The S&P 500 index touched a record high on Friday for the 15th time this year, but stock market futures are pointing to a more muted start to the trading week.

Even if stocks can keep rallying, the upside will be very limited, said Matt Maley, a strategist at investment firm Miller Tabak + Co., in ourcall of the day.

Maley said there “is no question that the stock market could rise further from current levels,” but his team believes that any more gains won’t be due to fundamentals.

This is largely because the market has already priced in fundamental growth expectations over the next 12 to 18 months. Some of those headline projections include year-over-year economic growth estimates as strong as 8% for 2021 and earnings growth of 25% this year.

And the strategist said that these bullish growth projections are out of focus. “Those are extraordinary numbers, but if you compare them to a normal year, they’re not anywhere near as impressive as they initially seem,” Maley said. The year-over-year estimates are comparisons to 2020—when the global economy all but shut down and company earnings were battered by the COVID-19 pandemic.

“More importantly, they do not justify a further rally in the stock market,” Maley said. “Something else is going to have to fuel a rally of significance.”

Valuations are “extreme,” according to Maley, and this expensive market “tells us that the upside is very limited,” with the risks “quite high” that a full-blown correction is coming.

The investment firm’s main concern right now is the divergence between the S&P 500SPXindex and technology stocks. The blue-chip index can hold up if there is weakness in the tech sector, but “once that weakness becomes more pronounced, it has always had a negative impact on the broader stock market,” Maley said.

Every time the NasdaqCOMPhas fallen between 12% and 14% in the last 40 years, it has created “material pullback” in the S&P 500, the strategist said. “If that correction becomes more than 15% in the Nasdaq, the S&P has always fallen at least 10% as well (and usually quite a bit more than 10%),” Maley said.

The divergence between the S&P 500 and Nasdaq is reasserting itself once again, Maley said. If the tech-heavy index moves much lower, it will “raise a serious warning flag” for both the Nasdaq and the broader stock market.

The buzz

The massive container ship that has blocked the Suez Canal and disrupted global trade for the last week is still stuck, but perhaps not for long. The Ever Givenwas successfully refloatedearly on Monday morning and tug boats are working to straighten the ship out.

The end of last week was marked bymassive block tradesworth around $30 billion, triggered by amargin call of U.S. investor Archegos Capital Management. The selloff pushed shares in media groups ViacomCBSVIACAand DiscoveryDISCAdown more than 27% on Friday and hit some Chinese internet stocks.

And banks tied to the fire sale on Fridayare feeling the heat. Shares in Japan’s NomuraJP:8604and Switzerland’s Credit SuisseCH:CSGNdived on Monday,after both groups extended creditto a major client that couldn’t meet its obligations. TheSwiss group said lossesfrom exiting positions as a result could have a “highly significant and material” impact on earnings.

It is a light day on the economic front, with the Chicago Fed national activity index for February due at 8:30 a.m. Eastern, followed by existing home sales data for February at 10 a.m.

Lawmakers in Albany reached a deal on Saturday toallow sales of cannabis for recreational use, opening the door for New York to join the growing list of states that have legalized marijuana. A vote on the bill could come by Tuesday.

British online car retailerCazoo is set to floaton the New York Stock Exchange in a listing worth $7 billion, after agreeing to a merger deal with a blank-check, special-purpose acquisition company (SPAC). Cazoo’s planned merger with AJAX I will bring the SPAC’s billionaire investor Dan Och onto the company’s board.

The markets

U.S. stock market futures are pointing downDJIA FUTURESSP 500 FUTURESNASDAQ 100 FUTURES,set for a weak open to start the new trading week.Bank stocks remain under pressurein the fallout from Friday’s Archegos unwinds, with Deutsche BankXE:DBKand UBSUBSamong the fallers and shares in Goldman SachsGSand Morgan StanleyMSlower in the premarket.

European indexes were mixedUK:UKXDX:DAXFR:PX1while Asian equitiesJP:NIKHK:HSICN:SHCOMPfinished Monday in the green.

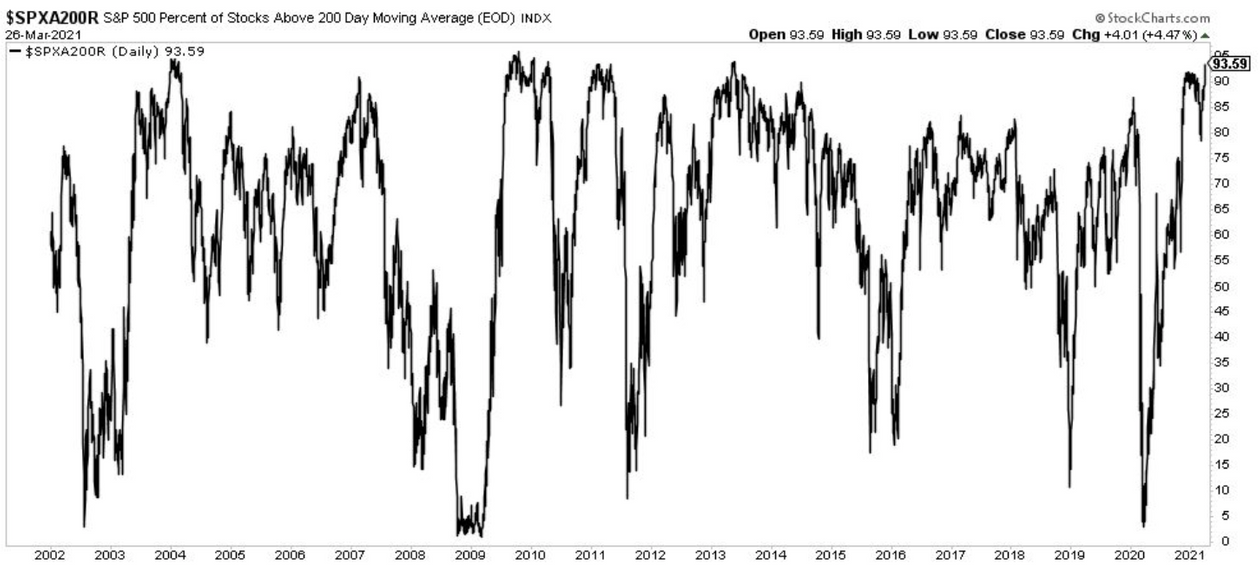

The chart

精彩评论