Famed portfolio manager Dan Niles thinks that Apple stock is going down, as the broad market corrects up to 20%. Could his bearishness come to fruition?

Apple stock is about to take a dive alongside the rest of the market. At least this is what Satori Fund’s portfolio manager Dan Niles believes in, as he unveiled his short position on AAPL during a CNBC interview earlier this week.

Today, the Apple Maven looks at the bearish case and assesses whether Dan’s concerns might have merits.

AAPL: pressure from all sides

Dan Niles’ list of reasons why Apple stock and the S&P 500 will likely dip is long. It all starts with an assessment of the Cupertino company’s share price behavior, following the September 14 announcement of the iPhone 13.

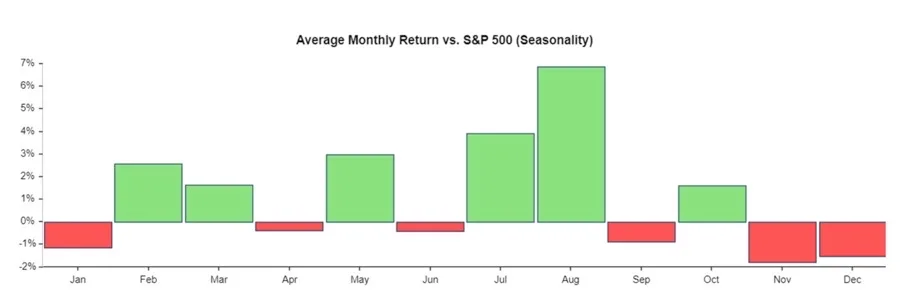

According to Mr. Niles, AAPL tends to succumb to sell-the-news pressures around this time of the year. His observation is well founded. The chart below,provided by Stock Rover, shows that Apple stock has underperformed the S&P 500 the most in the last few months of the year, at least over the past decade.

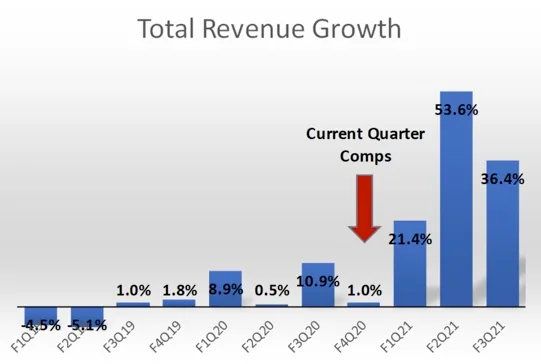

Still on short term performance, the portfolio manager thinks that Apple stock is priced too aggressively ahead of what he believes will be tough COVID-19 comps. Apple delivered outstanding results during and right after the holiday period last year, as the chart below depicts. Topping such performance will be hard, if not nearly impossible.

On this topic, experts seem to be split between a bullish majority and a bearish minority. Wedbush’s Dan Ives, for example, would likely disagree with Dan Niles. According to the Wall Street analyst – and I tend to agree with him – the digital transformation and 5G upgrade cycle should last years, not only a few atypical pandemic months.

S&P 500: pricey and facing headwinds

While Dan Niles’ bearish arguments on AAPL shares could stand alone, his pessimism towards the broad market might be the one-two punch that knocks Apple stock down. Mr. Niles sees the S&P 500 correcting between 10% and 20% by the end of this year.

At the top of his list of reasons why this could happen is a deadly combo: inflation, COVID-19 worries and high valuations. I sympathize with his concerns, as all three have been key risk factors for the markets since at least the beginning of this year, if not longer.

The better news for bulls, in my view, is that none of the above is “new news” to investors. Equities have endured the headwinds very well through several months in 2021 so far, which I take as a positive sign that any potential worry may have already been priced in.

This is not to say, of course, that risks should be dismissed. Rather, I just don’t believe that the market or Apple stock investors will suddenly dump their positions based on old information – unless something drastic and unexpected, such as substantially higher inflation or interest rates, were to happen.

精彩评论