Summary

- Poor Q1 results and a massive guidance cut shocked investors that sent the stock down 30+%.

- While bears are celebrating, investors shouldn't be too quick to dismiss Peloton's growth potential.

- Management is delaying gratification to build an ecosystem for tomorrow.

- An insider has been buying Peloton during the meltdown. So am I.

Investment Thesis

Peloton (PTON) reported disappointing back-to-back quarters. The most recent one was accompanied by a huge revenue guidance cut that lost many investors' confidence. Moreover, the reopening of the economy seemed to play a big role in Peloton's slowdown. Despite all these factors, Peloton still has a long growth runway ahead and the company should rise from the ashes in the following few quarters. Although quite risky, the recent valuation drop makes Peloton a compelling buy.

Two Bad Quarters

Let’s cut to the chase. Peloton’s most recent quarter performance was abysmal. Many thought that Q4 2021 results were bad enough and that it wouldn’t get worse but guess what? It did get worse, significantly.

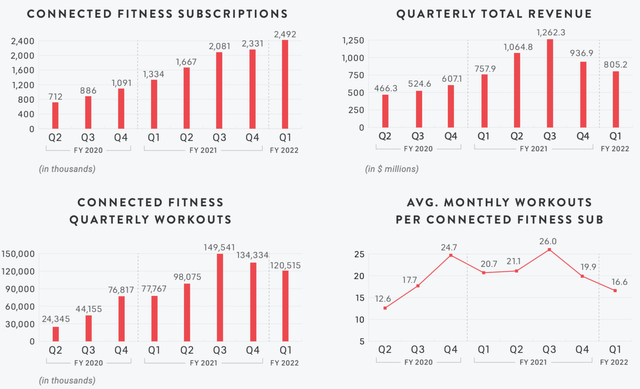

Peloton ended Q1 with revenue of $805 million, just 6% higher from the year-ago quarter and down 14% sequentially, but in line with management’s guidance of $800 million. The slowdown in growth was primarily due to weakness in the Connected Fitness segment, posting a 17% YOY decline to $501 million as a result of fewer Bike deliveries, Bike price cut, and Tread recall. This figure also includes about $60 million of contribution from Precor. So excluding Precor, Connected Fitness revenue would have dropped by about 27%, YOY.

On the bright side, subscription revenue growth remained strong, growing 94% YOY to $304 million, driven by an 87% increase in Connected Fitness subscriptions to 2.49 million and a 74% increase in digital subscriptions to 887,000, amassing 6.2 million total members globally. However, monthly churn rate ticked up slightly to 0.82% from the prior quarter’s 0.73%, and both total platform workouts and Average Monthly Workouts per Subscription continued their downtrend, signaling a gradual shift from in-home fitness to gyms.

Seeing Peloton maintain high subscription revenue growth is encouraging as it means that Peloton can rely on stable cash flow while its Connected Fitness segment continues to experience volatility in terms of operating results. Subscription revenue is also the high-margin segment of the Peloton business model. Overall gross margin was 32.6% for Q1 2022. Again, in line with management’s expectations. Product gross margin was 12.0%, as expected given the Bike price reduction, supply chain constraints, and impact from the Tread recall. Subscription gross margin was 66.7%, up 820 basis points.

Q1 Adjusted EBITDA was $(233.7) million. This was the result of revenue growing at only 6% while operating expenses continued to grow at a triple-digit rate. However, it is important to note that the reported Adjusted EBITDA was way less than the $(285) million guided in Q4 2021. Nonetheless, it’s still a considerable cash burn given the size of the company.

Peloton ended Q1 with $924 million in cash and cash equivalents, about $600+ million lower than the prior quarter. You can see why Peloton’s balance sheet health scared investors despite its CFO reassuring any liquidity concerns during the earnings call:

I think just cutting to the chase, we don't see the need for any additional capital raise based on our current outlook.As we mentioned, we're taking significant steps to adjust our expenses across COGS and opex with this revised revenue guidance, then we have a lot of levers to pull. In addition, what we're also going to do is reevaluate the cadence of some of the capital investments that we're making, inclusive of POP. And while we know that POP is a decades-long, right-term strategic move for us, there's definitely ways for us to find ways to make that a more economical spend over the next couple of years.

(Source: Peloton 2022 Q1 Earnings Call Transcript)

(“POP” refers to Peloton Output Park, Peloton’s goal of building its first US factory.)

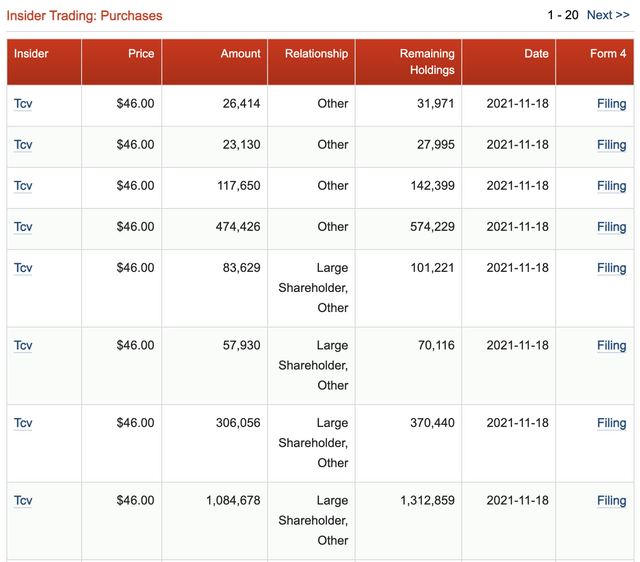

A few weeks later, Peloton announced an equity offering of 23,913,043 shares of common stock at $46 per share, totaling $1.07 billion. This dilutes shareholders and makes management looks like liars.

