Summary

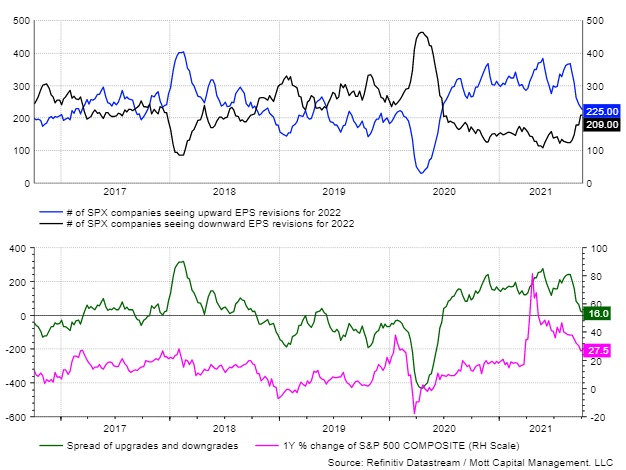

- Consensus earnings estimates have now turned lower, and more worrying is that the number of companies now seeing downward earnings revisions is on the rise.

- There is now an increasing amount of uncertainty around earnings estimates looking forward.

- The PE Ratio (NTM) fell below 20.5 for the first time since the spring of 2020 and has been a significant level of support.

This story was originally published on October 2 for members of Reading The Markets, an SA Marketplace service. It has been updated as of October 6.

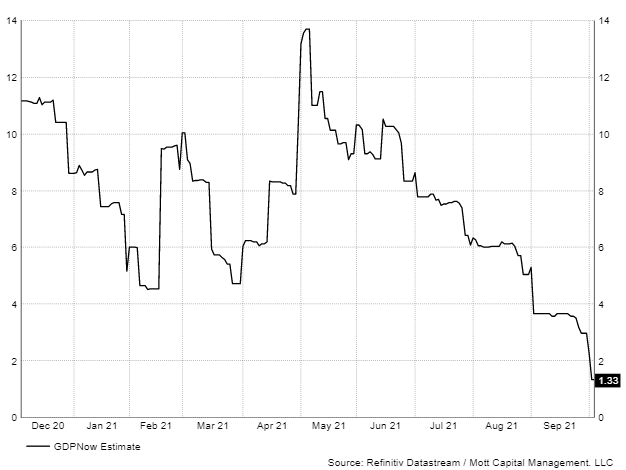

The S&P 500 just had its worst month in some time, with the index falling about 4.8% in September. It has been the steepest decline since the Covid pandemic began in March 2020. To this point, the slide appears to be in connection with a changing economic environment, which has been centered around slowing global growth, with the US GDP growth for the third quarter tracking at 1.3%, according to the Atlanta Fed GDPNow model. A far cry from the 7% projection that was initially forecast by many economists and analysts when the quarter began.

Exhibit 1: GDPNow is forecasting just 1.3% third-quarter US growth.

As highlighted on multiple occasions, there has been a clear sign that would suggest GDP growth was decelerating. Now that it is widely accepted that third-quarter GDP growth will be much slower than expected, it has become our belief that slowing GDP growth would eventually spill into earnings estimates. As notedpreviously, we began to see earnings estimates turn lower in our models, while consensus estimates began to stall. Those consensus earnings estimates have now turned lower, and more worrying is that the number of companies now seeing downward earnings revisions is on the rise.

Worse, there is now an increasing amount of uncertainty around earnings estimates looking forward. Based on historical trends, increasing uncertainty in earnings estimates appears to be highly correlated to spikes in the VIX index and S&P 500 drawdowns.

Downward Revisions

Consensus earnings estimates for the next twelve months (NTM) fell this week to $212.75 from $212.92. As of October 6, those estimates now stand at $211.97, a minor drop but the first big decline in estimates since October 2020. But more important is that the number of companies in the S&P 500 that saw downward earnings revisions rose to 209 this past week; it's the highest reading since the pandemic began. Meanwhile, the number of stocks seeing upgrades fell to 225, pushing the difference (spread) to just 16. Changes in the spread can also be highly correlated to year-over-year changes in the S&P 500 index itself. The decline in the spread of earnings revisions is similar to the deterioration witnessed at the beginning of 2018.

Exhibit 2: Downward earnings revisions are rising quickly, as upward revisions are falling.

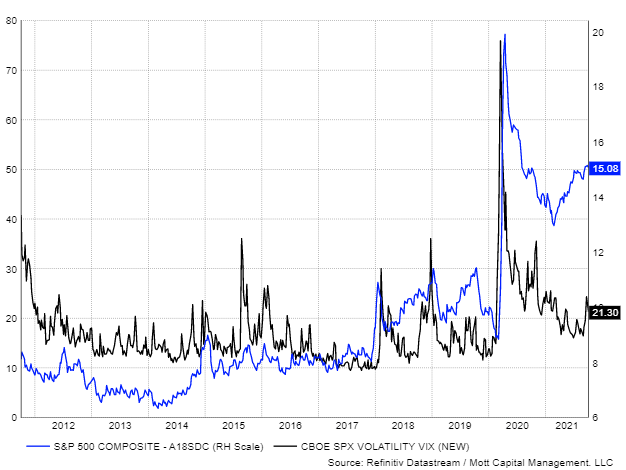

Also, perhaps more important is that analysts appear to be growing more uncertain about the future path of earnings estimates, as noted by the standard deviation of those estimates. The standard deviation for earnings estimates looking 18 months forward has steadily risen. It is now at 15.1%, up from a low of 12.9% in February. It is worth noting that the standard deviation in earnings has been much higher post-Covid than pre-Covid. The rising level of uncertainty in earnings estimates seems to connect with rises in volatility in the equity market, as noted by the VIX index.

Increasing Uncertainty

Starting in 2010, a falling standard deviation has been associated with a declining VIX index, while an increasing standard deviation has led to spikes in the index.

Exhibit 3: Uncertainty in earnings estimates appear to be highly correlated to the VIX index

This current period seems to resemble that of 2018 again, with the VIX and earnings uncertainty both spiking in January 2018, but then, more importantly, diverging in May 2018, with the VIX falling and remaining low, while earnings uncertainty was rising. It wasn't until October 2018 when the VIX began to spike. Currently, earnings uncertainty and the VIX declined until February 2021, when earnings uncertainty turned higher, and the VIX continued lower. However, there are signs that the VIX is now beginning to turn higher, once again, in this October period as we embark upon earnings season.

Exhibit 4: Earnings uncertainty is rising as the VIX is falling. The last time this happened was in 2018, and the VIX eventually caught up.

Multiple Contraction

Additionally, this week the PE ratio of the S&P 500 briefly fell below the critical 20.5 level. The PE Ratio (NTM) has been steadily declining but has always managed to find support at 20.5. This week it dipped below that level and closed on it to finish the week. This could be a turning point for the market, suggesting further ratio contraction in the weeks ahead. This would make sense, especially if downward earnings revisions and uncertainty pick up.

Exhibit 5: The PE Ratio (NTM) fell below 20.5 for the first time since the spring of 2020 and has been a significant level of support.

It really does all begin to make sense why we have started seeing volatility in the S&P 500 index pick-up. Due to several changing fundamental factors, including the Federal Reserve's evolving stance on monetary policy, which is likely to not be as friendly for stocks going forward. Couple this with a truly fundamental shift in earnings estimates, and this could be the market's first real test since the spring of 2020.

精彩评论