After a massive Q3 all-around beat, Avis stock shot up by more than 200% on November 2. With share price now soft landing, Wall Street Memes looks at what investors and traders could do next.

The popularity of Avis Budget stock surged on the main Reddit forums on November 2, after the stock tripled in price. The rental car company has been a target of short sellers for many months, in great part due to massive pandemic headwinds.

But a few days ago, Avis reported Q3 results that were well above expectations. Because of it, alongside a few other catalysts, bears witnessed a massive increase in trading volume and an unprecedented surge in stock price.

With CAR now giving up about half of its maximum post-earnings gains in a matter of a couple of days, Wall Street Memes asks: what should investors and traders do next?

All-around earnings beat

On Monday, November 1, Avis delivered a solid all-around beat. Pre-earnings consensus estimate EPS of $6.68 looked very conservative against the $10.74 delivered. Reported revenues of $3 billion topped expectations by $224 million, pointing at growth of 96% and 9% from the third quarters of 2020 and 2019, respectively.

Also, the rental car company repurchased approximately 11.6 million shares of common stock in the third quarter at an average cost of $86. Now, the outstanding share count has been down 16% since the end of this year’s Q2.

According to Avis CEO, Joe Ferraro, business execution and initiatives taken during the early days of the pandemic may have been the key pillars supporting the top line results:

“ Our third quarter results are a testament to our team’ s on-going focus around cost discipline and ability to execute operationally. We are seeing the benefits of initiatives we began during the early days of the pandemic and look to build on this positive momentum as the travel environment continues to normalize.”

Short selling target

At least until prior to Q3 earnings day, Avis stock’s short interest was abnormally high. Yahoo Finance reports that 13.4 million shares are shorted out of a float of 49.2 million, for a ratio of 28%. Short interest above 10% is generally considered elevated.

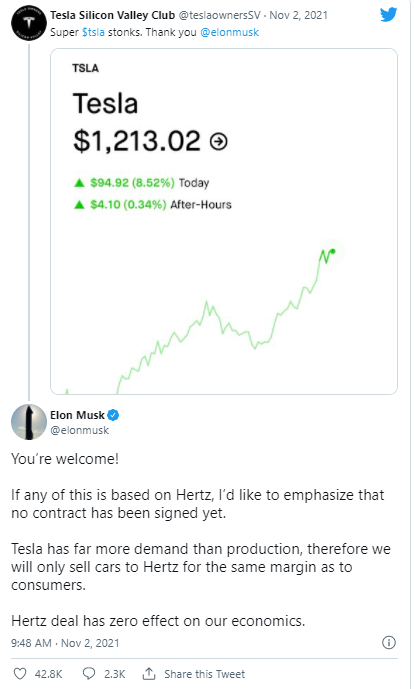

The recent surge in share price is possibly related to shorts covering their position in the face of earnings euphoria. Elon Musk’s tweet about the Tesla-Hertz deal may have also played a role in adding volatility to CAR stock. Hertz is one of Avis Budget’s main competitors.

Wall Street bearishness

Expert consensus around CAR stock was bearish even before Tuesday’s overwhelming price spike. Avis stock still has a moderate sell rating and price target of $180. Before heading to the moon, shares were valued at around $170, slightly short of Wall Street’s average price target.

A couple of days ago, two analysts downgraded their rating on Avis Budget. JPMorgan’s Ryan Brinkman moved to underweight from overweight, setting a $225 price target. Deutsche Bank analyst Chris Woronka also turned sour on the stock, moving from buy to sell and resetting the price target at $210.

In both cases, the valuation discrepancy following the likely short squeeze played a role in pushing the once bullish analysts to the sidelines.

What’s next

CAR seems to have been the target of a bullish “attack”: obscene one-day gains that are probably not fully justified by business fundamentals have been followed by a quick but partial pullback. This type of price movement, in our view, is enough to grant CAR the status of “meme stock”.

This being the case, we suggest caution. Volatility in CAR stock has shot through the roof, presenting oversized gain opportunities as well as risk of painful losses. It is nearly impossible to project at what price levels Avis shares are likely to trade going forward – but too easy to predict a bumpy ride ahead.

精彩评论