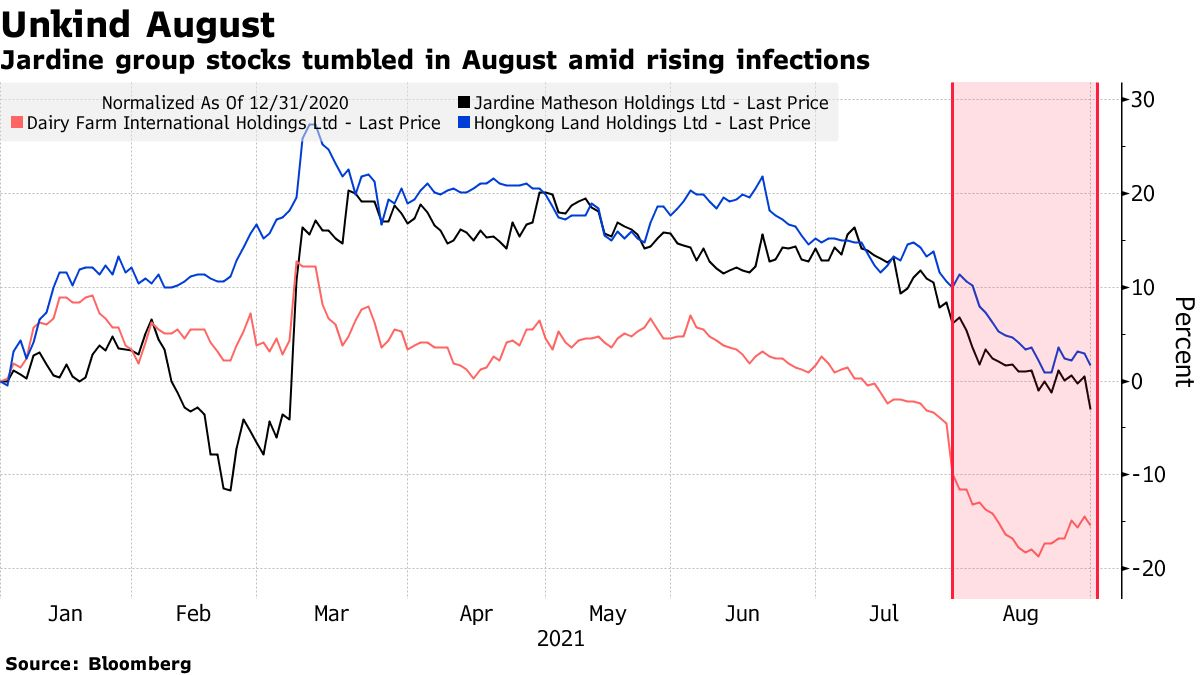

Jardine Matheson Holdings Ltd.group stocks have turned from some of Singapore’s best performers to the worst this year amid a resurgence of coronavirus infections in Southeast Asia.

Shares of the venerable trading firm, which gets more than half of its annual revenue from Southeast Asia, dropped 8.6% last month, ranking it among the worst performers on the Straits Times Index. Concerns over the delta variant have punctuated a stark turnaround for the stock, which had surged 25% in March on a restructuring plan.

Jardine group shares listed in Singapore lost a combined market value of about $5 billion in August, according to data compiled by Bloomberg. The slide marks a return the losses last year amid the global pandemic selloff.

“The expectation is that raging infections and restrictions in Southeast Asian economies will weigh on Jardine group businesses,” said Justin Tang, head of Asian research at United First Partners in Singapore.

精彩评论