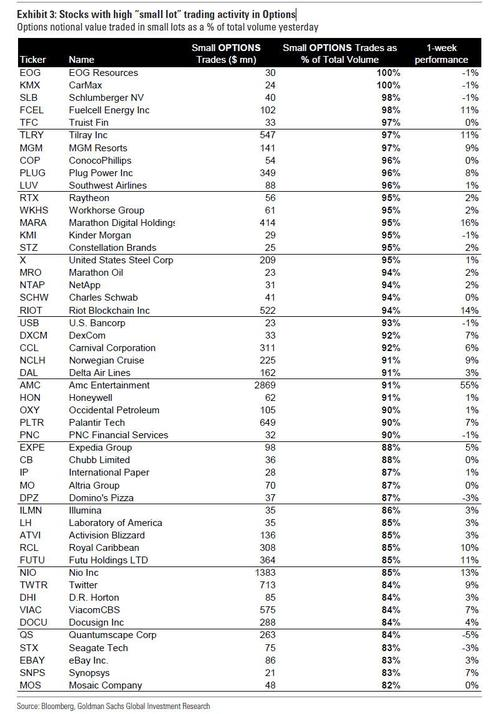

Not enough? Here are the stocks with high “small lot” trading activity in Options

精彩评论