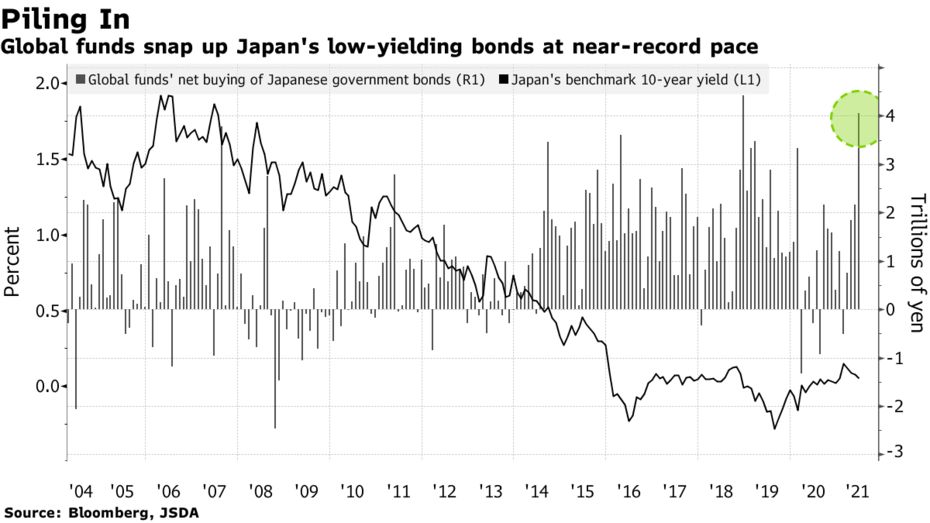

Overseas funds bought the second-highest amount of Japanese government bonds on record in June as the spread of the delta variant of the coronavirus spurred demand for haven assets.

Foreign investors purchased a net 4.06 trillion yen ($37 billion) of JGBs last month, just shy of the record 4.42 trillion yen they acquired in December 2018, according to data from the Japan Securities Dealers Association.

“While JGBs themselves aren’t attractive, they are included in global funds’ indexes and probably benefited from bond buying that accelerated worldwide,” said Kei Yamazaki, a senior fund manager at Sumitomo Mitsui DS Asset Management in Tokyo. “Profit-taking in stocks that had been rallying also likely guided money into bonds.”

Concern that virus outbreaks caused by the delta strain may slow the global recovery are pushing down bond yields around the world. The 10-year U.S. yield fell below 1.50% in June, while JGB yields also declined and are now approaching zeropercent.

Purchases of JGBs may have also increased as foreign funds were underweight on Japanese debt, Sumitomo Mitsui’s Yamazaki said.

精彩评论