AMC stock is about to set its largest decline from a peak ever. Is this an opportunity to buy and bet on the next rally, or a sign that the meme saga is reaching an end?

The unwind continues, and it has no end in sight. Right after lunch break on January 18, AMC stock dipped below $18 per share. These levels have not been witnessed since late May 2021 — that is, a mere few days after the most recent major rally began to take shape.

Now, the question: is AMC a house of cards that is about to crumble? Or could this be a rare opportunity for traders and investors that missed out on last year’s historic meme rally to partake in the next leg higher?

AMC stock: scary drawdown

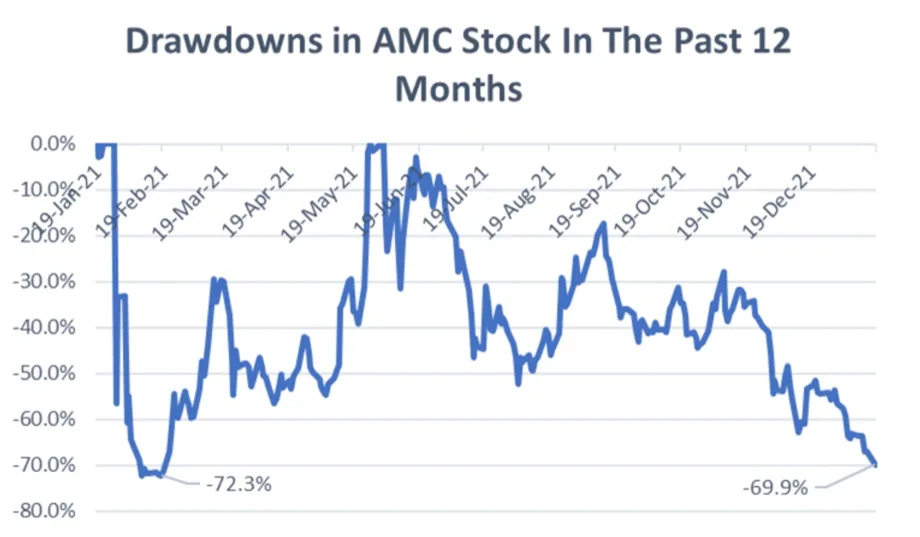

The chart below shows the drawdowns in AMC stock over the past 12 months — that is, the declines from a previous all-time high. Notice that, now trading 70% below last year’s peak, AMC could, at any moment, match the maximum drawdown of 72% reached in February 2021.

Whether this is good or bad news is open to interpretation. The glass-half-empty view is that AMC share price is finally descending to levels that are a bit more consistent with the company’s fundamentals.

This is not to say that AMC is a bad business, or that the movie operator might be in trouble. In fact,the company has been recovering well from what was perhaps the most disruptive crisis in its 100-plus years of existence.

But the cold truth is that a stock that trades at 4 times 2021 revenues and that is not expected to turn a net profit until 2024 or later clearly looks overvalued from a business perspective. Even if AMC returns to a pre-pandemic normal, it is unclear whether the stock at $18 apiece could boast a P/E ratio that most traditional investors would consider “reasonable”.

The bullish case for AMC

Here is where the glass-half-full argument comes into play. Most AMC shareholders know very well that this stock does not trade on fundamentals, but on buzz and excitement instead.

From that point of view, AMC continues to be a popular meme stock on the verge of undergoing a massive short squeeze. The ticker is still a top 5 most discussed on Reddit, according to Ape Wisdom. And with nearly 20% of the float shorted, a run to cover short positions could help to trigger a rally at any moment.

This last piece, in fact, is one of the main reasons why we think that “AMC stock may bite short sellers in 2022”. AMC does not move like other stocks: slowly and progressively higher, punctuated by sporadic declines. Instead, it tends to move slowly and progressively lower, punctuated by sporadic rallies.

When will the next bullish attack happen? Or will it happen at all? Stay tuned, as 2022 may prove to be an eventful year for AMC stock.

精彩评论