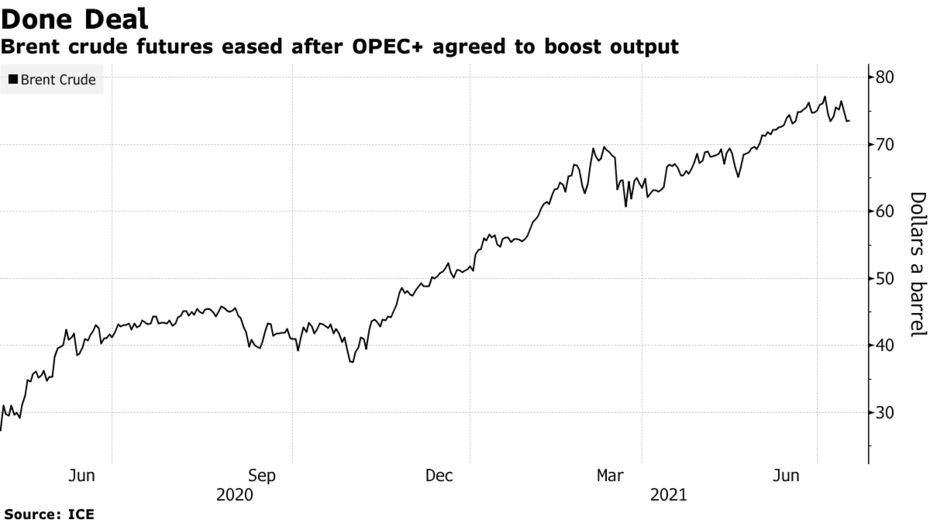

Oil eased after OPEC+ agreed to boost production into 2022, resolving an internal dispute that had shaken the alliance.

Brent crude declined 0.5% after losing 2.6% last week, while West Texas Intermediate slipped. The Organization of Petroleum Exporting Countries and its allies will add 400,000 barrels a day each month from August until all its halted output has been revived. The deal also gives Saudi Arabia, the UAE, Iraq, Kuwait and Russia higher baselines against which their output cuts are measured from May 2022.

The complex pact, announced at the weekend after a spat between Saudi Arabia and the United Arab Emirates, gives traders a better view of how quickly the cartel will restore the 5.8 million barrels a day it’s still withholding, since making deep cuts last year in the initial stages of the pandemic. It also resolves longstanding grievances that tested the unity of the alliance.

After soaring 45% in the first half, Brent hit a turbulent patch this month. Thebitter wrangleat OPEC+ spurred confusion among investors about the group’s plans for output just as the spread of the delta variant sowed concern about the potential impact of fresh outbreaks on demand. Still, with stockpiles being drawn down, market watchers including theInternational Energy Agencyhave said that additional barrels were needed to plug a projected shortfall.

While the OPEC+ agreement spans more than a year and covers millions of barrels of production, it remains a flexible arrangement. The alliance will continue to holdtalks every month, including a review of the market in December. It could adjust the schedule if required, according to Saudi Energy Minister Prince Abdulaziz bin Salman. The next gathering will be Sept. 1.

| PRICES: |

|---|

|

Brent’s prompt time spread was little changed at 63 cents a barrel in backwardation, a bullish pattern with near-dated prices trading above those further out. That’s down from 74 cents a week ago.

The more infectious delta variant is still on the ascendant, especially among the unvaccinated, with some countries reimposing curbs. In Asia, Indonesia, Thailand, South Korea, Vietnam and Singapore are all dealing with outbreaks. Elsewhere, the U.K. on Saturday reported the most cases since January.

Oil traders will also be on alert in the coming days for Iran’s first crude export from outside the Persian Gulf and beyond the Strait of Hormuz. TheIslamic Republicplans to ship a cargo of crude from Jask in the Gulf of Oman, according to Vahid Maleki, director of the Jask Oil Terminal.

精彩评论