Investors have been waiting for the Federal Reserve to rein in its monetary support as the economy stays on track for a healthy rebound from the Covid-19 pandemic.

In response to the pandemic last year, the Fed launched an emergency bond-buying program that includes $120 billion in monthly purchase of Treasury and mortgage-backed securities purchases. At the central bank’s virtual Jackson Hole conference on Friday, Fed Chairman Jerome Powell reiterated that a taper—the term referring to the Fed’s wind-down of asset purchasing—might be coming by the end of this year. Many analysts expect Powell to offer more details at the Federal Open Market Committee’s September or November meetings.

Although Powell has struck a relatively dovish tone on the tapering plan, some worry that both the stock and bond markets could see some volatility following the move in a “taper tantrum.”

Still, even if there is such a selloff, some stocks would survive better than others. The last time the Fed slowed down its pace of bond buying, in May 2013, the best-performing sectors in the following months were materials and industrials.

This time around, these sectors have even more tailwinds behind them. The $1.2 trillion Infrastructure Investment and Jobs Act has recently passed the Senate. If passed by the House and signed into law, the act will give companies in the material and industrial sector a significant revenue boost in the next few years. This could offset some of the headwinds from the Fed.

Less Fed money in the market could cause trouble for companies that are tight on cash and reliant on funds raised from the bond market. Within these sectors, investors should look for companies that have more cash on their balance sheets and can make efficient use of them.

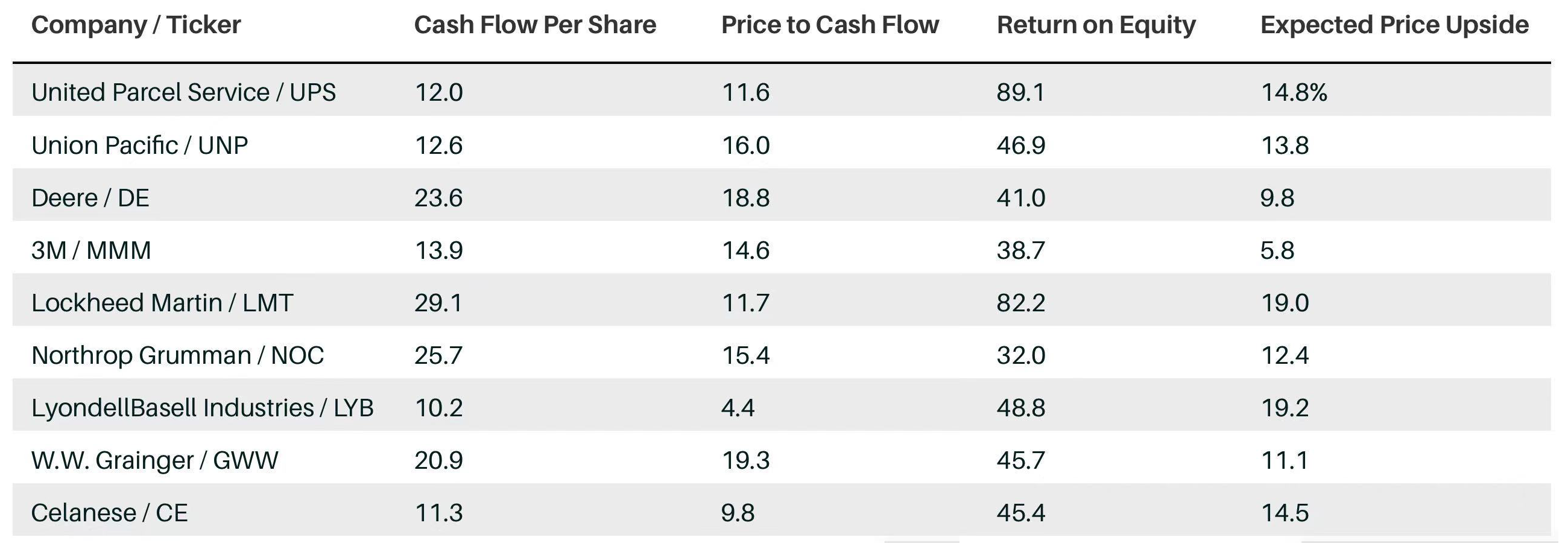

Barron’s screened for S&P 500 stocks within the industrial and material sectors that meet three criteria:

- Cash flow per share, which indicates how much cash a company generates for each outstanding share. For the purposes of our screen, it needed to be more than 10.

- The share price to cash flow, indicating how much investors pay for every dollar of cash flow, which needed to be lower than 20;

- The return on equity, which determines how much profit a company earns for every dollar of asset and which needed to be more than 30.

This has left us with nine names that are rich in cash and efficient with their capital deployment. They are more likely to continue marching ahead even when the Fed takes its feet off the gas. Wall Street consensus shows that analysts expect to see more upside in all these stocks in the next 12 months.

The nine are: United Parcel Service (UPS), Union Pacific (UNP), Deere (DE), 3M (MMM), Lockheed Martin (LMT), Northrop Grumman (NOC), LyondellBasell Industries (LYB), W.W. Grainger (GWW), and Celanese (CE).

精彩评论