Will Apple stock price rise once the company reports results? The Apple Maven reviews the base-, best- and worst-case scenarios for Apple investors after earnings.

Apple’s earnings day is finally here! On April 28, after the closing bell, the Cupertino company will release the results of its fiscal second quarter.

Below is a summary of the Apple Maven’s last preview articles ahead of earnings. So far, we have covered the following key topics:

- April 28 is the big day, so mark your calendars. The Apple Maven will review the Apple earnings report, conference call and Apple stock reaction via live blog, starting at 4 p.m. EST;

- Wall Street analysts expect to see outstanding numbers: revenues should climb 32% year-over-year, and earnings per share could reach as high as 53%;

- I believe that one of two product segments will shine brighter than the rest.The iPhone, for example, should benefit from a solid lineup and easy comps. Expect strong-double digit growth.

- The Mac is the other candidate for most successful segment in the quarter. Apple’s PC sales could rise by 50% or more, also over easy 2020 comps;

- Probably facing more of an uphill battle will be the iPad. Industry-wide tablet sales should fall double digits this quarter. The good news is that Apple could do better than peer average.

- If history serves as a guide, investors should be optimistic. Apple stock has gained three times more in the two weeks following earnings day than during other, non-earnings related weeks.

Today, I turn my attention to the very tricky topic of post-earnings share price movements. Will Apple stock react positively to earnings day news? Below are three possibilities.

Base case: Apple stock $132-$136

It is most likely that Apple will deliver record-breaking results this time. A confluence of positive factors should support the company’s financial performance: a strong product and service lineup, lingering effects of the stay-at-home economy, and strength of the US consumer.

The big question, however, is whether the market will reward the stock after earnings. Wall Street analysts have already raised their expectations.According to Stock Rover, earnings per share (EPS) consensus has climbed nearly 10% since last earnings season, to a fiscal second quarter record $0.98.

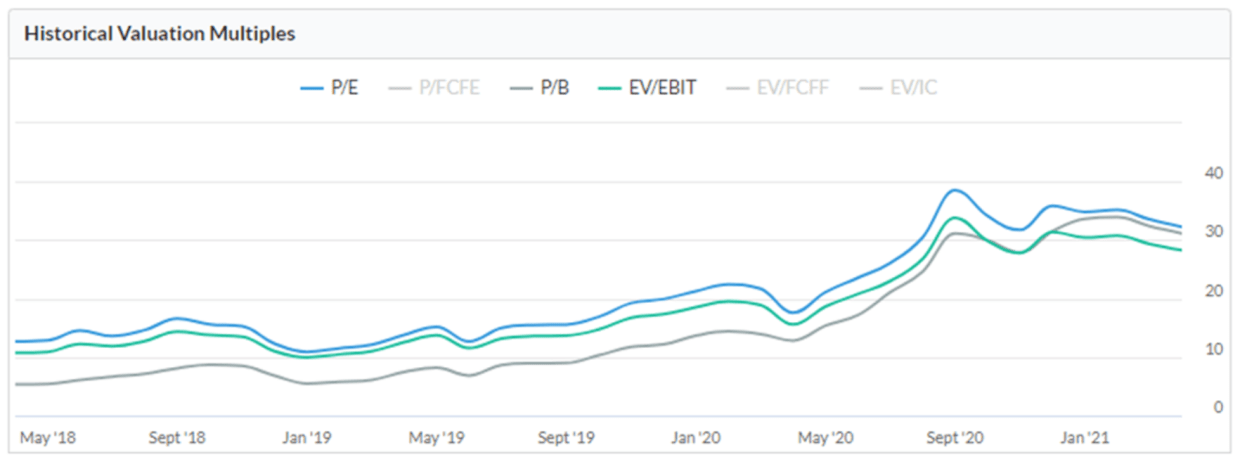

Apple’s valuations have also been rising, as the chart below depicts. While metrics like price-to-earnings (P/E) have come down since late January, they remain near all-time highs.

As a base-case scenario, I believe that Apple will deliver the goods, but the stock will struggle to climb to fresh peaks. I expect to see share price of $132 to $136 on Thursday morning, at the open, absent major developments.

Best case: Apple stock above $140

But instead, could Apple stock march towards peak levels once again? The answer is yes, of course, provided that one or a few of the following end up happening:

- Blowout fiscal second quarter results. The numbers would have to suggest not only strong past performance, but optimism for what lies ahead;

- Reinstatement of guidance. Apple’s management team stopped providing its next-quarter outlook when the pandemic started, in fiscal second quarter 2020;

- A bump in cash return to shareholders.Acceleration of Apple’s buyback program or a higher-than-average increase in the dividend payment could do the trick.

As a best-case scenario, fiscal second quarter results and the outlook for the rest of the year could be so strong as to cause the current 2021 EPS estimate of $4.44 to be revised higher. This could propel Apple share price. A post-earnings gain of at least 7% would represent fresh all-time highs.

Worst case: Apple stock below $130

Flip the assumptions above, and we have a worst-case scenario for Apple stock: (1) results that are good, but below or barely at expectations; (2) no guidance for fiscal third quarter; (3) status-quo dividend and buyback announcements.

I find it unlikely that Apple share price will drop precipitously, considering the strong momentum of the business and the apparent support at $120 per share in 2021 (see dotted red arrow below). But a decline to less than $130 apiece, levels reached as recently as early April, is not out of question.

Watch Apple’s peers

By the time Apple is ready to release earnings, on Wednesday, some of its peers will have done so already: Tesla on Monday and Microsoft on Tuesday are key examples.

Keep an eye on market reaction to these two reports. Great results coupled with muted stock price movement could be a bad sign for Apple. Big gains, on the other hand, could be bullish for the Cupertino company’s stock.

精彩评论