Pessimism toward emerging markets is building, with stocks close to wiping out their gains this year as the surge in U.S. yields dents the allure of riskier assets.

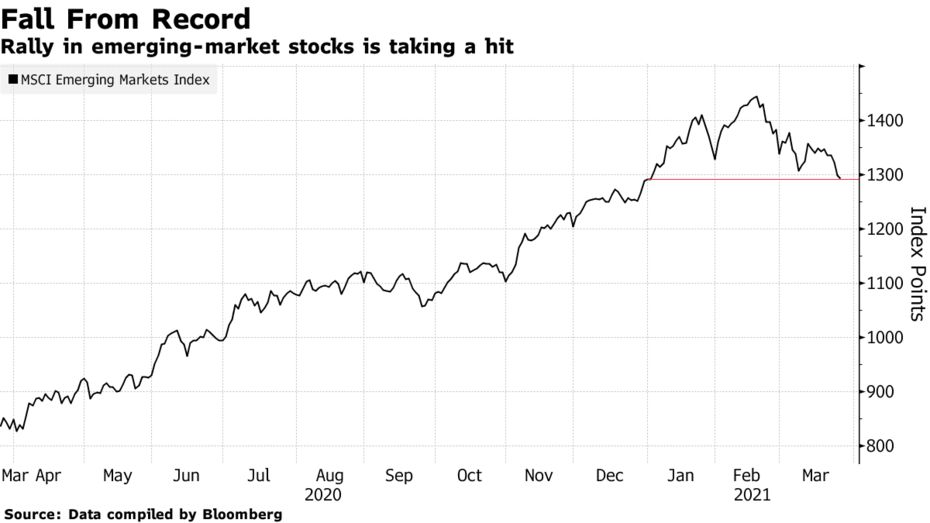

MSCI’s emerging-markets stock gauge fell 0.4% on Thursday, its fifth day of declines and longest losing streak in six months. The gauge has lost about 10% from a record high in February.

“Higher U.S. yields and a firmer dollar alongside investors either moving to safer shores or taking profits on past gains are clearly hurting EM equities,” said Mitul Kotecha, chief EM Asia & Europe strategist at TD Securities Ltd. in Singapore. “It’s hard to see a reversal in the short term, with pressure likely to be maintained for now.”

The surge in U.S. yields and a wave of monetary tightening in nations from Brazil to Russia this month is raising concern the rally in emerging stocks can’t be sustained. Developing-nation assets have skyrocketed since March last year as investors clamored for higher returns in a world awash with central-bank liquidity and negative-yielding securities.

MSCI’s gauge of emerging-market currencies have lost more than 1% this year. Meanwhile, the Bloomberg Barclays’s index of EM local-currency bonds is headed for a third monthly loss, its worst losing streak since 2018.

精彩评论