Summary

- Fastly reported a better-than-expected Q3, though continued adjusted EBITDA losses and negative free cash flow are starting to drain the company's liquidity.

- Management provided weaker-than-expected Q4 guidance, though the $1 billion revenue target by 2025 optically looks nice.

- Valuation seems to be pricing in strong growth over the coming years, and at 17x forward revenue, I remain on the sidelines waiting for a better entry point.

Fastly (FSLY) reported a good Q3 earnings with revenue above expectations, though the negative adjusted EBITDA and free cash flow continue to place questions around longer-term profitability. The stock has traded down around 15% since the company's earnings release, though continues to trade at a premium 17x forward revenue multiple.

Management also provided guidance for Q4 which seemed a little soft compared to expectations. On top of that, their $1 billion revenue target by 2025 seems positive at face value and represents a 30% growth CAGR, though they did acknowledge that some growth could come from M&A, meaning organic growth might be lower than 30%.

While the growth prospects have improved, I still remain on the sidelines and wait for a better entry point. I believe there remains execution risk to the growth story and even though the $1 billion revenue target seems positive, I believe investors will turn their focus towards profitability and the potential need to tap the debt and/or equity markets to fund growth given their negative free cash flows.

I last wrote about FSLY in mid-September when the stock was trading around $45 and noted a better entry point would be below $40. Since then, the stock has been quite volatile, yet we are still around the same $45 level.

Fastly operates a CDN (content delivery network). In other words, that have a network of services and data centers globally distributed that makes it easier for consumers to access faster internet. Through their edge cloud platform, FSLY's infrastructure is closer to the consumer's desired destination, which increases internet response times and can reduce latency.

Recent Financial Review

Revenue during Q3 grew 23% to $87 million, which came in just over $3 million above expectations for $83-84 million. Even though revenue had nearly $1 million impact from some write-downs associated with their Signal Sciences acquisition, growth was still pretty strong.

However, the company's adjusted EBITDA loss came in around $5.4 million, which was much worse than the profit of $0.8 million last year. It also should be noted that within adjusted EBITDA, the company is adding back a lot of stock compensation, to the tune of $36.6 million during the quarter. On a GAAP basis, the company's net loss was over $56 million.

Yes, investors are still more focused around the company's revenue growth potential, which I will discuss later on, but eventually FSLY will need to demonstrate a path towards consistent profitability.

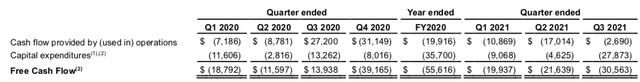

Even when looking at the company's free cash flow metrics, only once in the past 7+ quarters have been positive. The cash burn rate remains quite large and eventually we could see the company tap the debt and/or equity market for additional liquidity.

With almost $1.1 billion of cash and marketable securities combined with over $900 million of long-term debt, the company is sitting on just $200 million of net cash.

On a positive note, the company continues to expand their enterprise customer base, which reached 430 customers during the quarter. Net retention rate was 112%, which improved quite a bit from the 93% reported in the year-ago period.

However, when we look at a dollar-based net expansion rate, this came in at 118% during the quarter, down from 126% last quarter. Yes, this metric remains well above 100%, which signals continued strong growth, but the sequential slowdown may wave a slight caution flag for some investors.

Management provided guidance for Q4 which came in a little light of expectations. Revenue is expected to be $90-93 million and was a little below consensus expectations of $94.5 million. Also, non-GAAP operating loss is expected to be $15-18 million.

On top of that, the company talked about their $1 billion revenue goal by 2025. Optically, it sounds great to say the company is going to generate $1 billion of revenue. Looking at little further into this, $1 billion of revenue would represent a growth CAGR of ~30% for the next four years. Yes, this is a very strong growth rate, but the stock's valuation is already pricing in high expectations.

Other Recent Updates

Back in June, the company went through a widely publicized service outage that resulted in the company issuing credit to customers, the slowdown of existing traffic expansion, and the loss of a top 10 customer. Rumors also surfaced that Amazon(NASDAQ:AMZN)stopped using Fastly's services after the outage and it seems like the service outage impacts continue to weigh on the stock.

During the conference call,management was asked about the extent to which traffic volumes have started to come back from some of these larger clients.

So I think, as we've said, the top customer didn't return traffic, they returned to traffic. They do continue to ramp. The larger customers, when they come back, typically ramp their traffic back over time. I don't have a specific timeline, but they are back and that will increase over time.

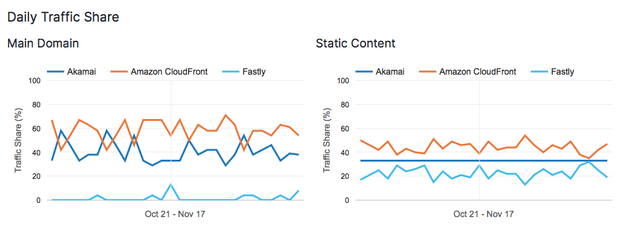

So while the traffic continues to ramp, it seems like it could take several quarters for the traffic to fully come back, that is if Amazon (or other larger clients) wants to come back to FSLY.

When looking at CDN Traffic Share, it continues to seem like Fastly has permanently lost a good chunk of their Amazon business. The charts above show the past 30-day CDN usage of Amazon, with the two primary resources being Amazon CloudFront and Akamai(NASDAQ:AKAM). Yes, Fastly is still seeing some traffic flow through their system, but they remain third on the totem pole and may have a long pathway back towards becoming a primary provider.

Valuation

Given the volatile news flow over the past several months, we have seen the stock trade in quite a volatile fashion, with +/- 3% days seemingly becoming the natural stock movement. Since reporting earnings, the stock has been down around 15% and remains well below their previous all-time high around $125.

The volatility does provide some interesting entry points for investors to make short-term money, however, I continue to believe there remains some execution risk to the stock. I have long-term confidence in the company's edge platform, but I believe valuation fully reflects long-term confidence, and investors should approach with caution.

With a current market cap of $5.3 billion and net cash of $200 million, this results in the company having an enterprise value of $5.1 billion.

While the company did provide a 2025 revenue target of $1 billion, we can start to view valuation in a few different ways.

First, if we assume the stock will trade at a 10x forward revenue multiple at the end of 2024 and by using the company's $1 billion revenue target, this could imply an enterprise value of $10 billion by the end of 2024. Given that we are already near the end of 2021, this would imply enterprise value growing at a ~25% CAGR through 2024.

However, this valuation method is a little challenging because in a few years, revenue growth may be below the 30% CAGR that is expected through 2025. Thus, if the company is only growing 20-25% (and assuming profitability has significantly improved), then maybe the multiple is only 8-9x forward revenue, which would imply an enterprise value growth CAGR of ~15-20% for the next few years. That's still a solid return, but at current valuation, it does not leave much room for error.

Another way to view valuation could be the following. Part of the $1 billion of revenue by 2025 could come from inorganic contributions, thus, the company's valuation multiple should better reflect their organic growth rate. By adding acquisitions to the equation and assuming a lower organic growth, we can still get to the company's ~30% revenue growth CAGR, but maybe the forward revenue multiple pulls back towards 5-8x. In addition, this forward revenue multiple would assume a significant expansion in profitability margins and positive free cash flow.

Under this scenario, we could see the stock's enterprise value grow at 10%+ CAGR over the next few years, which does not seem overly attractive considering the current valuation and embedded execution risks.

The stock currently trades just under 17x forward revenue as investors have confidence in the long-term trajectory. However, I continue to remain on the sidelines for now and the stock already is pricing in a strong rebound. I think a better entry point would be under $40.

精彩评论