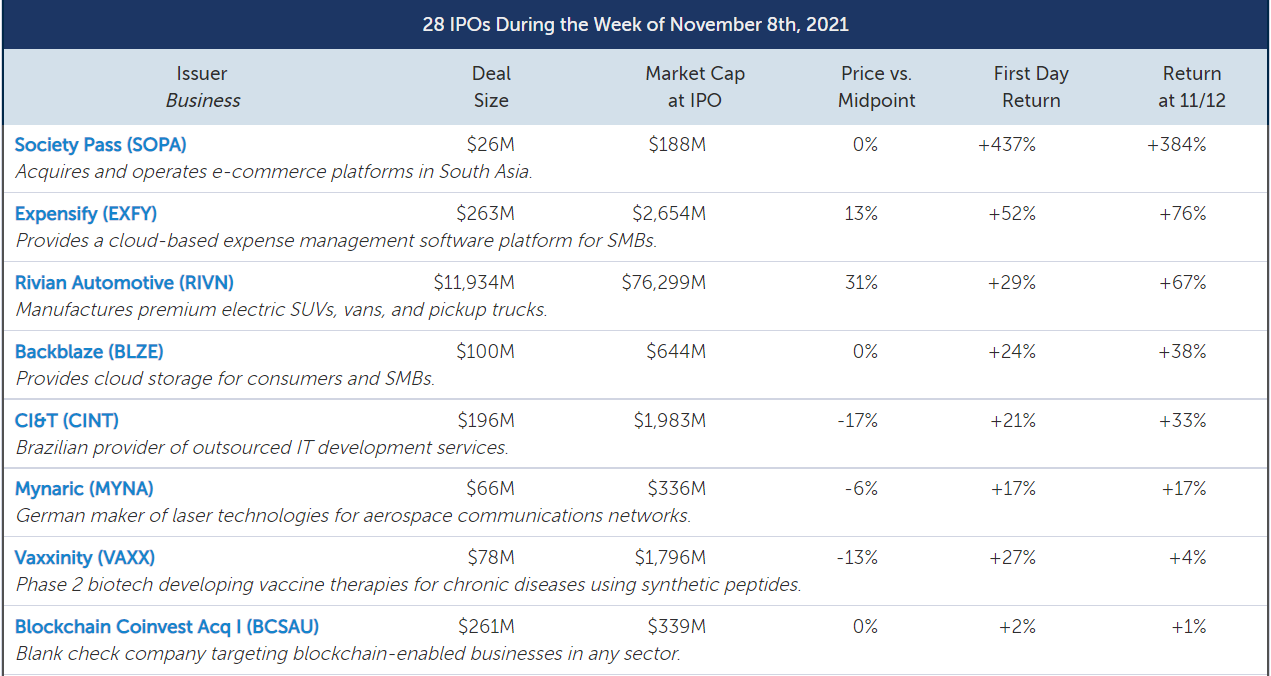

It was another busy week for the IPO market as 15 new issuers went public, with Rivian(RIVN) in the spotlight. The pre-revenue electric truck developer became the largest IPO of 2021, raising nearly $12 billion in the largest IPO since Alibaba (NYSE: BABA) in 2014, and popped 29% in its public debut.

Rivian Automotive(RIVN) upsized and priced well above the upwardly revised range to raise $11.9 billion at a $76.3 billion market cap. The founder-led company is launching a portfolio of electric adventure-ready consumer and commercial SUVs, vans, and pickup trucks. The company is still in the very early stages of commercialization, though it began its first deliveries in September of 2021. Rivian finished up 67%.

Expensify(EXFY) priced at the high end of the upwardly revised range to raise $263 million at a $2.7 billion market cap. Founder-led Expensify provides a mobile-first expense management platform for SMBs. While its paid member base remains below pre-COVID levels, the company is addressing a multibillion-dollar opportunity and saw robust profitability in the 1H21. Expensify finished up 76%.

Cloud storage platform Backblaze(BLZE) priced at the midpoint to raise $100 million at a $644 million market cap. With over 480,000 customers across 175 countries, Backblaze provides a storage cloud platform to store, use, and protect data. The company has delivered solid growth and maintained profitability on an EBITDA basis, though infrastructure investments have weighed on cash flow. Backblaze finished up 38%.

Outsourced IT services provider CI&T(CINT) priced at the low end to raise $196 million at a $2.0 billion market cap. Based in Brazil, CI&T provides strategy, design, and software engineering services to customers including Johnson & Johnson, Google, and Itaú Unibanco. Growing and profitable, the company has averaged a net revenue retention rate of 118% over the past four years. CI&T finished up 33%.