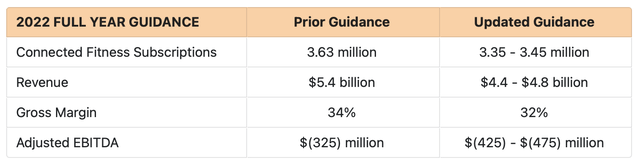

It gets worse from here. Management revised down its prior full-year guidance. The introduction of ranges in its guidance also means that there’s a lack of confidence on management’s part, as well as a great deal of uncertainty for Peloton as the economy reopens.

Despite all the doom and gloom, I believe the worst is behind Peloton - the Tread has been successfully recalled and the updated guidance has been issued. FY 2022 will be a challenging year for Peloton due to tough YOY comps, people returning to the office, and gyms reopening. Peloton should return to growth mode soon as management continued to pile cash on R&D ($97.7 million in Q1) and CapEx ($87.2 million in Q1). I’m not going to sugarcoat, it’s been a terrible few quarters, and there were some head-scratching moments like the Bike price cut as well as its recent equity raise. But a few bad quarters don’t make Peloton a bad investment.

Building An Ecosystem

The bear thesis has always been "the economy is reopening, people are returning to the gym, people want to socialize, working out at home is boring, Peloton is too expensive, Peloton is overhyped” yada, yada, yada. Consequently, negative news and poor results from the prior quarters make the bears sound smart. Furthermore, the stock price tanked to new 52-week lows. As such, sentiment on the company has been nothing but fear written all over, and therefore, it’s so easy for investors to dismiss Peloton’s bull case during these times.

In the next few paragraphs, I’d like to remind readers of Peloton’s bull thesis and why its growth story remains intact, despite short-term road bumps.

The Peloton Cult- Despite revenues only increasing 6% YOY, Connected Fitness subscriptions grew 87% YOY to 2.49 million with only 0.82% monthly churn, despite tough comps. I do not focus so much on revenue now since Peloton’s priority is to land as many members as possible, which is the sole reason why management made the price cut on the Peloton Bike - building a larger cult is what Peloton is striving for. In essence, Peloton is delaying gratification so it can reap the benefits of a network effect moat tomorrow by leveraging the strong brand moat it possesses today.

Operational Expansion- Speaking of network effects, Peloton has yet to establish a strong international market presence. In FY 2021, international revenue only makes up 7% of total revenue. The acquisition of Precor is highly strategic as the legacy manufacturer has a large presence in international markets. Such an acquisition should be beneficial for Peloton to enter into new markets. At the same time, the acquisition of Precor grants Peloton access to Precor's connections with commercial gyms. Management also has desires to expand commercially into hotels, universities, corporate campuses, and apartment buildings. Here's what Peloton President William Lynch said about what it means for Peloton if they expand commercially:

And then, also, that channel not only is a good business for us as it reemerges, it's also an incredible lead generation channel. Just an example of that is in hospitality, when we have a Peloton bike in a hotel for a year. It sells, on average, seven bikes into the home, and that talks to the quality of the experience that it offers.

When a traveler goes into a Westin and gets on their Peloton in the morning and tries it using our trial, we get that lead capture. And we know, given the strength of the experience, they come home, and they buy Peloton. And so, it's not only a business that we think has a lot of, financially, has a lot of upside going forward given the catalog. Not only have they been helpful on the manufacturing side, it's very strategic for our at-home business as a trial channel, certainly in hospitality, but also when you think about universities and other verticals.

(Source: Peloton 2022 Q1 Earnings Call)

New Product Lines- Here's an impressive statistic, Peloton was able to capture 2.49 million Connected Fitness subscribers with only two types of product: Bike and Tread. Imagine how many more members will join the cult when Peloton introduces new products like rowing machines, elliptical machines, or even punching bags. Just recently, Peloton launched the Peloton Guide, an “AI-enabled device easily connects to televisions, providing Members instant access to a suite of expert Instructors and the well-loved Peloton content library.” Among its features is a Movement Tracker, powered by smart camera technology and machine learning. A small step into the Metaverse perhaps? Nevertheless, management has been pouring money into R&D and I expect management to introduce more innovations in the near future.

