What happened

Shares of a large number of high-growth stocks tumbled on Tuesday, as the market focused on a wide range of economic issues that caused mixed results from the major U.S. stock indexes.

HubSpot stock was down as much as 3.8% on Monday, Okta was off by as much as 4.7%, and Appian was also down as much as 1.74%. The trio ended the session down 3.8%, 4.7%, and 1.7%, respectively. It's worth noting that the broader market indexes were mixed, with the S&P 500 gaining 0.17% on the day, while the Nasdaq Composite declined 0.5%.

There didn't appear to be any company-specific news contributing to the sell-off, but rather a variety of macroeconomic factors that may have had a hand in driving these stocks lower.

So what

There were a variety of headwinds facing investors on Tuesday, any one or more of which could have contributed to the decline of thesehigh-growth technology stocks.

On Monday, President Joe Biden nominated Federal Reserve Chairman Jerome Powell to a second term, causing a rise in U.S. Treasury yields. Rising yields are usually a sign investors are nervous about the potential for rising inflation and are looking for a safe haven to stash their cash. In the wake of the waning pandemic, the nation has faced the highest rate of inflation in decades. The central bank will likely raise key interest rates from their current level near zero in an attempt to stave off inflation in the coming months.

As the U.S. heads into the holiday season, President Biden announced Tuesday he will tap into the country's strategic petroleum reserves in a bid to bring down soaring gas prices, which have climbed to record highs in some areas of the country.

There are also concerns that the backlog of container ships floating off U.S. ports and a shortage of truck drivers will continue to drive shortages ahead of the holiday shopping season, exacerbating an already tenuous situation.

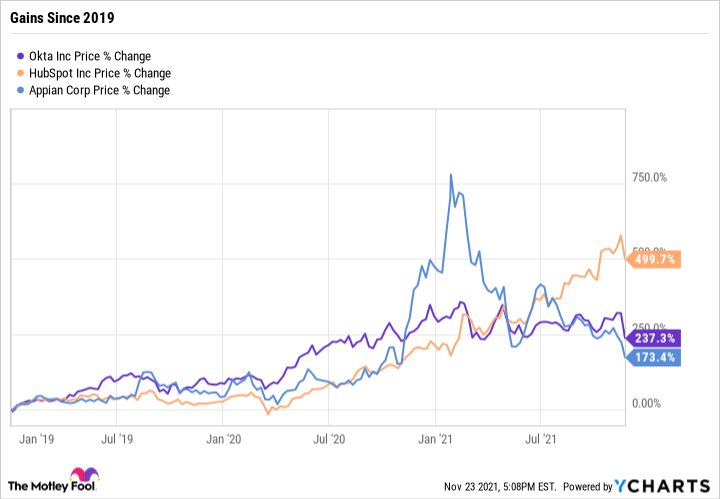

What does all this have to do with HubSpot, Okta, and Appian? In a word, nothing. However, these macroeconomic issues are leading some to worry that this could lead to longer-lasting problems for the economy. As a result, some investors are selling off some of their biggest winners and raising cash in the event of a correction. To put this in context, each of these stocks has generated strong, triple-digit returns over the past two years, and some investors see them as ripe for the picking.

DATA BYYCHARTS

Now what

Eagle-eyed investors will have detected a common thread running through these three stocks: Namely, even after today's declines, they're still not cheap when measured using traditional valuation metrics. HubSpot, Okta, and Appian are currently selling at 30, 29, and 15 times sales, respectively, while a good price-to-sales ratio is typically between 1 and 2.

During broad market declines, stocks with frothy valuations tend to get punished more than their peers, as investors tend to sell them first and ask questions later.

It's important to remember, however, that a strong underlying business and exemplary performance has been the catalyst that drove each of these stocks higher, so forward-thinking investors should avoid the temptation to follow the crowd.

精彩评论