Laser communications firm Mynaric(MYNA) raised $66 million at a $336 million market cap. Germany-based Mynaric develops and manufactures laser technologies for aerospace communications networks in government and commercial markets. The company is growing but highly unprofitable, with a -258% LTM gross margin. Mynaric finished up 17%.

Vaccine biotech Vaxxinity(VAXX) downsized and priced below the range to raise $78 million at a $1.8 billion market cap. The company is developing vaccines therapies for chronic diseases using synthetic peptides. Vaxxinity’s lead candidate, UB-311, is being developed for the treatment of Alzheimer’s Disease and is scheduled to start a Phase 2b efficacy trial in 2022. Vaxxinity finished up 4%.

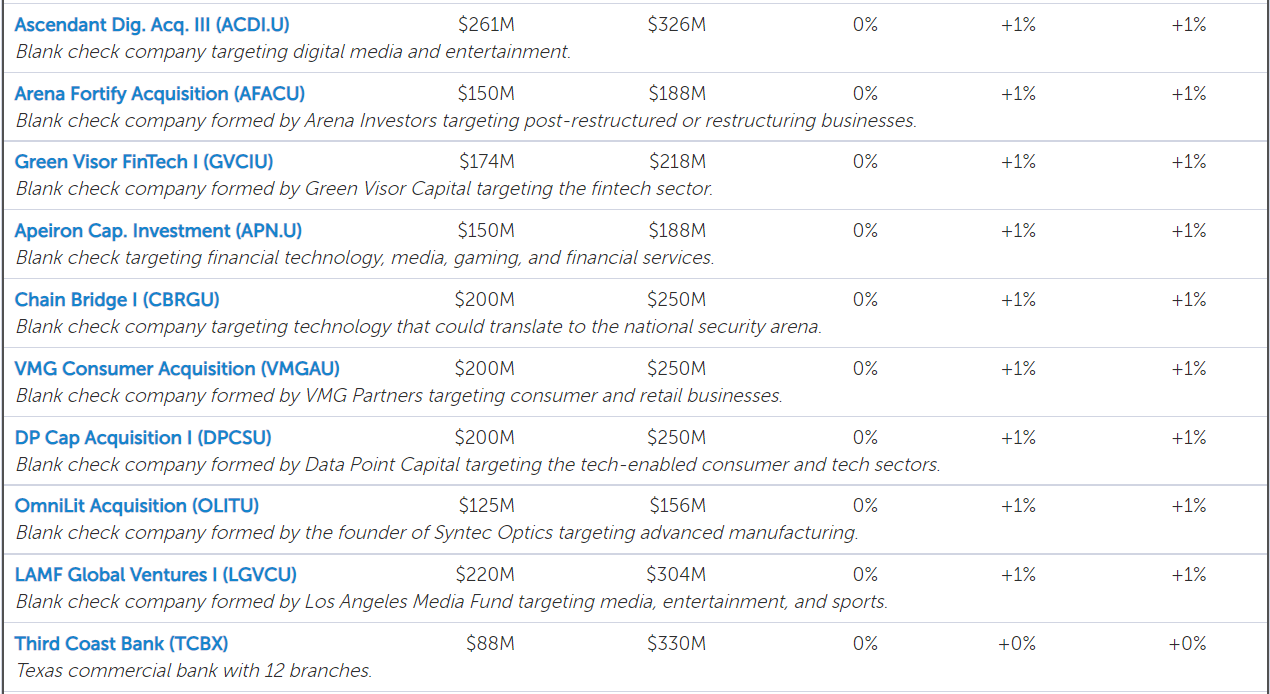

Commercially-focused Texas bank Third Coast Bank(TCBX) upsized and priced at the midpoint to raise $88 million at a $330 million market cap. Operates 12 branches, this bank had total assets of $2.0 billion, total loans of $1.6 billion, total deposits of $1.8 billion, and total shareholders’ equity of $138 million as of 6/30/21. Third Coast Bank finished flat.

