- Vessels sailing toward China climb to 6-month high on Friday

- Futures in London add 1% after rising more than 6% last week

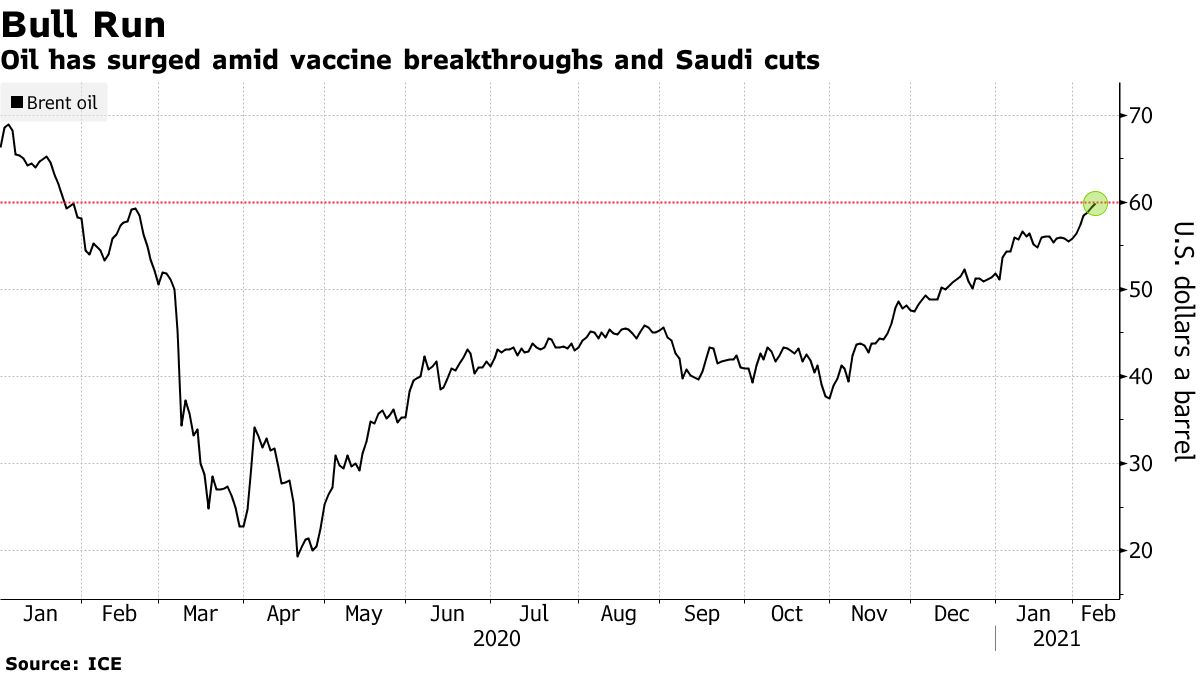

Oil extended gains toward $60 a barrel as global supplies tighten and the demand outlook improves with the rollout of Covid-19 vaccines.

Futures in London added 1% after capping a third weekly gain. The number of vessels sailing toward China jumped to asix-monthhigh on Friday, signaling robust demand from the world’s largest importer. Key prompt timespreads for the global benchmark Brent and U.S. crude have recently firmed in a bullish backwardation structure, indicating shrinking stockpiles.

Top independent trader Vitol SA, however, joined with rival Gunvor Group Ltd. in expressing caution about the recent surge in prices, while a technical indicator is showing that oil is overbought and due for a correction.

Oil has rallied since the end of October amid Covid-19 vaccine breakthroughs and after Saudi Arabia pledged to deepen output cuts. OPEC+ has vowed to quickly clear thesurplusleft behind by the pandemic, but there are still concerns about near-term demand, with a newvirus variantspreading in the U.S. and other regions across the world grappling with lockdowns.

“The fundamental picture of demand improvement and discipline on the supply side suggests there is clear upside for the market,” said Michael McCarthy, chief markets strategist at CMC Markets Asia Pacific in Sydney. “OPEC+ discipline has been a key to the gains.”

| PRICES |

|---|

|

Brent’s prompt timespread was 27 cents in backwardation -- where near-dated prices are more expensive than later-dated ones -- compared with a 7-cent contango at the start of the year.

The market is “getting ahead of itself in terms of a post-vaccine euphoria,” Mike Muller, the head of Vitol’s Asian operations said Sunday in an interview with Dubai-based consultant Gulf Intelligence. Gainsbeyond $60a barrel are unlikely because that would prompt energy companies to ramp up production, Gunvor Chief Executive Officer Torbjorn Tornqvist said on Friday.

精彩评论