Palantir investors have a wall of worry

After Palantir Technologies (NYSE:PLTR) posted quarterly results last week, the selling pressure abated. PLTR stock erased some of the month’s 13% loss by ending the week up a paltry 1.7%. Accumulated by ARK Invest at higher prices in the last few months and mentioned daily on Reddit’s WallStreetBest, why is Palantir stock so weak?

Long-term investors view PLTR stock as the next multi-bagger because of its long-tail revenue. Since its initial public offering, Palantir announced small contract wins with health organizations, government, and military. Over the next several years, these contract amounts will grow enormously. That would suggest the future value should easily exceed that of Snowflake (NYSE:SNOW) and other software firms.

As PLTR shares under-perform, what is the right price to pay? What is the stock worth?

PLTR Stock in Freefall

Palantir is falling alongside that of the Nasdaq Composite index. That may change. It posted strong first-quarter results. Revenue grew by 49% year-on-year to $341 million. U.S. government revenue rose at a faster pace, up 83% Y/Y while commercial revenue grew by 72% Y/Y.

Margins of 44% are notable but not enough to avoid a GAAP net loss per share of 7 cents. Sales and marketing costs topped $136 million, up sharply from $98.6 million last year. Research and development, a welcome cost because it enhances the product offerings, rose. The general and administrative costs of $146.6 million, up from $70.76 million, are a deep concern.

Near-term costs are still outpacing revenue growth.

Chief Operating Officer Shyam Sankar said the company is pioneering micro models for Apollo for Edge Artificial Intelligence. He said, “Just like micro services are the basis of modern software architectures, we believe that micro models are how you operationalize AI at scale for enduring advantage.”

Palantir demonstrated the micro model last month. Now that it is live, it will more efficiently train customers on the product features. The Edge AI will facilitate the management and deployment of multiple independently versioned models. Customers may manage tasks by breaking them down into multiple models. From there, they may improve the task in isolation. After that, they put the parts together for the AI model.

Opportunity

Palantir barely expanded within its addressable market. It only has a handful of Fortune 500 companies. Plus, as it expands its capacity through staff hiring, it may move downstream to medium-sized enterprises. When investors realize that Palantir has only a fraction of the U.S. defense spending and government budget, the future revenue potential is bigger than thought.

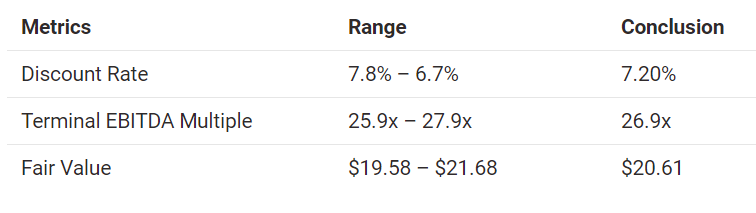

Readers should first forecast a modest revenue growth model for Palantir over the next five years. A discounted cash flow EBITDA Exit model applies an EBITDA Exit multiple to calculate Terminal Value after five years. Assume the following metrics below:

At $20.61, Palantir does not offer much upside currently. Revenue must grow by up to 50% annually while EBITDA expands starting in the fiscal year 2023. That would give the company enough time to solidify larger deals with the government.

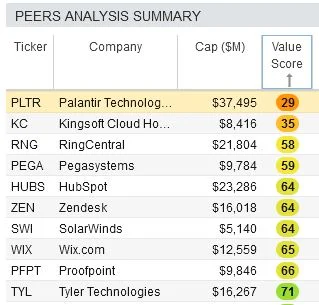

In the above chart, Palantir offers the lowest value compared to peers like Kingsoft (NASDAQ:KC) or PagSeguro Digital (NYSE:PAGS). Fortunately, its value improves over several quarters as operating profits rise. In Palantir’s defense as a better investment, Kingsoft is an Infrastructure as a Service company. Margins in the infrastructure space are thin. Palantir has room to expand margins as customers buy its AI solutions in increasing amounts.

Your Takeaway

Palantir still has too many followers and fans. The quarterly results are encouraging, suggesting that investors who bought the post-IPO stock at $10 should still hold. Anyone who bought the stock at between $25 – $40 will likely need to wait a few years before breaking even.

精彩评论