Fitness Streaming Giant- Peloton offers unmatched workout content led by 45+ world-class instructors across 10+ different workout categories, enhanced with interactive music from world-renowned artists. The Peloton app boasts a 4.9 rating with 580,000+, more than twice its biggest competitor, Beachbody (BODY). Peloton is without any doubt, the largest premium fitness streaming platform in the world. Its stellar reputation in content creation opens the doors for collaboration with other streaming giants such as Spotify (SPOT), Apple (AAPL), Roku (ROKU), and Netflix (NFLX). With its valuation cut to about $16 billion at the time of this writing, Peloton may also be an attractive acquisition target for Apple, a complement to Apple Fitness+.

In addition, Peloton’s powerful streaming platform may also be an excellent medium for sports federations to conduct global online events. For example, holding a marathon race using the Tread or an online bicycle race with the Peloton Bikes. This allows people from all over the world to compete with one another in the comfort of their homes.

Selling Ads- Here's another common bear thesis: “Peloton is just an iPad attached to a Bike.” Well, Peloton can one day use those screens to run ads, as a way to diversify its revenue stream. For example, Ads can hover over the screen or be spoken out by the instructors during mid-workout breaks. Another way would be for Peloton to switch to a freemium model where one subscription price includes ads and limited content access, while the other is ad-free with unlimited access.

These are just some of the things Peloton can do to continue to grow as a company so claiming that Peloton is dead in the water is clearly false. Again, the past few quarters have been terrible. But Peloton’s first-mover advantage and market leadership give the company the opportunity to grow further as outlined above. Its cult-like following, expanding network of members, innovative products, industry-leading content, and new revenue opportunity are signs of an emerging Peloton ecosystem.

Investors shouldn't be so quick to dismiss Peloton's growth potential.

Valuation

In my first Peloton article, I mentioned:

While growth may slow down due to product recalls, negative publicity, and the reopening of the economy, Peloton still has a long growth runway ahead. However, despite its bullish growth thesis, valuations and technicals seemed bearish at the moment.

Sometimes, it pays to wait a little longer.

(Source: Author’s article: Peloton: Growth Story Still Intact, But Valuations And Technicals Do Not Look Good)

Wait a little longer I did.

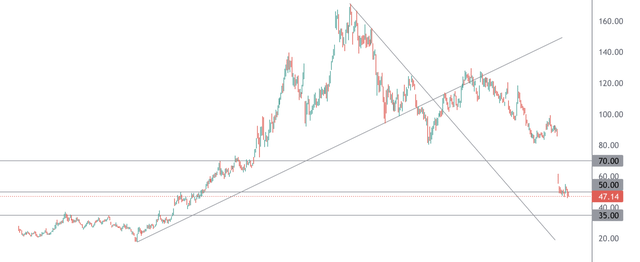

I argued that the stock was forming a head and shoulder pattern and that it will likely trend downwards to the $70 or $50 level. As we all know, the stock tanked following Q1 earnings, primarily due to the huge guidance cut. It gapped below the $70 support and is now hovering in the $50 support level where I initiated a starter position. The next major support level is $35.

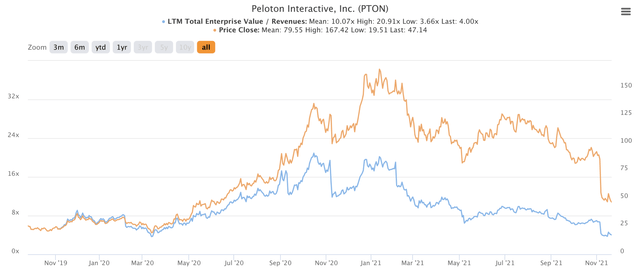

At current prices, Peloton is trading at only 4.0x EV / LTM Revenue, close to its historical low of 3.7x. The problem with valuing Peloton is that it is currently unprofitable so we can only use revenue multiples to gauge its relative valuation - operating results are too volatile to make accurate assumptions in the DCF model. In my opinion, a 4.0x revenue multiple provides ample margin of safety for a growth stock (or turnaround stock for that matter).

It also helps to know that TCV bought more shares of PTON at $46 after initiating a position back in May 2021 at around $100. TCV is led by Jay Hoag, who is on the board of directors of Peloton.

While Peloton looks cheap on a historical basis, Peloton is still a high-risk bet due to headwinds from the reopening of the economy, the return to gyms, supply chain constraints, unprofitability, and unsustainable cash burn rates.

Conclusion

Depending on which camp you belong to, Peloton may or may not be the most revolutionary company. But we can all agree that Peloton has a strong brand, best-in-class hardware, and industry-leading fitness content. However, a few bad quarters seemed to have spooked investors, especially regarding the company’s unprofitability and the recent guidance cut. The reopening of the economy is also threatening Peloton’s growth prospects.

While discouraging, a few bad quarters don’t make Peloton a bad investment. To me, Peloton’s network is growing day by day and it has the potential to scale further as new products, content, and regions are added. In addition, the recent equity raise also provided Peloton with ample liquidity to cover near-term cash burn. Couple that with cost savings initiatives, Peloton should be able to return to cash-flow-positive by next year. Finally, I believe the selloff is overdone. The stock could go even lower from here but current valuations already provide a decent margin of safety for investors. As such, I am Long PTON.

精彩评论