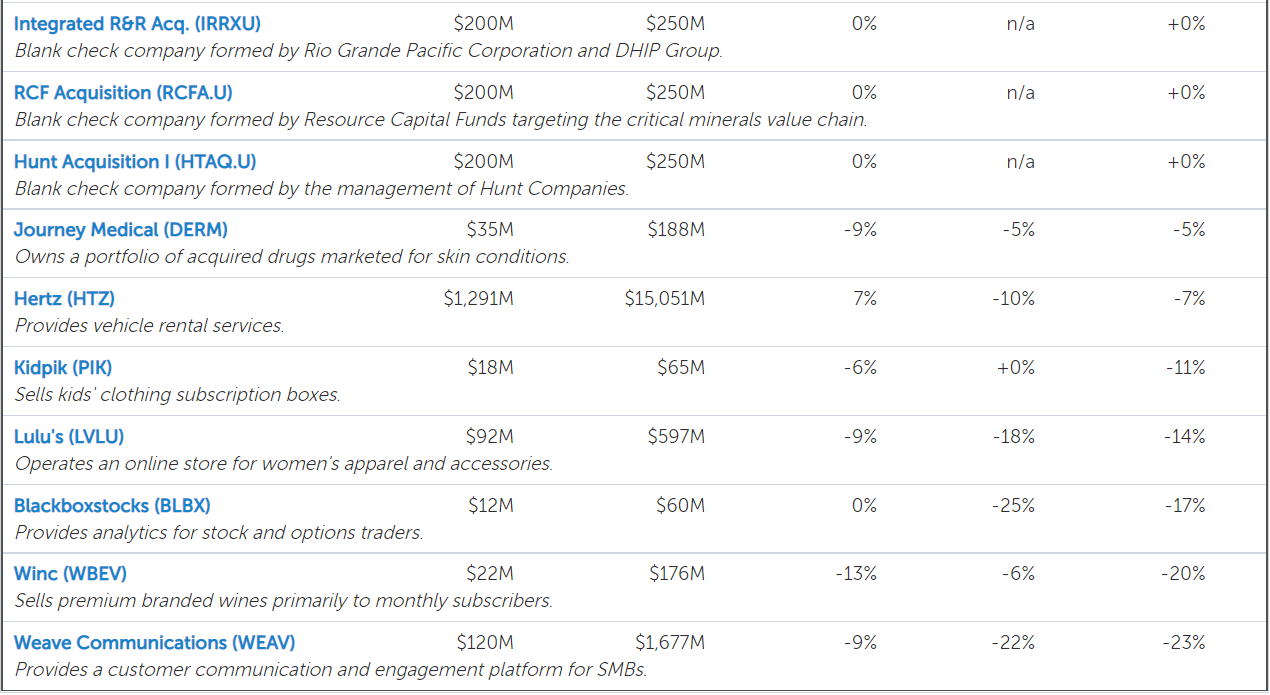

Dermatological drug maker Journey Medical(DERM) priced at the low end to raise $35 million at a $188 million market cap. Journey’s current portfolio includes five branded and three authorized generic prescription drugs for dermatological conditions that are marketed in the US. It anticipates remaining a majority-owned subsidiary of Fortress Biotech (Nasdaq: FBIO). Journey finished down 5%.

Nasdaq uplisting Hertz Global Holdings(HTZ) upsized and priced at the high end to raise $1.3 billion at a $15.1 billion market cap. Hertz provides vehicle rental services globally primarily through the Hertz, Dollar, and Thrifty brands. The company is profitable, though its business is capex-intensive, and the company previously filed for bankruptcy. Hertz finished down 7%.

Subscription service Kidpik(PIK) upsized and priced within the range to raise $18 million at a $65 million market cap. Kidpik provides kids' clothing subscription boxes for boys and girls of varying sizes from toddler to youth. Unprofitable with solid growth, the company acquired its first member in 2016, and in April 2021, it shipped its millionth box. Kidpik finished down 11%.

Online fashion retailer Lulu’s Fashion Lounge Holdings(LVLU) priced at the low end to raise $92 million at a $597 million market cap. Lulu’s sells apparel and accessories primarily to Millennial and Gen Z women. While the company has rebounded since the pandemic, it operates in a highly competitive industry. Lulu’s finished down 14%.

After postponing in October, winery Winc(WBEV) priced at the midpoint to raise $22 million at a $176 million market cap. Winc states that it is one of the fastest growing at scale wineries in the US, and a pandemic-related increase in DTC demand caused a jump in revenue in 2020. The company is unprofitable and operates in a highly competitive market. Winc finished down 20%.

Weave Communications(WEAV) priced below the range to raise $120 million at a $1.7 billion market cap. Weave provides a customer communication and engagement software platform to SMBs in healthcare. Fast growing and unprofitable, the company served more than 21,000 locations as of 6/30/21, though it is unproven in non-health verticals. Weave finished down 23%.

Micro-capSociety Pass(SOPA) priced at the midpoint to raise $26 million at a $188 million market cap. Society Pass acquires and operates e-commerce platforms through its subsidiaries. It currently markets to both consumers and merchants in Vietnam, and intends to expand to the rest of SEA and South Asia post-IPO. After soaring more than 400% on its first day, Society Pass finished up 384%.

OTC-listedBlackboxstocks(BLBX) raised $12 million at a $60 million market cap. Blackboxstocks’ platform offers real-time proprietary analytics and news for stock and options traders of all levels. The company employs a subscription based SaaS business model and maintains a growing base of users that currently spans 42 countries. Blackboxstocks finished down 17%.

