Economists expect that applications for new jobless benefits fell last week.

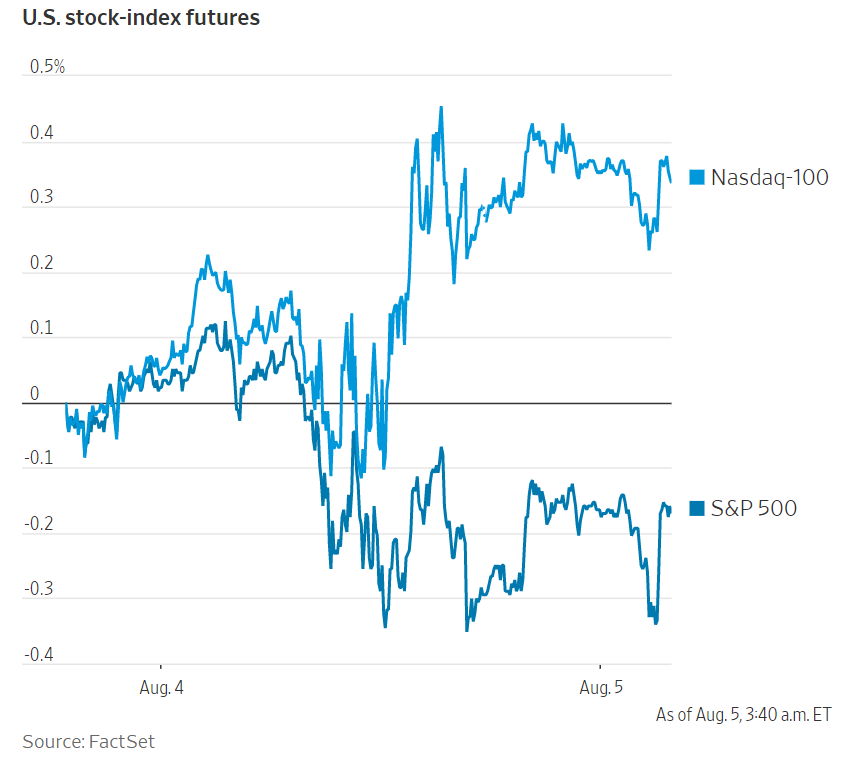

U.S. stock futures edged up ahead of unemployment figures that will be closely watched for clues about the state of the economy, a day after a private jobs report signaled unexpected weakness.

S&P 500 futures strengthened 0.2% and futures tied to the DJIA were up 0.1%. Changes in futures don’t necessarily predict market moves after the markets open.

In Europe, the Stoxx Europe 600 meandered after the flat line in morning trade as gains in healthcare and utilities sectors were offset by losses in materials and energy sectors.

CENTAMIN slipped 4% for a two-day losing streak.

The U.K.’s FTSE 100 was down 0.3%. Other stock indexes in Europe were mixed as France’s CAC 40 added 0.1%, whereas the U.K.’s FTSE 250 was lower 0.2% and Germany’s DAX lost 0.1%.

The euro and the British pound gained 0.1% and 0.2% respectively against the U.S. dollar and the Swiss franc was flat against the U.S. dollar, with 1 franc buying $1.10.

In commodities, international benchmark Brent crude declined 0.2% to $70.23 a barrel. Gold was also down 0.1% to $1,812.70 a troy ounce.

The German 10-year bund yield was up to minus 0.494% and the yield on 10-year gilts gained to 0.522%. 10-year U.S. Treasury yields strengthened to 1.190% from 1.183%. Bond yields and prices move inversely.

Stocks in Asia were mixed as Japan’s Nikkei 225 index climbed 0.5%, whereas Hong Kong’s Hang Seng shed 0.6% after gaining 0.5% during the session and China’s benchmark Shanghai Composite fell 0.3%.

精彩评论