13 SPACs went public led by entertainment-focused Ascendant Digital Acquisition III(ACDI.U) and blockchain tech-focused Blockchain Coinvest Acquisition I(BCSAU), both of which raised $261 million.

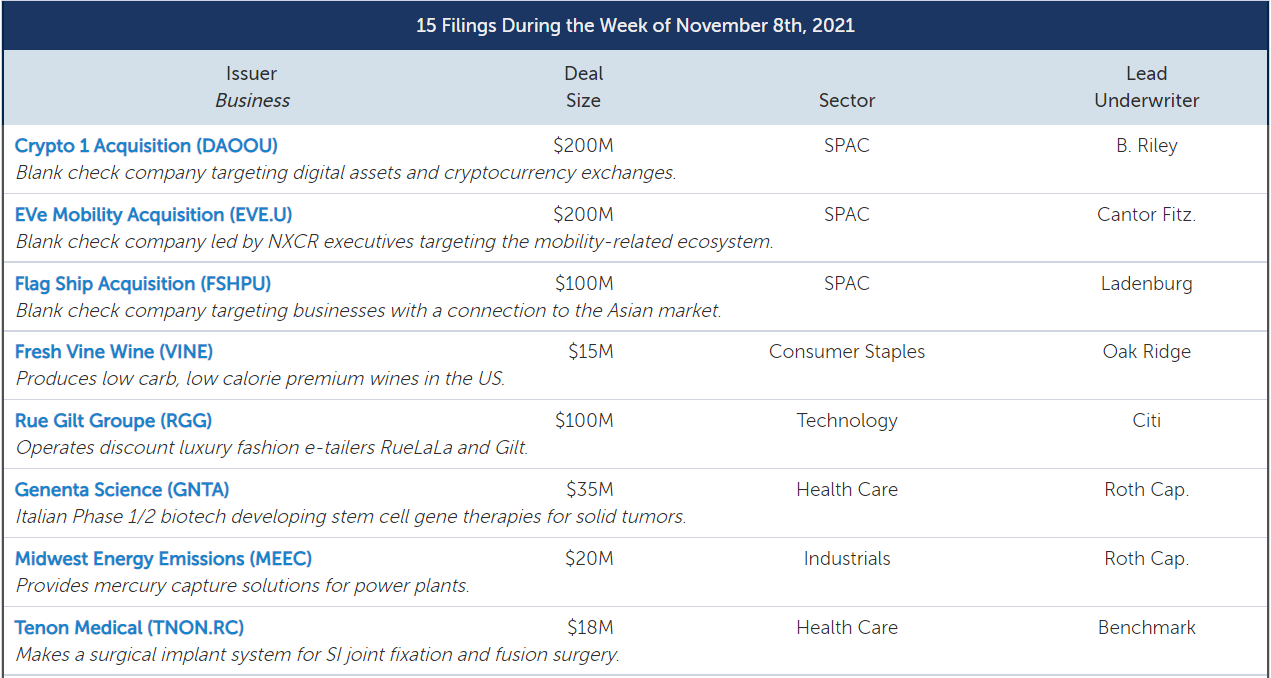

Seven IPOs submitted initial filings. Rugged apparel brand 5.11 ABR(VXI), Florida-based insurer TypTap Insurance(TYTP), and luxury e-commerce retailer Rue Gilt Group(RGG) all filed to raise $100 million. Italian biotech Genenta Science(GNTA) filed to raise $35 million, environmental tech firm Midwest Energy Emissions(MEEC) filed to raise $20 million, surgical implant makerTenon Medical(TNON.RC) filed to raise $18 million, and wine brand Fresh Vine Wine(VINE) filed to raise $15 million.

Eight SPACs submitted initial filings led by Crypto 1 Acquisition(DAOOU),EVe Mobility Acquisition(EVE.U), and gaming-focused UTA Acquisition(UTAAU), which all filed to raise $200 million.

IPO Market Snapshot

The Renaissance IPO Indices are market cap weighted baskets of newly public companies. As of 11/11/2021, the Renaissance IPO Index was up 3.6% year-to-date, while the S&P 500 was up 23.8%. Renaissance Capital's IPO ETF (NYSE: IPO) tracks the index, and top ETF holdings include Snowflake (SNOW) and Uber Technologies (UBER). The Renaissance International IPO Index was down 18.7% year-to-date, while the ACWX was up 8.7%. Renaissance Capital’s International IPO ETF (NYSE: IPOS) tracks the index, and top ETF holdings include Meituan-Dianping and SoftBank.

精彩评论